Business-to-business (B2B) tech giant IBM (NYSE: IBM) is acquiring data-streaming specialist Confluent (NASDAQ: CFLT) in an all-cash deal valued at US$11 billion, marking one of IBM’s most significant moves yet to strengthen its position in hybrid cloud and artificial intelligence infrastructure (AI).

IBM will purchase all outstanding Confluent shares at US$31 each, expanding its portfolio with technology designed to move and manage data across modern, distributed IT environments.

The acquisition adds a platform widely used for processing and governing data in motion — a capability becoming increasingly essential as enterprises race to support AI systems that depend on immediate, reliable access to information.

Embedded in the open-source Apache Kafka framework, Confluent’s technology enables organisations to connect disparate systems and stream data in real time, a requirement for deploying generative and agent-based AI tools at scale.

Industry forecasts point to dramatic growth in software development and data generation.

Global provider of market intelligence, IDC, projects that more than one billion new logical applications will be created by 2028, a surge expected to reshape enterprise architectures.

These applications, along with emerging AI agents, will demand continuous flows of consistent and trustworthy data, regardless of where it is stored.

IBM expects the Confluent acquisition positions the company to deliver seamless integration across AI, analytics and enterprise systems.

The combined technologies are expected to give organisations a unified data backbone running across hybrid cloud environments, supporting resilience and automated intelligence across their operations.

