American pharmaceutifcal giant Pfizer has locked in exclusive global rights to a new oral treatment from China’s YaoPharma in a deal worth almost US$2 billion.

Pfizer says it will pay $150 million upfront to license YP05002, a small-molecule glucagon-like peptide-1 (GLP-1) receptor agonist currently running through Phase 1 trials in Australia.

The deal structure could see the total payout swell to $1.935 billion if development milestones are hit, plus royalties on future sales.

The play comes just weeks after Pfizer closed its monster $10 billion acquisition of Metsera as it looks to play catch-up on weight-loss market leaders Novo Nordisk and Eli Lilly.

“We look forward to contributing our expertise and resources to continue the development of this investigational GLP-1 small molecule which complements and strengthens our growing portfolio of novel candidates for treating obesity and its adjacent diseases,” Pfizer Chief Scientific Officer Dr Chris Boshoff said.

“Cardiometabolic research is a strategic priority for Pfizer that has the potential to be a key driver of growth for our business.”

Under the agreement, YaoPharma - a subsidiary of the Shanghai-listed Fosun Pharmaceutical - will wrap up the current Phase 1 clinical trial. Pfizer then takes the wheel, with plans to trial the drug alongside its own pipeline assets, specifically a GIPR antagonist (PF-07976016).

This "cocktail" approach is the new battlefront. As the sector matures, the focus is pivoting from raw weight loss to "quality" loss - torching fat while sparing muscle - and improving patient tolerability.

Headquartered in Chongqing, YaoPharma is a key cog in the Fosun Pharma machine. While it has long been a heavyweight in domestic manufacturing and API production, the strategic deal catapults its R&D onto a global scale.

Chasing the 'holy grail'

While injectable heavyweights like Wegovy and Zepbound have upended the sector, the industry is scrambling for an effective oral pill - the so-called "holy grail" that offers patients freedom from needles and manufacturers a break from complex cold-chain logistics.

Pfizer’s track record in this space is bruised; the company scrapped its previous oral contender, danuglipron, after users reported high rates of nausea and adverse liver signals.

The YP05002 peptide, however, represents a fresh shot on goal.

A $150 billion prize

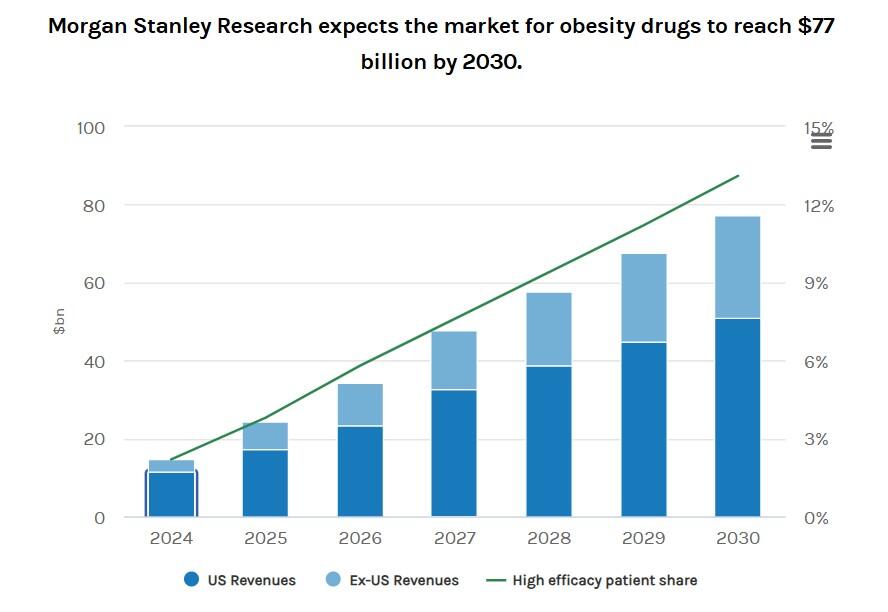

The financial incentives for creating an oral drug are staggering. Morgan Stanley analysts forecast the global obesity market could balloon to $77 billion in five years and somewhere between $100-$150 billion by the early 2030s.

“Social media activity documenting transformative weight loss, together with the establishment of affordable insurance coverage more quickly than anticipated, has helped drive demand for obesity medicines beyond our expectations,” Morgan Stanley European Biopharmaceuticals analyst Mark Purcell wrote.

Currently, supply bottlenecks and eye-watering price tags lock out millions of potential patients; however, an oral option could smash those barriers, democratising access and opening up massive new revenue streams in developing markets.

But the path isn't clear of obstacles. Pricing scrutiny is ramping up, particularly with U.S. Medicare negotiations looming, and the long-term safety profile of these potent metabolic shifters remains under the microscope.

Despite the strategic logic, Wall Street offered a muted response, with Pfizer shares slipping 1.6% to $25.35 on the back of the news, while Fosun Pharma saw just a modest bump to its stock in Shanghai.