United States soft drinks company Coca-Cola, is scrambling to save its Costa Coffee sale after a pricing standoff put the deal on the brink, forcing urgent weekend talks with private equity suitor TDR Capital.

Coca-Cola’s plan to sell Costa Coffee is wobbling, with negotiations threatening to fall apart just days after TDR Capital was named preferred bidder.

While TDR was selected as Coca-Cola's preferred bidder last week, talks with the company and its advisers at Lazard have stumbled over the price of a deal that is understood to include the soft drinks giant retaining a small stake in the British coffee chain.

According to the Financial Times, the two sides are locked in last-minute discussions as they try to bridge a gap over valuation.

At the heart of the dispute is price, with Coca-Cola understood to be chasing around £2 billion (A$4.01 billion) for Costa.

This is considered a tough sell given that the business has struggled to keep up with cheaper rivals and independent cafés while battling higher costs.

The current proposal would leave Coca-Cola holding a minority holding, a lever that could yet be pulled to get the deal across the line.

If talks fail, Coca-Cola is expected to decide next week whether to abandon the sale altogether.

Costa has had a checkered run since Coca-Cola bought it from Whitbread in 2018 for £3.9 billion.

Competition from the likes of Greggs, alongside rising bean prices and wage bills, has pushed the coffee chain into the red.

In 2023, Costa posted a £13.8 million loss on £1.2 billion in revenue.

While other would-be buyers have come and gone, TDR - which also co-owns petrol forecourt group EG – appears to be the last serious contender for Costa’s UK and international operations, excluding China.

The timing adds another twist, with Coca-Cola shares ending last week slightly higher as investors weighed the shaky Costa talks alongside a planned CEO handover in 2026 and an upcoming dividend week.

For a stock prized as a defensive steady hand, this is shaping up as a rare bout of event-driven drama.

If the sale collapses, Coca-Cola may be left holding onto a business it has already admitted “has not delivered” — and that could prove harder to swallow than a flat Coke.

Coca-Cola ended last week at US$70.52, up about 0.7% week-over-week, as investors made sense of recent developments.

With Coca-Cola also heading into a dividend week and a data-heavy macro calendar that could swing rates and the U.S. dollar, the setup for the week ahead is a classic “defensive stalwart meets event risk.”

Other former bidders for Costa included Bain Capital’s special situations division, which owns Gail’s and PizzaExpress.

Centurium Capital, the private equity owner of China’s Luckin Coffee chain, has also been involved in the auction, according to people familiar with the process.

Private capital firms Apollo and KKR have both dropped out of the process in the past few months.

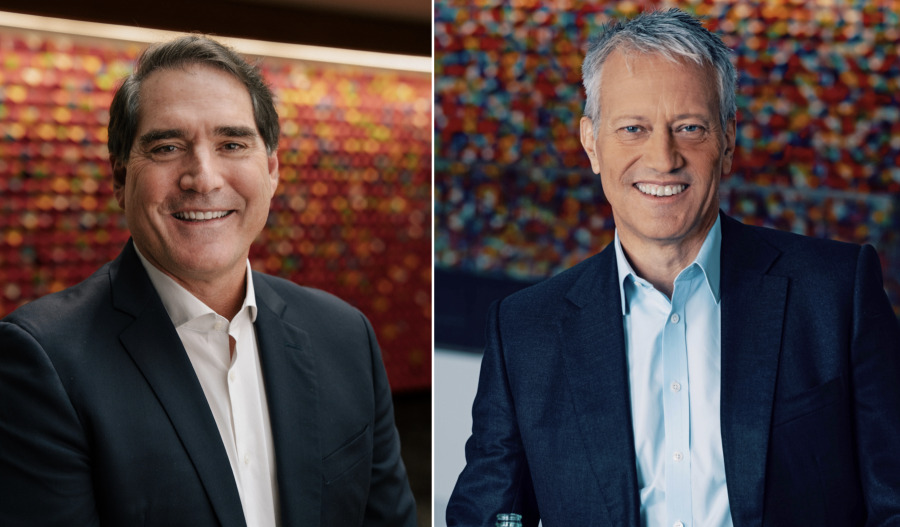

Coke announced last week that CEO James Quincey will be replaced by chief operating officer Henrique Braun in March.

Quincey, who told analysts in July that Costa had “not delivered”, will become executive chair.

The potential collapse of the sale could have significant implications for both Coca-Cola and Costa Coffee.

For Coca-Cola, it could mean a missed opportunity to recoup a substantial portion of its initial investment in Costa, while for Costa, it could mean continued struggles in a competitive market without the anticipated infusion of capital from the sale.

Join our community of decision-makers. No card required

Join now