Superannuation members received a 0.8% return from median growth funds in September as international shares overcame losses from Australian shares, according to Chant West.

This was the sixth successive month of positive returns, the research, data and analytics provider said.

Chant West estimated the median growth fund return was returning 9% in the 2025 calendar year with share markets up in October so far and despite some volatility creeping back into markets.

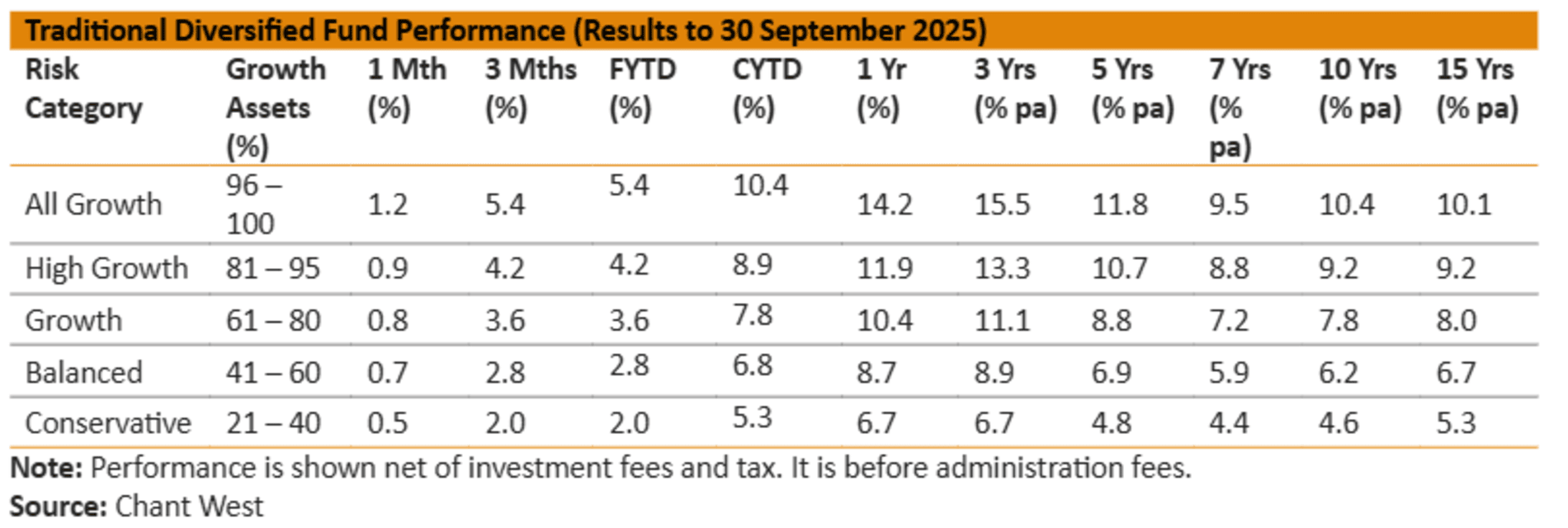

The returns in September were: 1.2% for all growth funds (96%-100% in growth assets), 0.9% from high growth (81%-95%), 0.7% from balanced (41-60%) and 0.5% from conservative (21-40%).

Head of Superannuation Investment Research Mano Mohankumar said developed international shares returned 3.3% and 2% in hedged and unhedged terms as the United States and technology sector benefitted from artificial intelligence enthusiasm.

He said markers were also buoyed by the resumption of interest rate cuts by the Federal Reserve last month and solid corporate earnings.

Emerging market shares outperformed developed markets, surging 5.8% on an unhedged basis, representing their strongest return in more than two years.

“Australian shares underperformed with a small loss of 0.6%, as expectations for interest rate cuts were scaled back in response to firmer economic data and moderately stickier inflation,” he said.

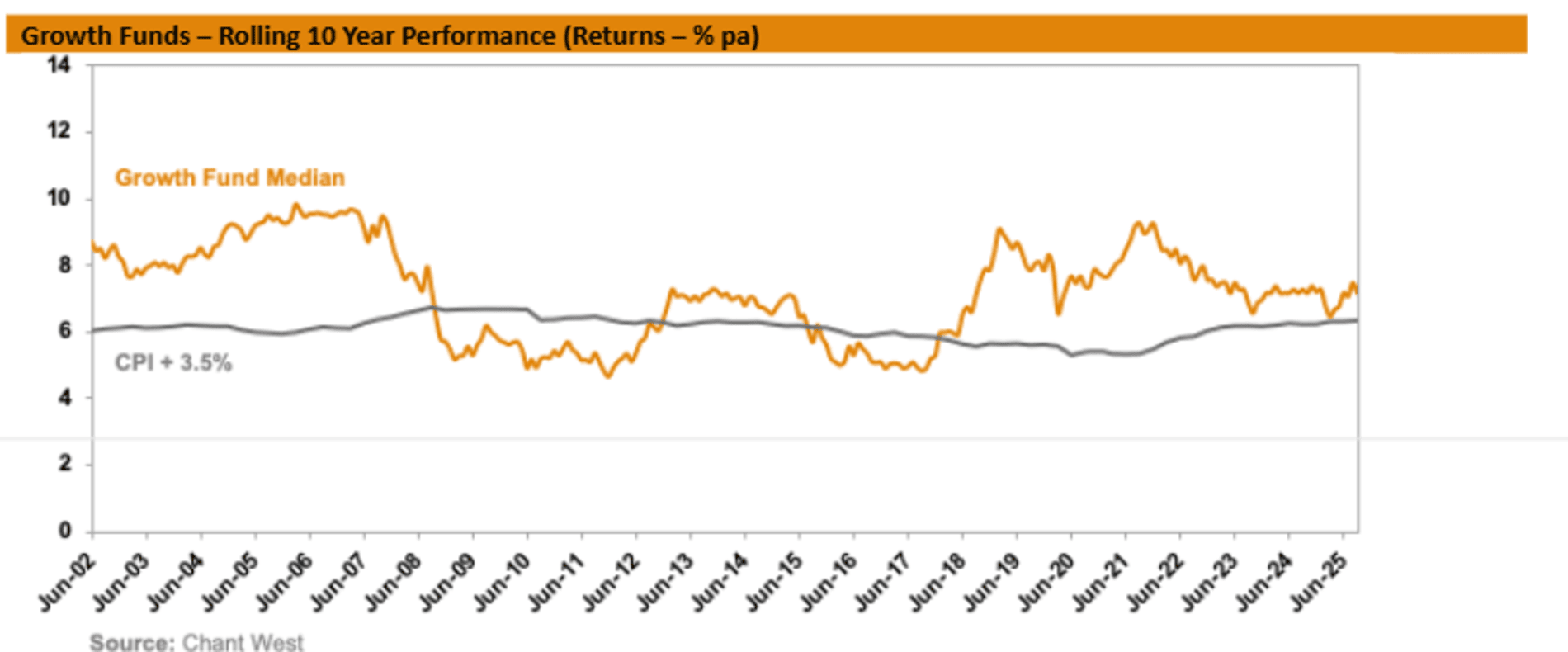

Mohankumar said since the introduction of compulsory super in July 1992, the median growth fund had returned 8% per year, producing a real return of 5.3% when taking account of inflation, which was well above the typical 3.5% target.

“Even looking at the past 20 years, which includes three major share market downturns – the GFC in 2007-2009, COVID-19 in 2020, and the high inflation and rising interest rates in 2022 – super funds have returned 7% p.a., which is still comfortably ahead of the typical objective,” he said.