CY2026 so far has been defined by humanity's current buzz sectors - energy and tech. As markets gobbled up a cooldown in American inflationary pressure, the real heat was generated by Washington’s renewed interest in Greenland and a tightening grip on South American energy flows.

All the top moves, shakes, and high-stakes power plays from Azzet’s editorial team are right here in your weekly business wrap every Friday (9 January, 2026).

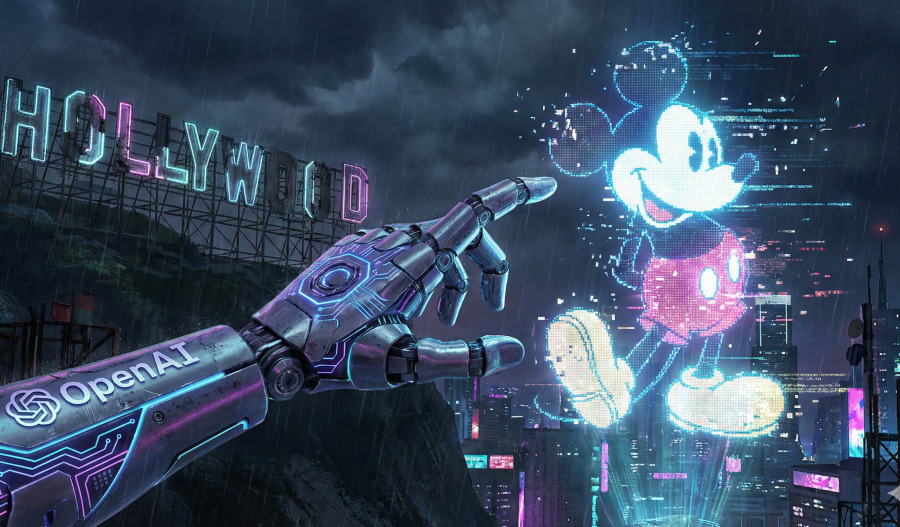

From the boardrooms of Silicon Valley - where xAI secured a war chest that would make most nations blush - to the halls of Copenhagen, where sovereignty is being fiercely defended, the team at Azzet put the squeeze on some big topics in business this week.

Here's what you need to know:

Monday

The week opened with a focus on yield and long-term stability as analysts suggested that 2026 Aussie bonds and fixed interest are set to remain attractive for investors seeking a safe haven.

This positive sentiment was bolstered by a strong lead from New York, with the ASX set to rise after a higher close on Wall Street.

However, the transition to green energy faced a legal hurdle as wind developers moved to challenge lease suspensions, highlighting the ongoing friction between industrial rollout and regulatory oversight.

Tuesday

Geopolitics and energy took centre stage on Tuesday as Wall Street energy stocks rallied following reports of a significant strike in Venezuela.

The U.S. further applied pressure in the region, with the Coast Guard pursuing a third oil tanker near Venezuela in a week as part of its enforcement of shipping sanctions.

The day also saw a sharp diplomatic rebuke from Europe, as the Denmark Prime Minister stated the U.S. has no right to Greenland, responding to renewed chatter from Washington.

Meanwhile, back home, the sporting world prepared for a massive summer as the Australian Open announced a record A$11.5 million prize pool.

Wednesday

The middle of the week belonged to Big Tech and defence.

Elon Musk’s xAI finalised a staggering US$40 billion funding round from a syndicate of "tech buddies", dramatically raising the stakes in the LLM race.

To keep pace with rising global tensions, Lockheed Martin announced it would triple its Patriot missile output.

On the economic front, the RBA received a welcome data point as Australian inflation fell to 3.4% in November, easing pressure on households.

In the corporate sector, the AI benchmarking platform LMarena achieved a US$1.7 billion valuation, while regulators warned there would be no rest for watchdogs in the wake of recent superannuation collapses.

Thursday

The "Arctic Interest" deepened on Thursday as news broke that the U.S. is actively discussing buying Greenland, despite earlier denials.

At the same time, the U.S. moved to further control Venezuelan oil sales, driving global crude prices higher.

On the corporate floor, the "Brew King" AB InBev rode a global alcoholic drinks wave to stronger earnings, while the domestic trading floor saw Monadelphous and Linq Minerals rise as Ansell shares dropped.

Friday

Closing out the week, the news cycle hit a fever pitch.

In Washington, Donald Trump announced plans to ban corporate home ownership in a bid to assist first-home buyers, while simultaneously looking at a range of options to take Greenland.

In the tech sector, Nvidia completed its strategic rescue of Intel through a massive placement, and SoftBank moved to buy DigitalBridge for US$4 billion.

However, security concerns weighed heavily as Australia banned DeepSeek on government devices and stolen Qantas customer data surfaced on the dark web.

The resources sector also faced a shakeup as battery giant CATL poured salt in lithium-cobalt wounds with its focus on alternative battery materials, just as U.S. futures gained on a late-week tech recovery.