The United States Federal Reserve approved its third interest rate reduction of the year on Wednesday (Thursday AEDT), but the move underscored deep divisions within the central bank and hinted at a far more cautious pace of easing ahead.

In a 9-3 decision, the Federal Open Market Committee (FOMC) lowered its benchmark federal funds rate by a quarter percentage point to a range of 3.5%-3.75%, delivering what markets had widely dubbed a “hawkish cut”.

The decision was accompanied by an unusually large number of dissents, highlighting an internal struggle over the appropriate direction for monetary policy. Three policymakers voted against the move, the first time such a split has appeared since September 2019, with Governor Stephen Miran pushing for a larger half-point cut, while Kansas City President Jeffrey Schmid and Chicago’s Austan Goolsbee preferred to hold rates steady.

The disagreement reflects the broader ideological divide within the Fed. Hawks remain focused on persistent inflation pressures, advocating for tighter policy, while doves argue that a cooling labour market warrants more support.

Miran, who is set to leave the Fed in January, registered his third consecutive “no” vote, while Schmid dissented for the second meeting running.

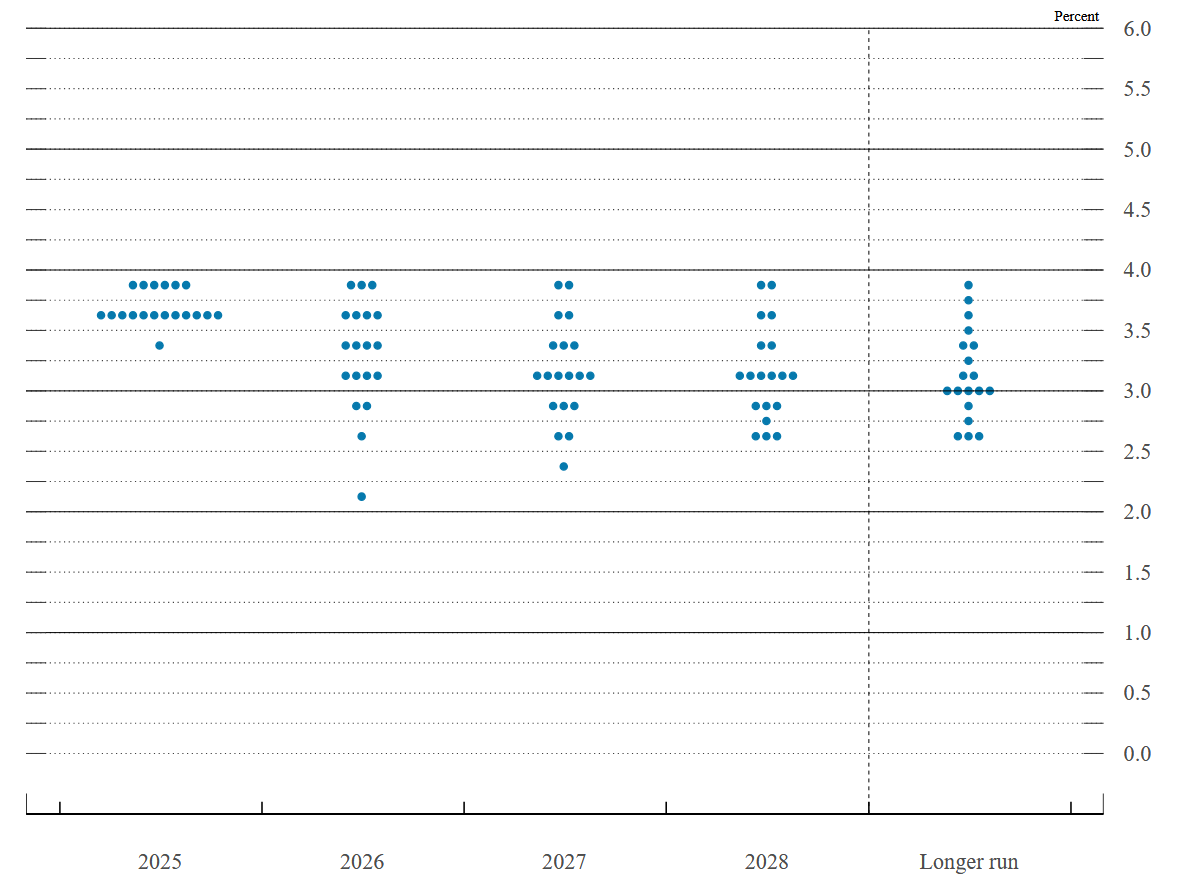

The committee’s updated “dot plot”, which maps individual policymakers’ expectations for future interest rates, reinforced the message that further reductions may come slowly.

The projections again pointed to just one additional cut in 2026 and another in 2027, leaving rates hovering near a 3% longer-run level.

While unchanged from September, the distribution of views revealed pronounced disagreement, with seven officials signalling that no cuts should be delivered next year.

Several nonvoting participants also expressed informal reservations about the latest move.

Fed Chair Jerome Powell said at his post-meeting press conference that policymakers were confident in their current position.

“We are well-positioned to wait and see how the economy evolves,” he said, noting that the central bank would remain data-dependent as it navigates the next phase of the cycle.

Economic projections offered a mixed picture. The Fed raised its 2026 GDP growth estimate to 2.3%, half a percentage point higher than its September forecast, suggesting some optimism about medium-term economic resilience.

However, inflation is still expected to sit above the 2% target until at least 2028. The Fed’s preferred inflation gauge showed annual price increases at 2.8% in September - well below the peaks of the past few years, but still too high for comfort.

Beyond the rate cut, the Fed also announced it would resume buying Treasury securities, beginning with US$40 billion in Treasury bills starting Friday.

These purchases are likely to remain sizeable over the coming months before being scaled back.

The move follows concerns about stress in overnight funding markets and comes just weeks after the Fed said it would halt its balance-sheet runoff.

The timing of these policy shifts is politically sensitive. Powell is nearing the end of his second term as chair, with just three meetings remaining before his successor is installed.

President Donald Trump has indicated he will prioritise candidates who favour lower interest rates, rather than those who place equal weight on the Fed’s dual mandate of stable prices and maximum employment.

Complicating matters further, the Fed has been operating without access to a full suite of economic data due to a six-week government shutdown that lasted until 12 November.

The information that has been available points to a labour market in a holding pattern; employers are reluctant to hire aggressively but also hesitant to conduct major layoffs.

However, private-sector indicators suggest heavier job reductions may be approaching, with announced layoffs through November surpassing 1.1 million, according to Challenger, Gray & Christmas.