Super Nation is a fortnightly column that examines, explains and analyses key issues in one of Australia's largest, fastest-growing and most important industries: superannuation.

A new report has shone a spotlight on the need for self-managed superannuation fund (SMSF) trustees to ensure their members are ready for a potentially huge increase in tax liabilities, and revealed some have started to cash up by liquidating assets.

A significant focus of the Class Annual Benchmark Report 2025 is the proposed new Division 296 of Australian Income Tax Assessment Act 1997, which would double the tax on the earnings on super account balances over A$3 million (US$2 million) if passed into law.

Controversial not only because it would tax unrealised capital gains but also because it is not indexed for inflation, the proposed new fiscal impost is under a political cloud, with media reports suggesting the Australian Government is having second thoughts.

Prime Minister Anthony Albanese has reportedly intervened to rein in Treasurer Jim Chalmers' fund-raising ambitions due to concerns about the impact on Australians’ aspiration, but so far nothing has been confirmed.

Treasurer Jim Chalmers could not convince enough upper house members to support the Superannuation (Better Targeted Superannuation Concessions) Imposition Bill 2023 before the last poll, which the ruling Labor Party won in a landslide in May.

Although the legislation has not yet been introduced into the House of Representatives, Labor would need only the support of the left-leaning Greens to pass the legislation in the Senate because it dominates the lower house.

Preparing just in case

Facing the possibility that it may be introduced in the current Parliament and knowing it will be more affected than other parts of the super industry, the $1.05 billion SMSF sector is opposing it vehemently but also getting ready for its introduction.

The tax, which is forecast to raise $2.3 billion in 2027/28, was to start from 1 July 2025, but the first test of the $3 million threshold is 30 June 2026.

Class said the average liability for affected members using its SMSF software would have been about $51,700 if Division 296 had applied in the 2024 financial year (FY24), with a total potential impact of $940.9 million across 18,198 Class members in FY24.

This is Class’ share of the overall SMSF market, which had 1.203 million members in 653,062 funds with total assets of $1.015 billion at 30 June, according to Australian Taxation Office statistics.

The average SMSF balance on Class was $1.9 million, compared with about $844,000 across the whole sector.

A total of 21,141, or 8.7% of Class members, held balances between $2 million and $3 million in FY25, but as assets increase in value and balances rise, more of them may be affected by the new tax.

“It is anticipated that many members will start to implement strategies to reduce the impact of this tax,” Class wrote.

Of the Class SMSFs with at least one affected member, 6.7% did not have enough cash or term deposits to meet the liability, up from 5.0% in FY23, and about one third owned direct property, which the firm noted “can be challenging to liquidate quickly”.

Selling property

Exposure to direct property eased with the percentage of funds holding it falling by 0.9 percentage points to 29.8% or $74.0 billion, “signalling some trustees may be reducing holdings ahead of potential Division 296 changes”.

By contrast, Australian Prudential Regulation Authority (APRA)-regulated super funds held just 7% of their assets in property at 30 June 20, according to APRA data.

For funds owning property, residential holdings represented a larger share of smaller funds at about one-half of total assets, while commercial exposure in larger funds was closer to one-third.

APRA-regulated funds rarely hold residential property and then only with strict limitations, recognising their members may directly own it themselves.

Property made up $749,000 of total fund assets of $1.4 million among funds owning residential property, while it consisted of $1.2 million of $3.0 million in total assets among funds with commercial property.

“This concentration in lower-balance funds can affect diversification and liquidity, so keeping valuations and property documentation current will help with planning,” the software provider said.

Time to talk

Class Chief Executive Officer Tim Steele said early conversations on liquidity and tax planning would be critical for SMSF members likely to be affected by the proposed Division 296 changes.

This was the fifth annual benchmark report by Class, a cloud-based accounting and SMSF administration software provider owned by HUB24, which is one of the major providers of investment platforms offering super products.

Class said the new tax was reducing the attractiveness of starting an SMSF with direct property, which may explain why larger balance fund establishments were falling.

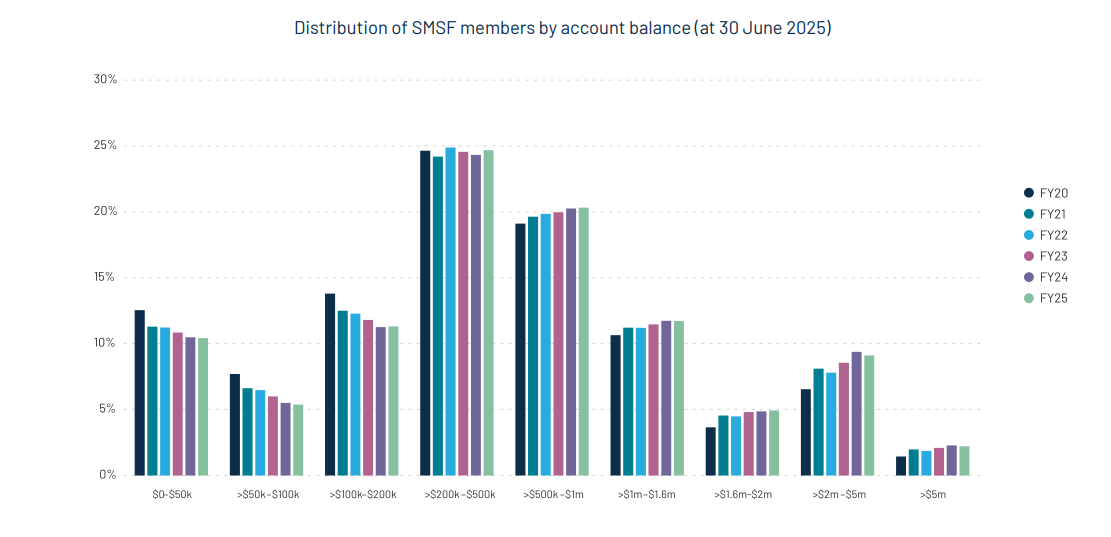

The steady rise in member balances of $500,000 and above continued in FY25, while those with balances in the $2 million to $5 million range fell, which suggested some may be shifting funds out of super in preparation for the proposed Division 296 tax.

Noting that without indexation, more SMSF members were likely to be captured by the tax over time, Class said advisers would be instrumental in helping clients with options such as rebalancing, diversification and reviewing alternative structures for managing wealth above $3 million outside superannuation.