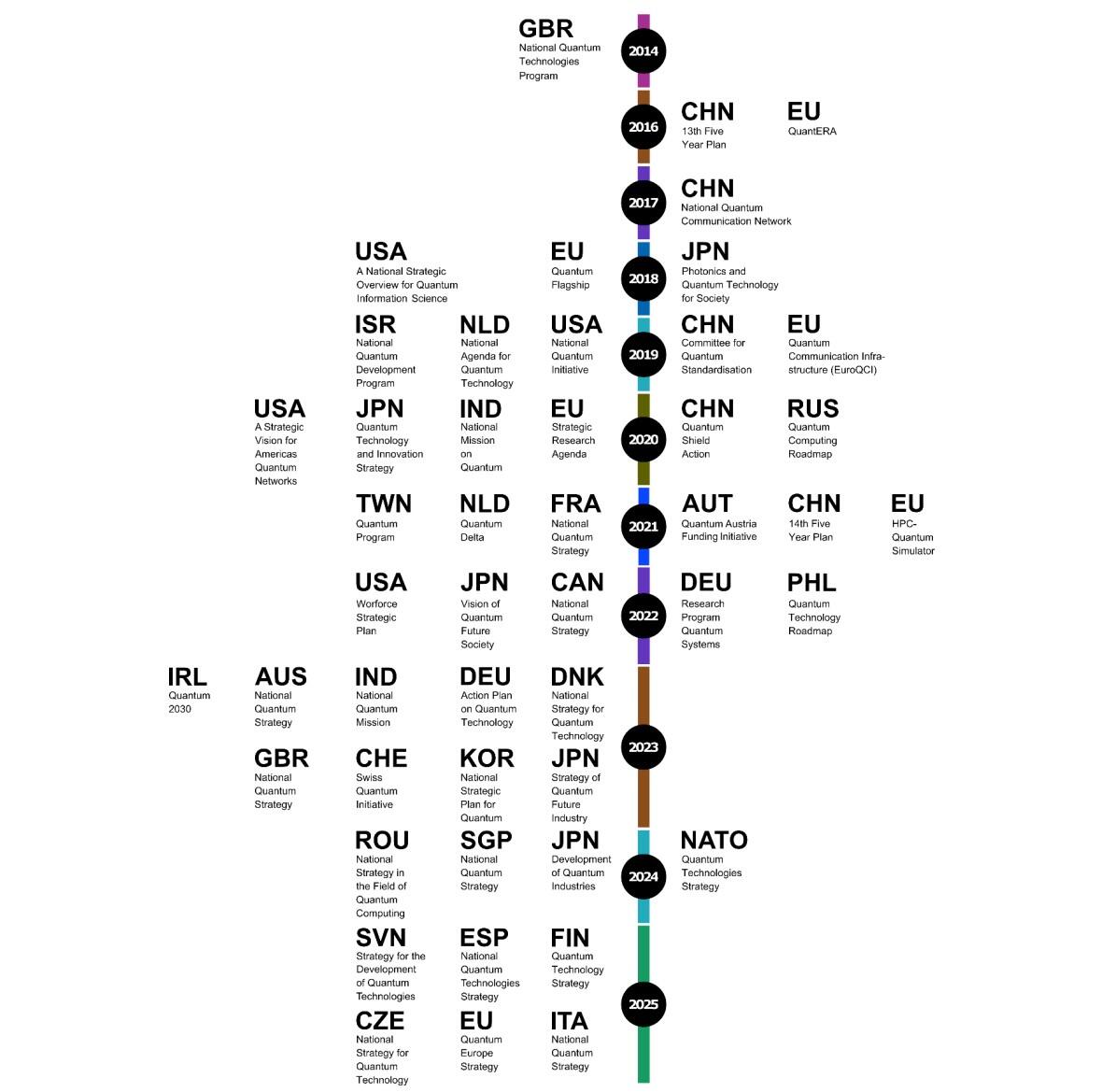

If you want to pinpoint the precise moment quantum technology shifted from a theoretical curiosity for physicists to a strategic asset for nations, the latest data from the OECD provides a definitive update.

