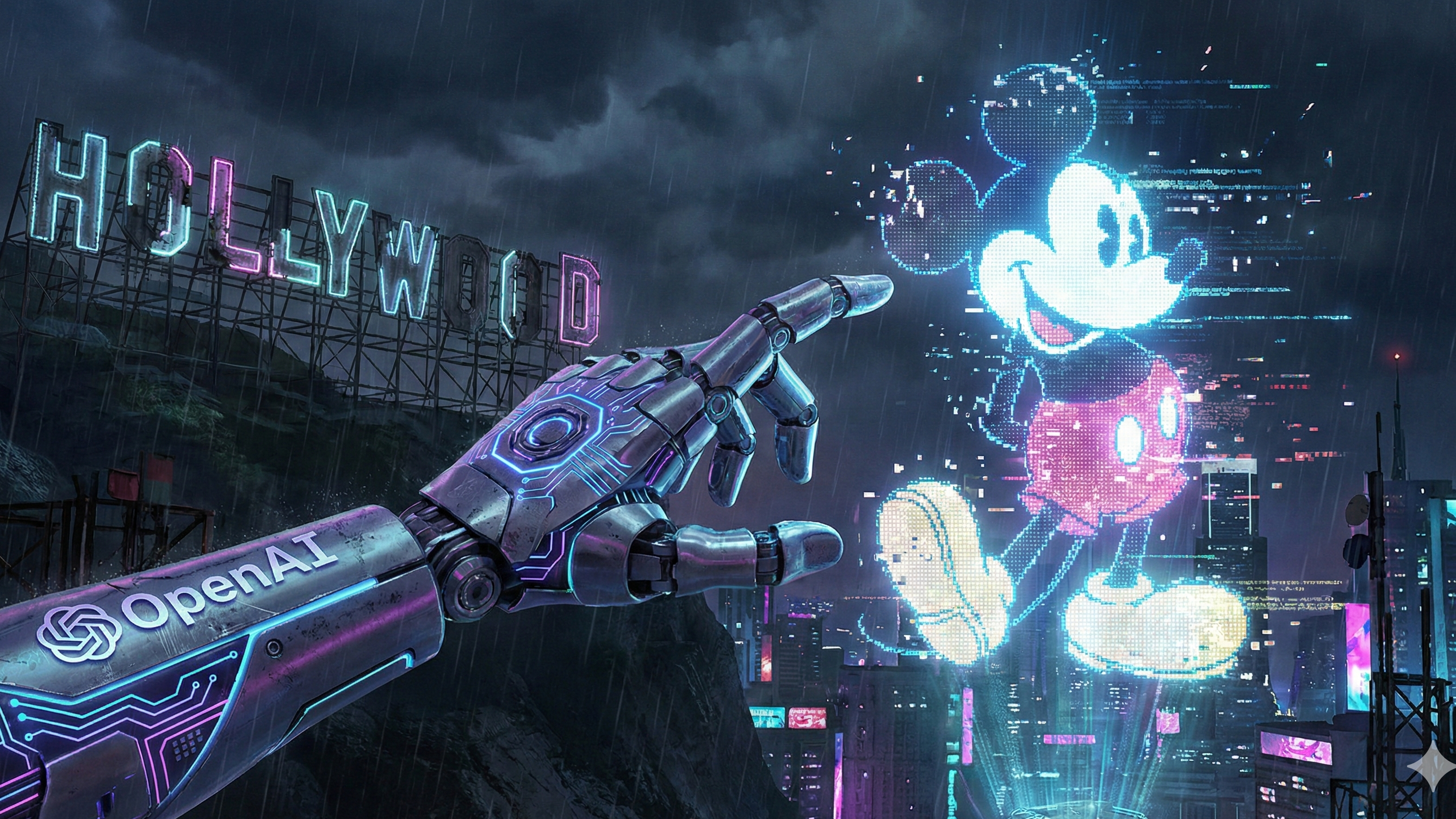

Who's the leader of the (OpenAI) club that's made for you and me? M-I-C-K-E-Y M-O-U-S-E! Popcorn at the ready? Welcome back to Azzet Unpacked.

If you thought your family's holiday negotiation over the remote was heated, spare a thought for the Warner Bros boardroom. We’ve seen the streaming wars go nuclear with hostile bids and class actions fit for a Hollywood drama. From massive M&A plays to AI eating the world (and Disney's IP), the capital flow this week was anything but a low-key trip to the movies.

All the top moves, shakes, and Christmas party steaks from Azzet's editorial team are right here in your weekly business wrap every Friday (12 December, 2025).

