After a seven-month streak of positive returns, superannuation funds have suddenly dropped the ball by reporting a loss in November, but unless you check your balance regularly – as most people don’t – chances are you’d never know.

According to SuperRatings returns data for November, the median balanced option lost 0.5% last month while the median growth option was down 0.6%.

Those funds with a capital stable option performed marginally better with smaller losses of 0.2%.

Pension returns also fell over the month, with the median balanced pension option losing 0.5%.

While the size of these losses shouldn’t have you reaching for the anti-depressants, all eyes will now be on whether this heralds lower return expectations heading into the New Year.

November’s losses were an about-face from a month earlier, when the median balanced option had seen positive gains of 1.3%.

While November losses were attributed to a pullback in Australian shares and listed property sectors, with the ASX200 losing 3.6% during the month, the 2026 outlook suggests the downturn could be short-lived.

Due to a resurgence in the materials/resources sector, analysts expect the S&P/ASX200 to achieve between 7% to 10%-plus earnings growth for FY26.

Meanwhile, Kirby Rappell, director of SuperRatings, told investors that the estimated decline suggests a second consecutive double-digit calendar return is now unlikely.

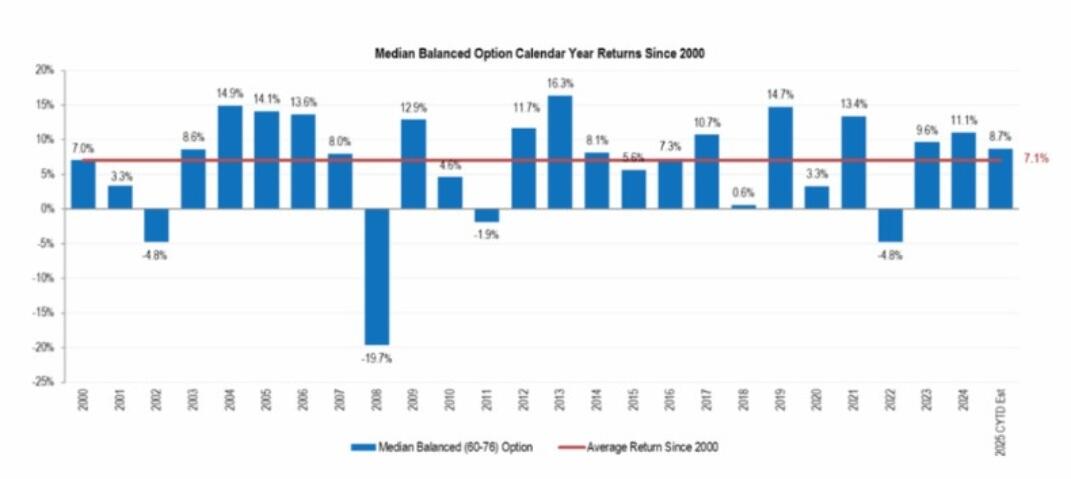

While the reversal to negative returns was disappointing this month, Rappell also reminds super fund members that returns - which have defied despite recent jitters over a potential bubble in technology shares and doubts over interest rate cuts - remain strong over the long term with the median balanced option providing an estimated 7.1% per annum over the last 25 years.

This means members drawing down 5% in an account-based pension would see their super fund balance growing annually.

“For pension members, the results have been even better with the median balanced pension product is estimated to return 9.5% for the 11 months to 30 November 2025,” he said.

“While this month breaks the strong run, 2025 is well on track to be an above average year for member balances, with the 11 months to 30 November 2025 estimated to have returned 8.7% against a median of 7.1% for the full year since 2000.

Despite geopolitical tensions continuing to create the potential for market shocks over the coming months, Rappell recently noted that super funds have had a strong start to the financial year, with returns remaining well above objectives over the long term.

What's particularly pleasing to Rappell is the market's sustained tolerance to increased volatility, with both Australian and international share markets starting the new financial year with positive returns.

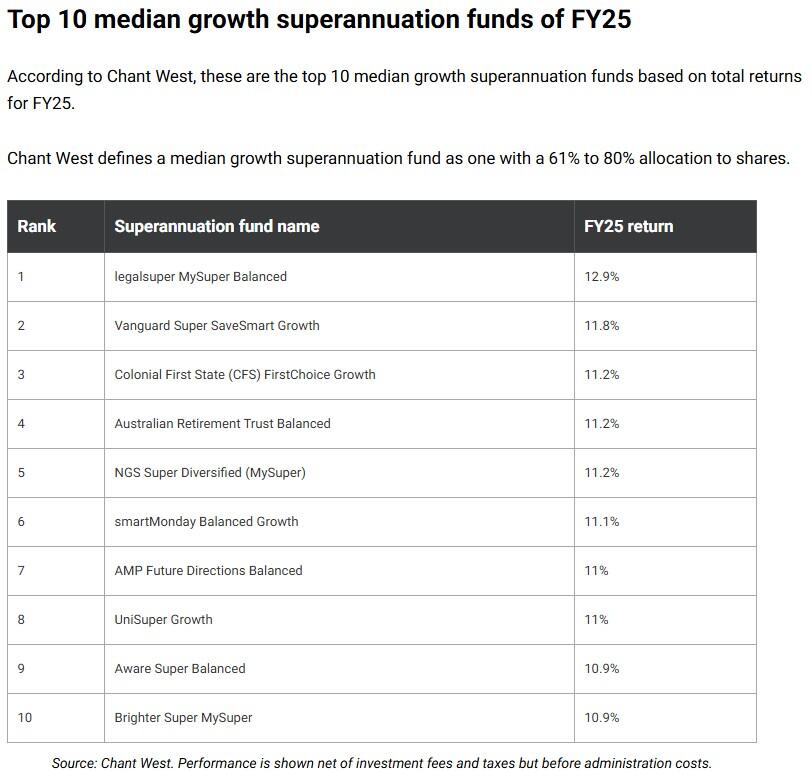

Last month, research house Chant West estimated that the typical “growth” fund option used by many Australians is on track for returns of 7.8% over the year.

Chant West’s head of superannuation research, Mano Mohankumar, notes that this would be a good outcome if it stays around where it is now, particularly given current market dynamics.

Meanwhile, Wall Street has outperformed Australia’s market significantly in 2025, with the S&P 500 up about 12%, compared with about 3% for the S&P/ASX 200.

What's clearly been driving the S&P 500 outperformance was the resilience of the U.S. economy, hype around AI and interest rate cuts from the Federal Reserve (The Fed).

“Overall, those factors have considerably outweighed the drag that was expected from the U.S. tariffs,” notes Matt Sherwood, Perpetual’s head of investment strategy, multi-asset.

However, Sherwood attributes the recent souring in market sentiment to uncertainty around further U.S. rate cuts and the sky-high valuations placed on U.S. tech giants.

“All of a sudden, people are starting to question whether these behemoth U.S. technology stocks should be traded on the valuations that they are,” he said.

Putting the importance of global exposure in context, Chant West data suggests overseas share markets account for over 31% of the assets within the typical growth fund option – compared with a weighting of about 25% for Australian shares.

Sherwood attributed the weaker performance of the local market to company valuations that were high by historical standards and low growth prospects for the economy.

“Australia has been one of the worst-performing markets this year. That reflects the fact that the market is egregiously priced in a lacklustre economy," he said.