Released last week, the OECD's An Overview of National Strategies and Policies for Quantum Technologies presents data that contrasts sharply with industry marketing.

Governments across the world have committed an eye-whopping US$55.7 billion (A$88 billion) to the sector, a figure confirming public funding has now overtaken private venture capital as the primary driver of the growing tech sector.

As of late 2025, the OECD notes that 18 countries have formalised national quantum strategies, indicating a shift from broad scientific research grants to targeted "mission-oriented" policies designed to secure specific industrial capabilities.

The OECD report highlights a concentration of resources that creates a distinct "quantum divide" between nations with the capital to compete and those without.

Seeking alpha

In the United States, the Department of Energy (DOE) announced $625 million in new funding on November 4, specifically for National Quantum Information Science Research Centers.

This allocation is part of a broader push that includes the proposed $2.5 billion Quantum Leadership Act, which was introduced to the Senate earlier this year to supercharge R&D through to 2030.

Meanwhile, China continues to operate on an entirely different scale, having announced a 1 trillion yuan ($138 billion) fund back in March targeting AI, hydrogen, and quantum technologies, though the exact quantum-specific allocation remains opaque.

The U.S. government has admitted that the Middle Kingdom is way ahead in sub-sectors like quantum communications - which can create virtually unhackable data storage and transfer.

Japan has also accelerated its spending, with the "Integrated Innovation Strategy 2025" channelling approximately $900 million (¥130 billion) into the sector as of November to bolster domestic research bases.

For Australian observers, the OECD’s analysis of "direct government intervention" aligns with the federal and Queensland governments' A$940 million bet on PsiQuantum.

This deal, structured to deliver a utility-scale computer in Brisbane, represents one of the largest single-project investments globally, although recent reports indicate the build is facing tight timelines as of the time of writing.

Beyond the headlines, local players are also securing capital, with Sydney-based Diraq closing a $15 million Series B in July to advance its silicon quantum dot technology.

EU fragmentation not a surprise

While the U.S. and China deploy massive capital blocks, Europe’s approach relies on cross-border collaboration to maintain competitiveness in a fragmented market.

On December 5th, the UK and Germany announced a £14 million partnership, £6 million for joint R&D and £8 million directed to the Fraunhofer Centre in Glasgow.

France remains aggressive in the space too, with national champion Pasqal expanding internationally with a $52 million investment in South Korea in November and establishing a new U.S. headquarters.

Spain is also punching upward with an €808 million strategy extending to 2030, which was unveiled at the OECD Global Technology Forum in Madrid earlier this year.

Corporate capex

Private capital is now following the security provided by government contracts, creating a market where valuations are increasingly decoupled from near-term revenue.

On November 5th, Quantinuum raised $800 million at a $10 billion valuation, with backing from Fidelity, JPMorgan, and Nvidia.

IonQ, a pure-play listed competitor, reported strong Q3 2025 financials and noted it had reached its "AQ 64" technical milestone three months ahead of schedule.

The company also closed a $2 billion equity offering in October, fortifying its balance sheet as it chases government procurements that require long-term stability.

Anticipatory governance

Regulators around the world are attempting to establish controls before quantum hardware reaches maturity, lest the tech falls into the hands of bad actors.

The OECD report dedicates significant space to “anticipatory governance” - particularly regarding encryption risks and the "dual-use" nature of the technology.

Coming to the fore is an intense focus on "post-quantum cryptography" (PQC) - reflecting government concern that functional quantum computers will eventually compromise current encryption standards.

Standardisation bodies are accelerating the validation of PQC algorithms, treating the issue as a critical infrastructure vulnerability rather than a routine software update.

OECD notes that nations such as Australia and Korea have established advisory groups composed of leading experts in quantum science and technology, helping to “ensure that national policies are grounded in scientific excellence and practical feasibility”.

“In Australia, the National Committee on Quantum brings together experts to advise the government on quantum policies, making sure that scientific developments align with industry needs and public policy objectives,” the OECD says.

“Similarly, Korea’s Quantum Strategy Committee offers strategic guidance to the government, helping to steer national efforts in quantum technologies and ensure that the country’s quantum ambitions are effectively integrated into its broader technological and industrial strategies.”