Australian superannuation funds generated a 1.3% return for median balanced options in the accumulation phase in August, according to SuperRatings estimates.

The super research house said funds had made a smoother start to the new financial year compared with the start of August 2024.

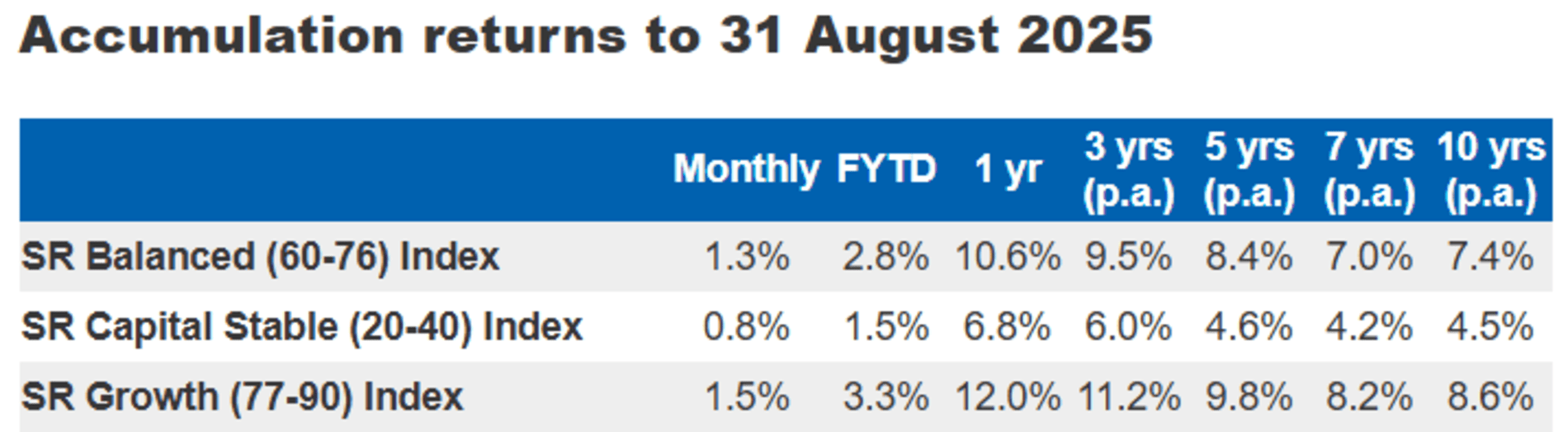

The August 2025 result was above the 0.4% return in August 2024 and brought the financial year-to-date (FYTD) return to 2.8% and the one-year return to 10.6%, up from 1.5% and 9.7%, respectively, in the equivalent period last year.

The research firm said the median growth option grew by an estimated 1.5% and the median capital stable option rose by an estimated 0.8% in August, bringing the FYTD and one-year returns to 3.3% and 12.0% (growth) and 1.5% and 6.8% (capital stable).

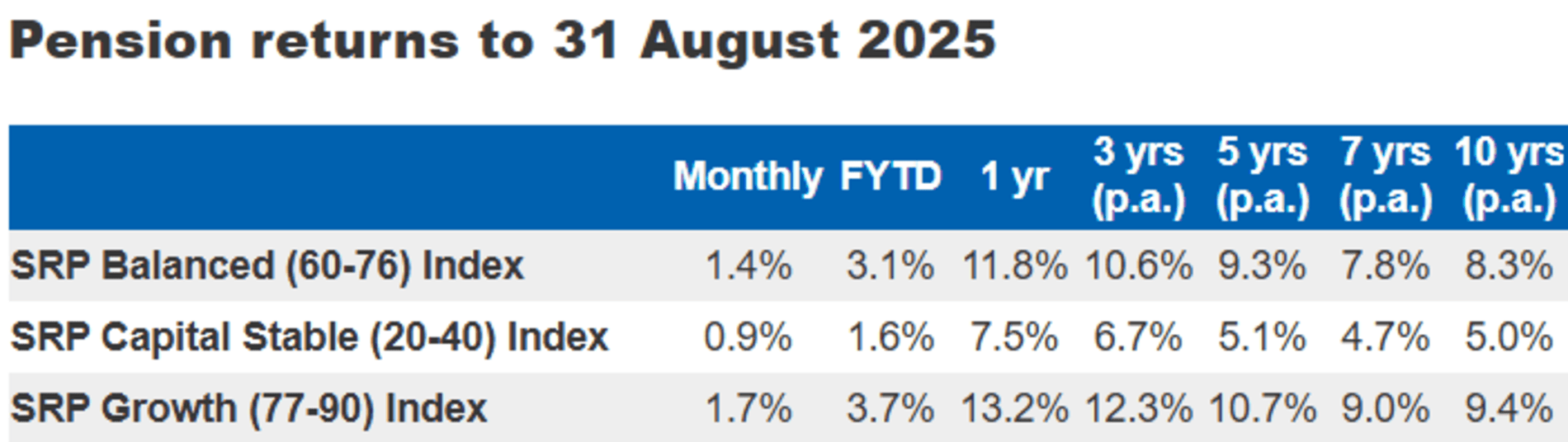

Pension returns, which are tax free, in August were higher than in August 2024, with the median balanced pension option increasing by an estimated 1.4%, the median growth option 1.7% and the capital stable pension option 0.9%.

SuperRatings Director Kirby Rappell said super had generated five consecutive months of positive returns.

“While the longer-term impacts of U.S. tariffs, high valuations and the trajectory of inflation need careful monitoring, members should be comforted by the track record of Australian funds delivering strong returns for members over the long term,” Rappell said in a media release.

“We expect the major factor influencing super returns over the short term will shift from the impact of U.S. tariffs back towards inflation levels and central bank decisions on when to act on interest rates, both in Australia and the U.S.”