What a difference a month makes: After what’s been a rollercoaster year for bonds, we’re now finishing 2025 with an about-face on the additional rate cuts that the market was expecting only last October, to the possibility two rate hikes in 2026.

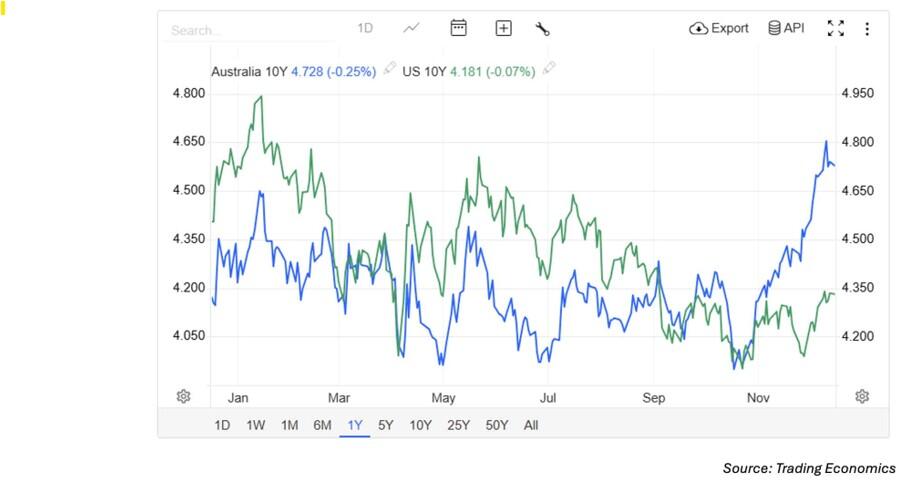

Reflecting the scale and speed of the market’s pivot, Australian 10-year government bond yield spiked to over 4.8% last week - a whopping 55 basis points higher than the U.S. 10-year yield - a level last seen in November 2023.

With bond markets having sharply repriced the outlook for interest rates in recent weeks, there’s no better time to review the risk assets within your portfolio.

While government and high-grade bonds are currently deemed attractive, some commentary suggests that credit spreads in the corporate bond market are currently tight, meaning investors may not be adequately compensated for taking on additional default risk in that segment.

It was easy to conclude that the current 3.6% cash rate was close to neutral, or at least that was the case until the October consumer price index (CPI) release threw a spanner in the works.

With inflation well over the 2-3% target, the Reserve Bank (RBA) may find itself with little choice but to raise rates.

Citi has become the first major global bank to forecast interest rate hikes in Australia as early as February.

While this outcome won’t be good for mortgage holders, it’s good news for income investors.

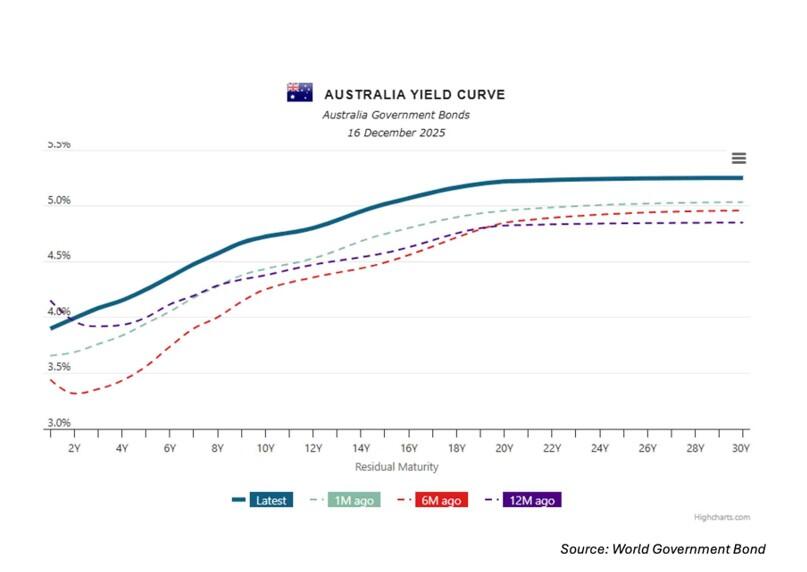

The entire government bond yield curve has jumped from where it was a month ago.

The net effect of possible hikes is that investors will prefer floating-rate securities.

Overall, while bond valuations are considered broadly fair - with inflation surprises remaining a key risk - current bond yields are near multi-year highs, making them attractive for income-oriented investors.

This explains why the local bond market is increasingly attracting global investors, particularly from Asia, due to its stable institutions, AAA credit rating, and attractive yields relative to other comparable risks globally.

Subordinated debt and asset-backed securities, including residential mortgage-backed securities, are two sub-sectors you may wish to consider.

VanEck’s Australian Subordinated Debt ETF (ASX: SUBD) comes to mind as does as does Betashares Australian Major Bank Subordinated Debt ETF(ASX: BSUB) and newly launched VanEck Australian RMBS ETF (ASX: RMBS).

To make it easier to find a fund that suits your portfolio, take a look at this ETF finder, which classifies ETFs into sectors, including Government, Corporate, High Yield, Cash and Multi, covering multiple sectors.

Within spread sectors Jay Sivapalan, head of Australian Fixed Interest at Janus Henderson Investors, believes state governments are well poised to outperform and remain one of his highest conviction active positions.

He expects ongoing opportunities in both primary and secondary markets – in both traditional as well as new market segments, such as data centres, and issuers helping facilitate a successful energy transition.

Meanwhile, in light of the current market environment, PIMCO Australia reminds investors that bonds aren’t just relevant again; they’re compelling and well-positioned to play a stronger role in portfolio construction.

“The shape of the yield curve adds another layer of opportunity. While short-term rates have been falling, long-term rates have risen, resulting in a steepening of global curves,” said PIMCO.

“This creates potential for capital gains through roll-down strategies – where bonds appreciate as they move closer to maturity.”

PIMCO believes the five to seven-year part of the curve is particularly attractive, offering a favourable balance between yield and duration risk.