Ford to throw billions behind new EV technology

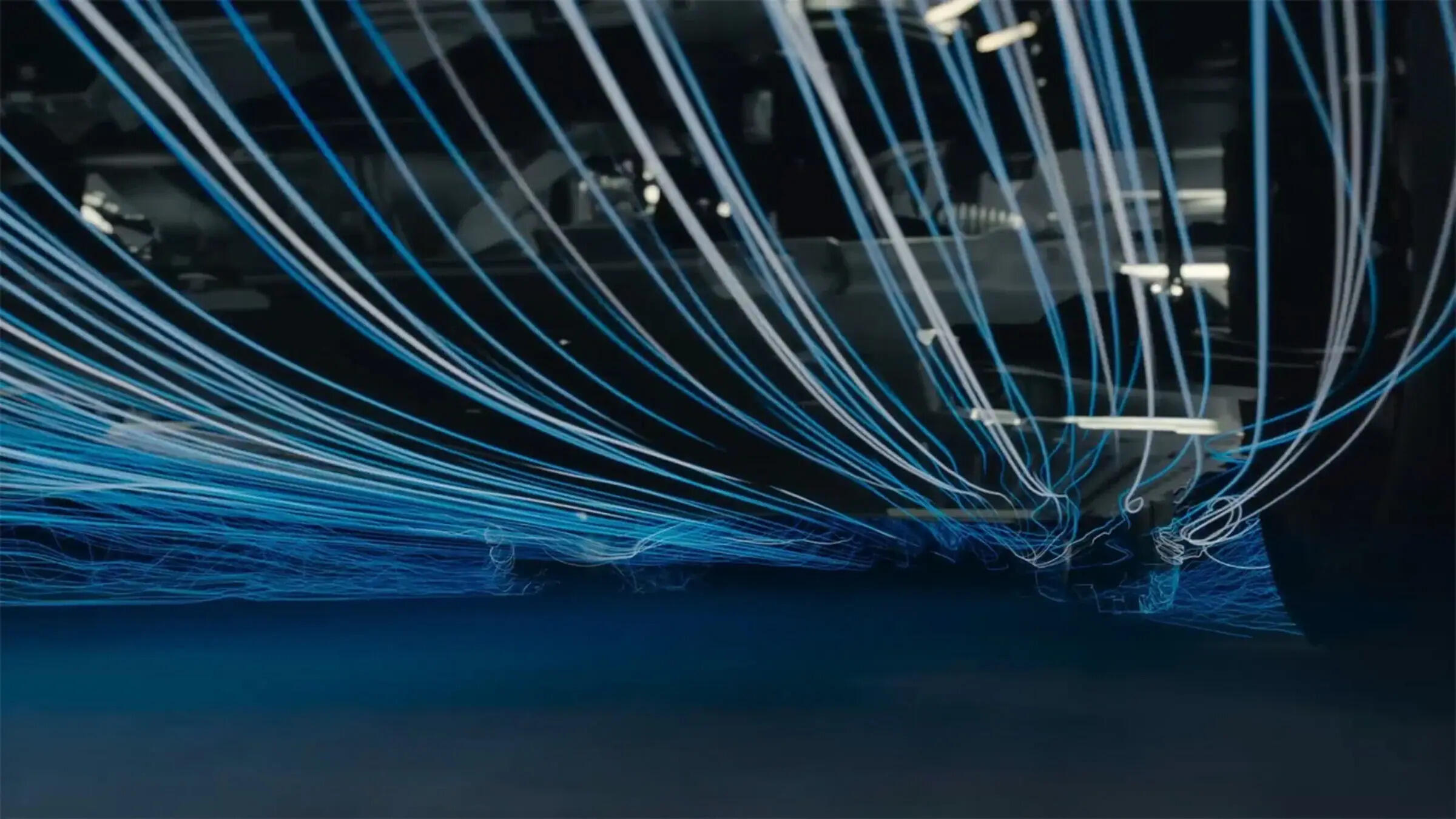

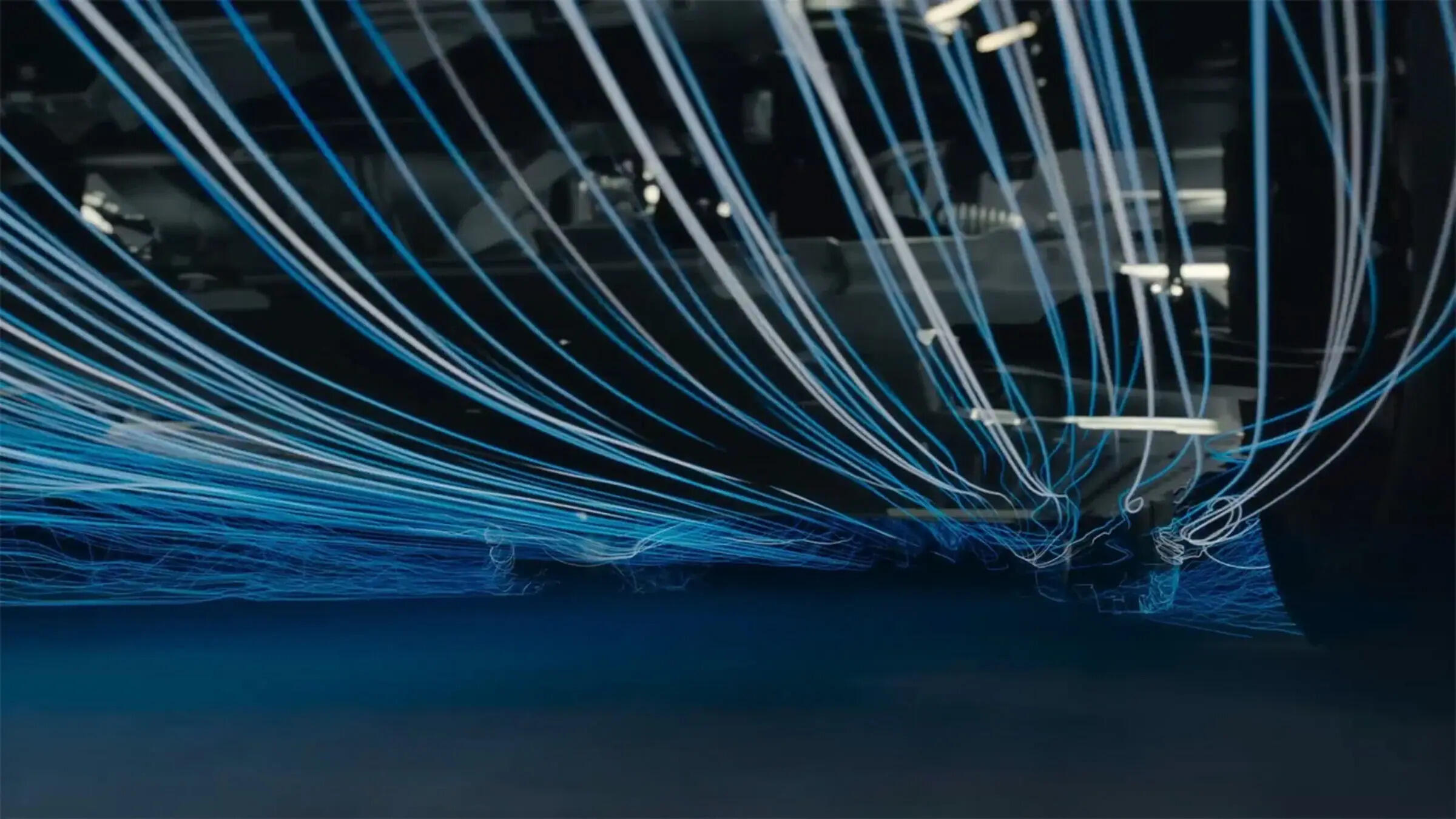

Ford is set to launch a new tech system in its electric vehicles, following in the footsteps of Tesla's Cybertruck. First commercialised by Tesla in 2023, the new 48-volt electrical architecture would be a major upgrade for a new generation of Ford EVs, which currently run on a 12-volt system. The new rollout will start with a pickup truck in 2027, with a US$30,000 (A$42,417.90) price tag, which will feature the new 48-volt system. The automaker has thrown $5 billion behind the venture, calling it the Universal Electric Vehicle platform, which is also expected to generate 4000 jobs. While first announced back in August, this week, Ford has teased new details for the upcoming family of vehicles using this new technology. “At Ford, we took on the challenge many others have stopped doing. We’re taking the fight to our competition, including the Chinese,” said CEO Jim Farley back in August. “For too long, legacy automakers played it safe.”