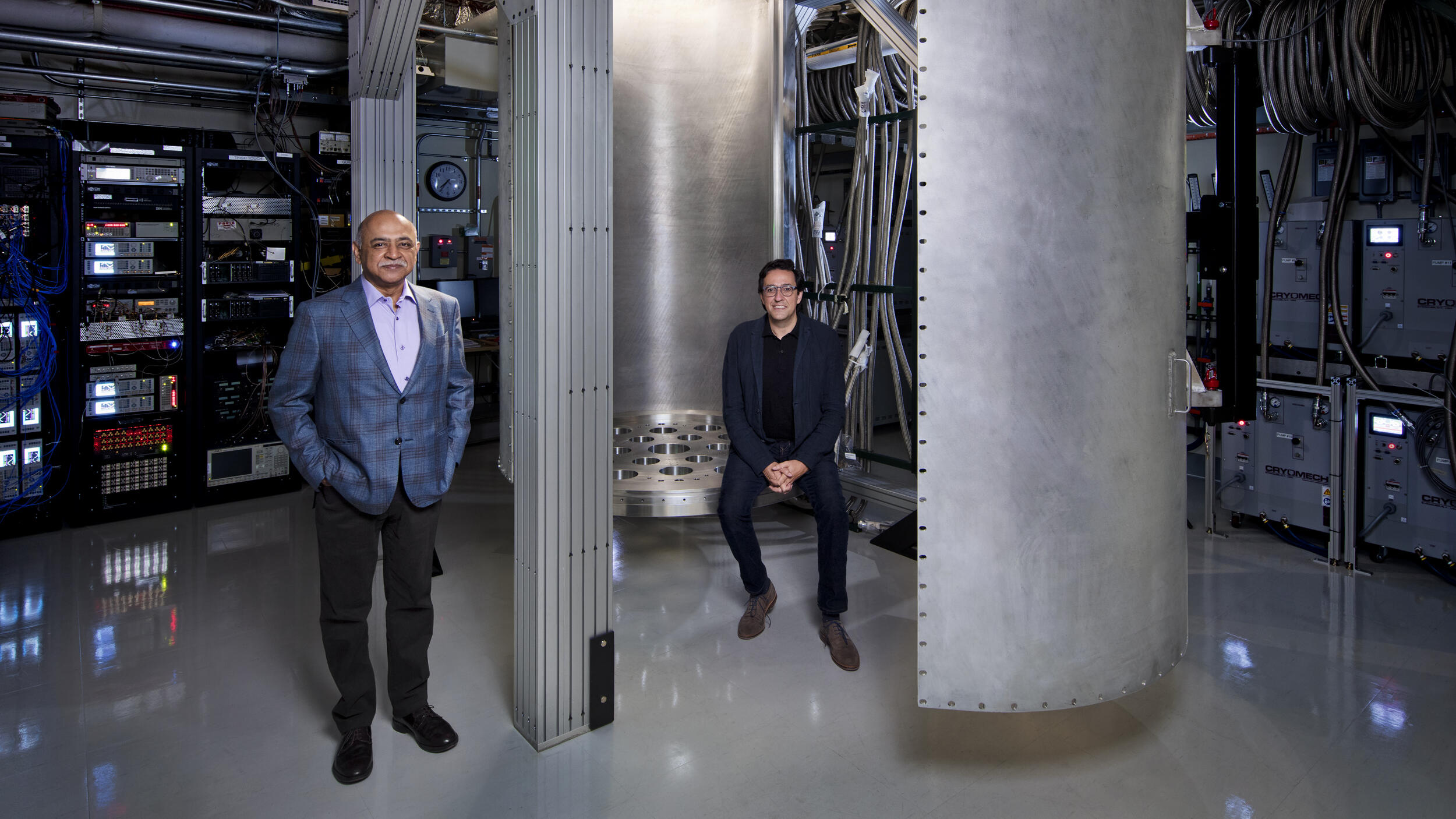

IBM chair and CEO Arvind Krishna told the market that the deal strengthens the company’s ability to serve enterprises facing data fragmentation across clouds, data centres and software platforms.

“IBM and Confluent together will enable enterprises to deploy generative and agentic AI better and faster by providing trusted communication and data flow between environments, applications and APIs,” said Krishna, who described the future combined platform as “purpose-built for AI”.

Meanwhile, Confluent CEO Jay Kreps noted the role the company he co-founded plays in helping clients extract value from real-time data.

He expects joining IBM to accelerate Confluent’s reach globally and expand the platform’s capabilities.

“We are extremely proud of the work we’ve done in providing clients with a real-time data streaming platform for the next era of technology, including generative and agentic AI,” Kreps said.

Confluent’s technology addresses one of the central obstacles facing enterprises today: ensuring data remains clean, consistent and accessible as it moves through multiple applications and cloud providers.

The company’s architecture is built to eliminate silos that hinder the performance of AI systems, particularly those that rely on continuous streams of events.

The company’s total addressable market has doubled in just four years and is expected to reach US$100 billion by 2025, which reflects the rising demand for real-time data solutions.

By integrating Confluent with its automation and AI infrastructure software, IBM aims to capture a larger share of that market and offer a broader suite of data-driven tools.

Confluent serves more than 6,500 customers, including over 40% of Fortune 500 companies.

Its platform is deployed across industries and integrates with major technology partners, including Anthropic, AWS, Google Cloud, Microsoft and Snowflake.

The company’s products span managed cloud services, self-hosted options and hybrid models designed to meet data sovereignty and security requirements.

IBM described the acquisition as a natural extension of its long-term strategy centred on hybrid cloud and AI.

As global data volumes are forecast to more than double by 2028, organisations are seeking to simplify and automate complex IT environments.

IBM expects Confluent’s capabilities to complement its existing data and automation portfolio, much as past acquisitions of Red Hat and HashiCorp expanded its open-source and infrastructure offerings.

The company anticipates strong synergies across its software and consulting lines, enhanced by IBM’s global sales reach.

Operational efficiencies from IBM’s scale are expected to further improve the deal’s long-term financial impact. IBM projected that the acquisition will be accretive to adjusted earnings within the first year after closing and to free cash flow by the second year.

While both companies’ boards have approved the agreement, the deal still requires regulatory clearance and a shareholder vote.

Confluent’s largest investors, representing roughly 62% of voting power, have committed to supporting the transaction.

IBM plans to fund the acquisition – expected to close by mid-2026 - entirely with cash on hand.

Once completed, the acquisition will deepen IBM’s role in the infrastructure that underpins modern AI, anchoring its strategy in real-time data capabilities that are expected to become a fundamental requirement across industries.

Join our community of decision-makers. No card required

Join now