Grab a stiff drink - unless you were on the Warner Bros board - in which case you probably already drained the minibar in a panic. Elon Musk’s net worth spiralled into numbers usually reserved for sovereign debt, and Ford’s bean counters were busy incinerating US$19.5 billion on an EV dream that hit the wall hard.

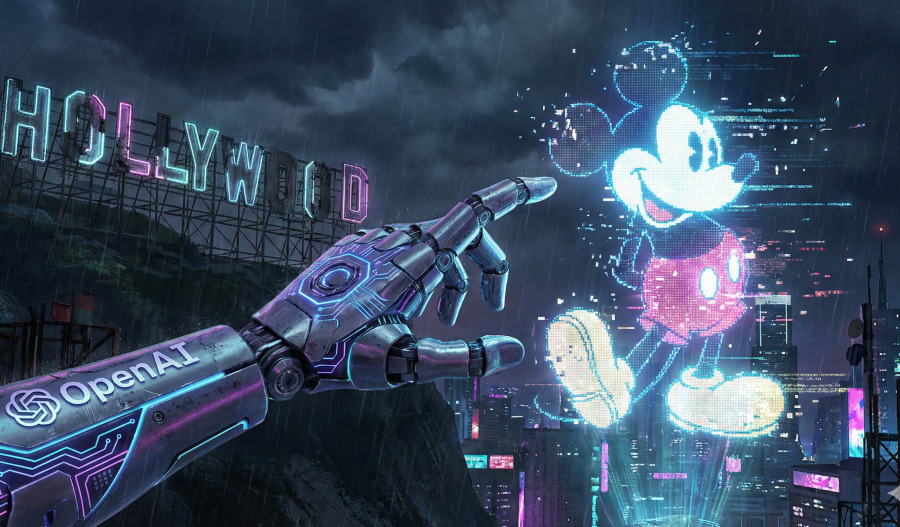

And somewhere in between those extremes, Big Tech decided it owned Hollywood now, and global trade deals started unravelling faster than a pound shop cardigan.

Welcome back to Azzet Unpacked.

All the top moves, shakes, and family gathering ham's from Azzet's editorial team are right here in your weekly business wrap every Friday (19 December, 2025).

Here's what you need to know:

Monday

In entertainment, Disney proved everyone still loves a talking fox as Zootopia 2 became the second 2025 film to crack $1 billion, while elsewhere in the sector, LiveNation and Ticketmaster faced antitrust lawsuits for their stranglehold on live events.

Locally, financial news was grim as a Super fund stumble dimmed returns for retirees, coinciding with reports that Coca-Cola's Costa exit faced valuation hurdles after an expensive impulse buy.

Wall Street saw some political manoeuvring as Jamie Dimon backed Kevin Warsh for Fed Chair, while the Trump admin lowered marijuana restrictions in a move that might finally mellow out the electorate.

Looking ahead, currency traders braced for impact as the greenback slid for a third week and investors scoured the globe for nations searching for a quantum leap in deep tech supremacy.

Tuesday

Tesla stans got their "look ma, no hands" moment as Tesla shares nudged all-time highs on driverless footage, but reality bit hard elsewhere as iRobot was hoovered up by a Chinese partner in bankruptcy.

Inflationary pressure remained the theme as U.S. tariff revenue hit $200 billion, effectively passing costs to consumers just as consumer confidence sank in December.

Legal headaches mounted for logistics giants when the New York AG sued UPS for underpaying workers, while the government launched a tech force bridging Silicon Valley to solve its talent crisis.

The property market sent mixed signals as homebuilder sentiment rose despite costs, while Fed's Williams said policy was set to handle the economic turbulence.

Finally, investors worried the post-pandemic boom had stalled as corporate travel's ASX run stalled, leaving portfolios in suspended animation.

Wednesday

Elon Musk flexed on the billionaire class as he became worth over $600 billion on the back of Tesla puinching up to all-time highs, while in Detroit, automaker Ford waved the white flag and admitted EV failure with writedowns totalling $19.5 billion.

Geopolitics got messy as the U.S. suspended tech trade deals with the UK, coinciding with reports that a Ukraine deal was almost done despite Putin's absence from the table.

The AI talent war continued spinning as Google's Albert Lee joined OpenAI, while Pfizer chased the next cash cow by committing to weight loss R&D.

Despite economic gloom, travel chaos was guaranteed as airlines expected record holiday passengers, and bulls predicted the Nasdaq will post double-digit growth in FY26.

Trade tensions flared when the U.S. threatened Europe's companies over Musk's X, though bacon lovers rejoiced as China lowered EU pork duties.

Confusion reigned in the labour market as payrolls rose 64k in delayed release, leaving economists scratching their heads.

Thursday

Streaming officially killed the video star as YouTube announced it would exclusively stream the Oscars and the Warner board rejected the Paramount Skydance bid in favour of Netflix.

Bond traders sweated as a sharp repricing hit the bond market, though consumers found relief when UK inflation fell amid lower prices.

International pressure ramped up as Trump ordered blockade of Venezuelan tankers, while a potential peace deal saw a Russia-Ukraine deal spark defence selloffs.

Meanwhile, the bill for the conflict came due as the EU investigated Ukraine war damages to tally the astronomical reconstruction costs.

Friday

The IPO market showed signs of life as Medline shares were up 41% on debut and Woodside began hunting for a new leader after Meg O'Neill departed for supermajor bp.

Tech investment billions kept flowing as Amazon was in talks to invest $10 billion in OpenAI, though Oracle stumbled when shares dropped 5% on a partner exit.

Precious metals outshone the rest as the silver surge continued unabated, and mortgage applications dropped after rate cuts failed to ignite housing.

Finally, European re-armament continued as EU defence stocks rose on news of a German military boost.

Earnings calls

Nike face-planted after the finish line as shares tanked 9% after-hours due to Chinese weakness, while Micron posted record beats on the relentless AI hype train.

FedEx beat estimates and cut costs, while brokers placed bets on Apple.

Meme stocks roared back when Trump Media's $6bn reverse merger stirred a 25% share price jump, and activists cheered as Elliot Management's stake lifted Lululemon.

Mining investors saw red metal as mission-critical electrification will see copper prices rise, while macro data remained murky after U.S. inflation cooled in November.

Tensions drew breath in Asia as the U.S. backed Taiwan with $11 billion in military aid, and German airline Lufthansa cashed in and capitalised on U.S. demand.