We saw Netflix make a play for the crown, Paramount try to slap it out of their hands, and Disney finally deciding that if you can't beat the bots, you should probably just license Mickey Mouse to them for a billion dollars.

Here's what you need to know:

The week that was

The media landscape effectively melted down this week, starting with Netflix acquiring Warner Bros in a US$72 billion deal. The move, which would see the streaming giant swallow HBO and the DC Universe, immediately drew regulatory heat and industry panic about a monopoly on creativity.

But the ink was barely dry before the plot twisted. By Tuesday, Paramount had launched a hostile bid for Warner Bros, offering an all-cash sweetener to shareholders with leveraging support from President Trump - who appears sceptical of the Netflix dominance. The Netflix deal now faces a consumer class action. As usual in Hollywood, the drama is rarely confined to the screen.

In the other major land grab of the week, the Mouse House has opened its gates to the machines. Disney allows OpenAI to license its characters for $1 billion, a partnership that will see Sora AI trained on everything from Pixar to Star Wars.

Monday

The week kicked off with a "Goldilocks" narrative as outperformance lifted hedge funds, supported by data showing the U.S. inflation gauge slipping while sentiment ticked up.

In the deal room, Big Tech continued its shopping spree with Meta acquiring AI wearables company Limitless, signalling Zuckerberg's intent to dominate the post-smartphone era. Meanwhile, National Storage entered a $4 billion takeover, proving there's still plenty of money in cardboard boxes.

On the geopolitical front, the U.S. expanded its travel ban to over 30 countries, while a US envoy claimed a Ukraine-Russia peace deal is "really close". Closer to home, Albanese warned of a difficult bushfire season, and Life360 fell 3.5% as a director sold off stock.

Elsewhere, SpaceX denied reports of a $800 million valuation, the EU engine ban could be relaxed, and Moscow prepared to send fuel to India.

Tuesday

Tensions simmered as the NY Fed saw households gloomier on finances, but that didn't stop the corporate raiders. IBM boosted its AI infra with a $1.1 billion Confluent acquisition, while Renault and Ford unveiled a partnership to kick off with EVs.

In policy news, Trump announced a $12 billion aid package for farmers and prepared to sign a federal AI order overriding state rules. Meanwhile, Ukraine prepared a revised peace plan to present to the US.

Locally, the RBA held rates steady despite rising inflation, and Global assets were tipped as key for Aussie growth.

Commodities went wild as Silver smashed through the $60 mark, outrunning a blistering gold. In the workforce, Wells Fargo planned cuts to make way for AI, and Pfizer bet $2 billion on a Chinese obesity drug.

Tragedy struck in Asia with Japan hit by a 7.5 magnitude earthquake.

Wednesday

The "Goldilocks" mood soured mid-week as Netflix faced a consumer class action over its mega-merger, proving that in Hollywood, the drama is rarely confined to the screen.

In the markets, commodities went wild as Silver smashed through US$60, outrunning gold, while crypto stumbled with Twenty One Shares plummeting in its NYSE debut.

The AI pivot continued to claim casualties and capital alike. Wells Fargo planned cuts to make way for AI, while Microsoft invested billions into AI in India and Canada.

In the auto world, Renault and Ford unveiled a partnership to kick off with EVs, and Nedeljkovic was named as the new CEO of BMW.

Elsewhere, Pfizer bet $2 billion on a Chinese obesity drug chasing the weight-loss "holy grail", Home Depot missed its outlook, and a Trump ban on wind power was overturned.

Thursday

Wall Street jitters returned as Money market jitters echoed a new RBA "Lowe moment" and the Fed delivered a third cut. Crypto didn't fare much better, with Twenty-One Shares plummeting in its NYSE debut.

Big tech kept spending, with Microsoft investing billions into AI in India and Canada and Amazon pouring an additional $3.5 billion into India. GameStop earnings took a hit, proving the meme dream might be fading, while Rivian pivoted to AI affordable models.

Down under, the Australian social media ban for under-16s is now in place, and Bupa was ordered to pay $35 million for ripping off sick Australians. The unemployment rate remained steady at 4.3%, even though the income needed to rent in capitals is rising.

Friday

We wrapped the week with earnings season delivering mixed bags. Adobe results beat estimates on record revenue, and Broadcom posted strong AI chip sales. However, Oracle stock fell 10.7% on a revenue miss.

Retailer Costco beat expectations, and Lululemon jumped 11% as its CEO departed.

In tech expansion, Google DeepMind expanded its UK presence, and Rivian doubled down on AI and custom chips.

Finally, novel fund structures are broadening access to private equity, ensuring everyone gets a bite of the high-risk cherry.