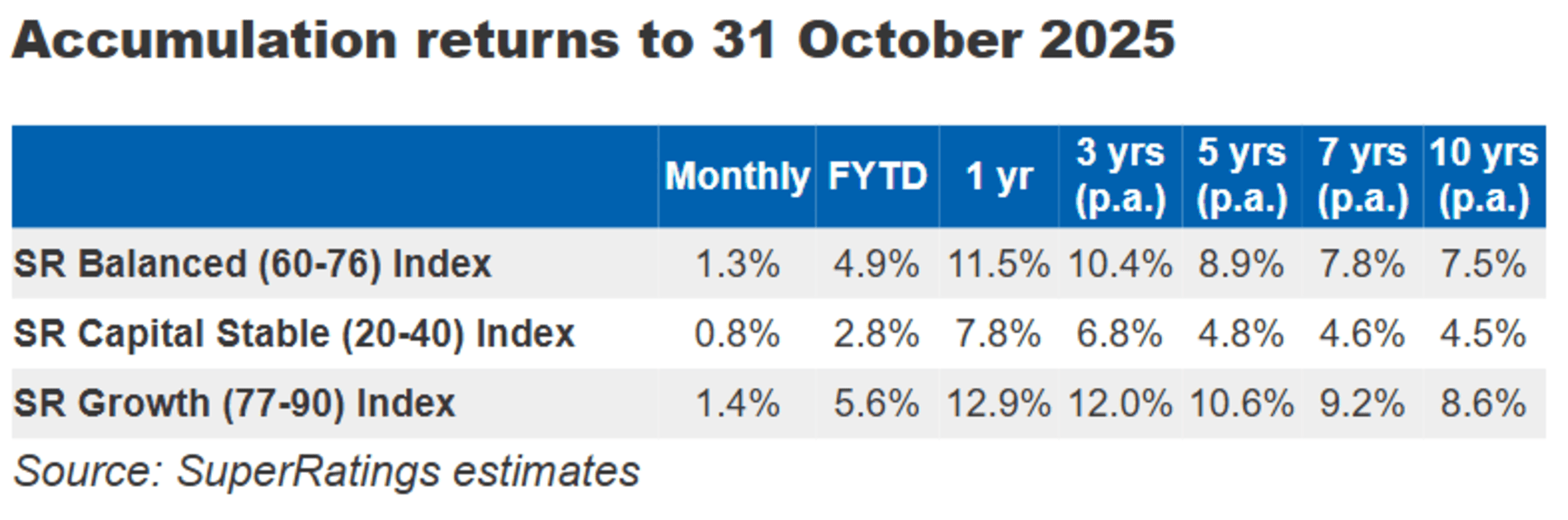

Australian superannuation funds generated a 1.3% return for median balanced options in the accumulation phase in October as Australian shares improved, according to SuperRatings estimates.

The super research house said this was the seventh consecutive month of positive returns and the sixth time in the last 25 years that the first four months of the financial year had delivered positive returns.

“Share markets continued to remain optimistic over October driving a good return for the month,” Director of SuperRatings Kirby Rappell said in a media release.

“While international shares remain the key driver, Australian shares had a better month, and outcomes were positive across key asset classes.”

The median growth option grew by an estimated 1.4% in October, while the median capital stable option grew by 0.8%.

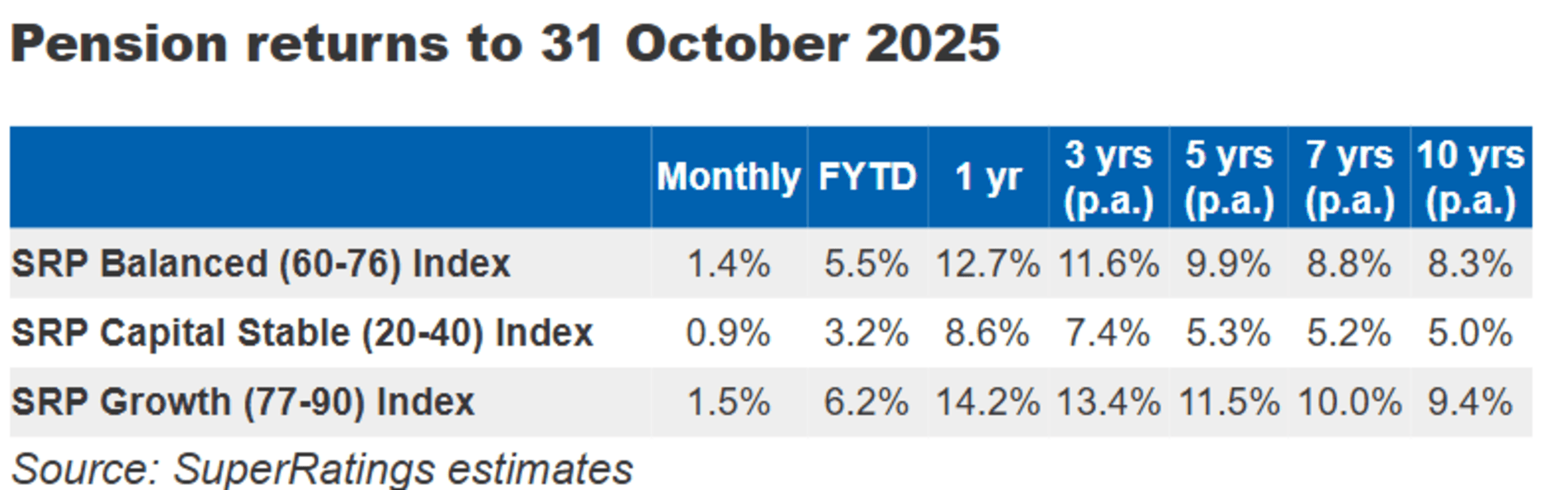

The super research house said pension returns, which are tax-free, were also strong with the median balanced option increasing by an estimated by 1.4%, the median capital stable option by 0.9% and the median growth option by 1.5%.

The October 2025 result exceeded the 0.2% accumulation median balanced return in October 2024 and brought the financial year-to-date (FYTD) return to 4.9% and the one-year return to 11.5%, compared with 3.7% and 15.2% respectively a year earlier.

“November brought the second consecutive month of interest rates being left on hold by the Reserve Bank of Australia with inflation sitting higher than anticipated. Geopolitical tensions continue to create the potential for market shocks meaning we may see some more bumps in the road over the coming months,” Rappell said.

“However, funds have had a strong start to the financial year and returns remain well above objectives over the long term. We encourage members to review any changes with their long-term strategy in mind and seek advice if they are unsure how to maximise their final retirement outcomes.”