Australian superannuation funds generated an 0.8% return for median balanced options in the accumulation phase in September as international markets performed well, according to SuperRatings estimates.

The super research house said international share market returns were bolstered by the artificial intelligence (AI) theme and the United States interest rate cut.

“International share markets delivered strong returns over the month, particularly markets in Southeast Asia and the U.S.,” SupeRatings said.

“The returns cap off a strong first quarter for FY26 with the median balanced fund expected to return 3.6% over the last three months.”

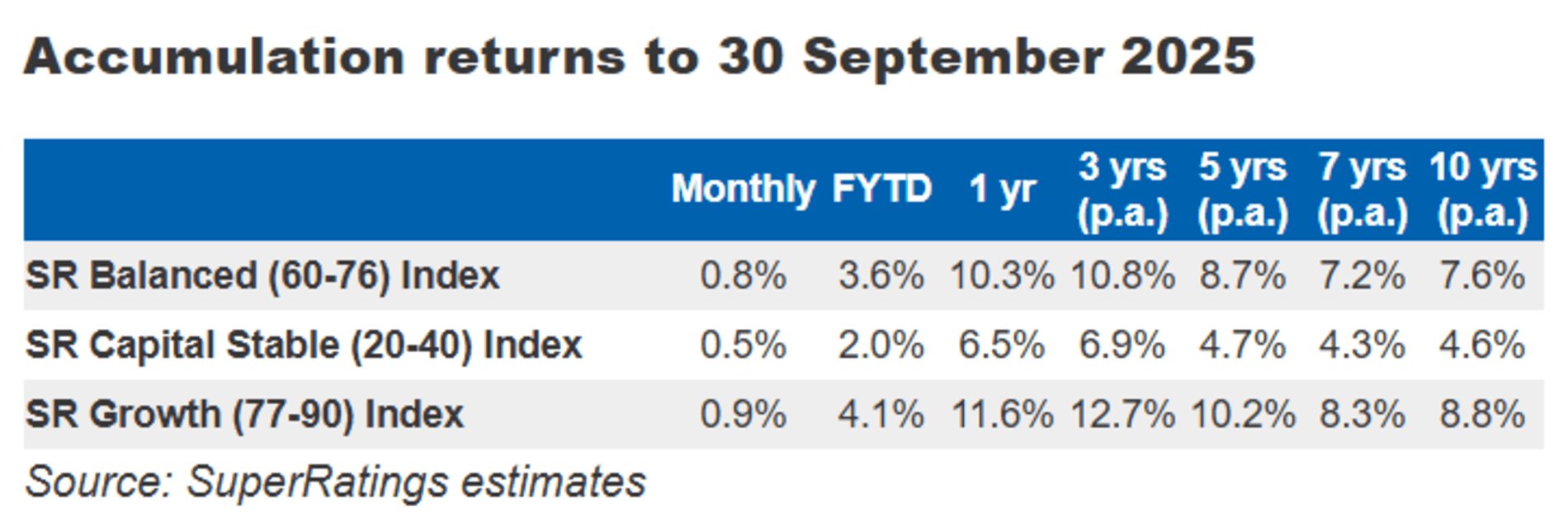

The September 2025 result was below the 1.1% return in September 2024 and brought the financial year-to-date (FYTD) return to 3.6% and the one-year return to 10.3%, compared with 3.4% and 13.2% respectively in the equivalent period last year.

The research firm said the median growth option grew by an estimated 0.9% and the median capital stable option rose an estimated 0.5% in September, bringing the FYTD and one-year returns to 4.1% and 11.6% (growth) and 2.0% and 6.5% (capital stable).

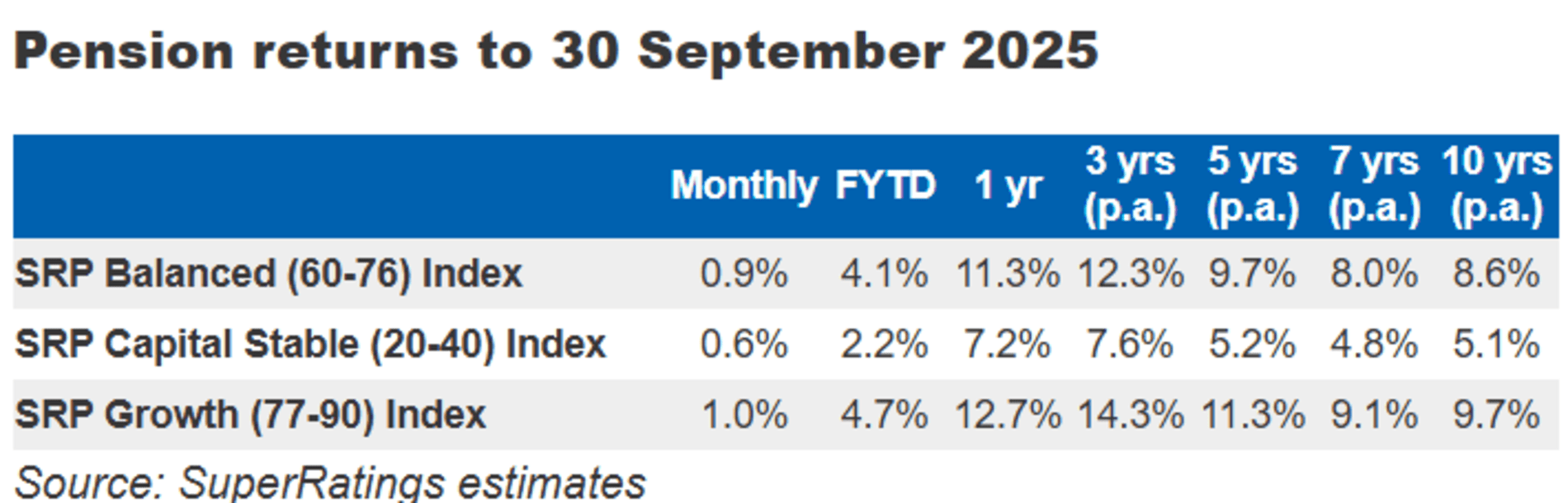

Pension returns, which are tax-free, in September were lower than in August 2024, with the median balanced pension option increasing by an estimated 0.9%, the median growth option 1.0% and the capital stable pension option 0.6% over the month.

SuperRatings Director Kirby Rappell said, although international markets had performed well, Australian shares were expected to have dampened overall returns due to fears that higher-than-expected levels of inflation would reduce the likelihood of further rate cuts.

“Over recent years we have seen a shift in super fund investments towards a more equal mix of Australian and international shares, compared to the historically higher Australian shares allocation,” he said

“We continue to see the benefits of having a range of asset types, regions and sectors with a long-term focus.

“For most of us, super is a long-term investment, and we encourage members to formulate and stick to a long-term plan that is suitable for them.”