The battery energy sector, led by China's CATL, is - whether purposefully or not - forcing a fundamental pivot toward sodium-ion (Na-ion) technology to mitigate the supply risks associated with lithium-based chemistries.

The move's aim is de-risking manufacturing chains from the price volatility of cobalt, nickel, and lithium carbonate.

Contemporary Amperex Technology Co., Limited (CATL) confirmed in early 2026 that its salty "Naxtra" cells had moved beyond pilot phases into full industrial integration across multiple vehicle platforms.

The rollout serves a dual purpose: providing a buffer against mineral shortages and enabling a lower price floor for entry-level electric transport.

Defining sodium technology

A sodium-ion battery operates on a cation-shuttling principle where sodium ions migrate between electrodes through a non-aqueous electrolyte.

The metallurgical requirements for sodium differ from lithium systems because the sodium ion possesses a larger physical radius.

Standard graphite anodes cannot effectively accommodate these larger ions, necessitating the use of specialised hard carbon which features a non-graphitising, disordered atomic structure.

Cathodes typically employ layered transition metal oxides or Prussian Blue analogues, utilising abundant elements such as iron and manganese to eliminate the need for expensive imported minerals.

Leading industry participants

CATL remains the primary innovator of the new chemistry, recently achieving a verified gravimetric energy density of 175 Wh/kg in its second-generation production cells.

With one-third of the global market share of battery production, CATL announcing the start of commercial production of sodium-ion batteries sent ripples up and down the supply chain.

In the European market, Northvolt has validated a 160 Wh/kg cell specifically engineered for the grid-scale energy storage sector.

Car and battery maker BYD is scaling its 30 GWh Xuzhou facility to supply its compact vehicle range and stationary storage products globally.

French manufacturer Tiamat is focusing on high-power applications, developing cells capable of ultra-fast charging for hybrid systems and heavy industrial equipment.

These developments indicate that the technology is no longer a laboratory curiosity but a commercial necessity for diversified energy portfolios.

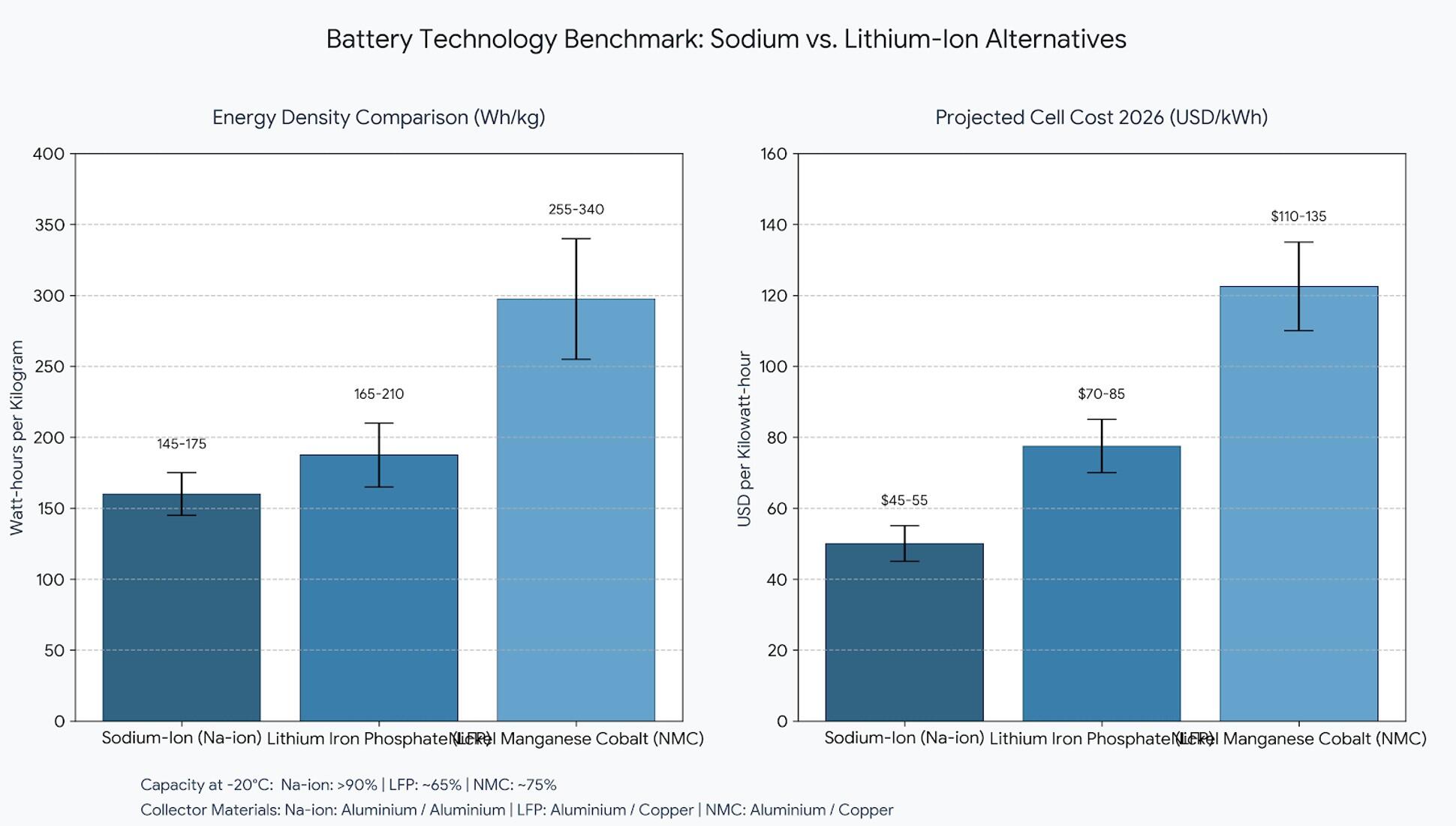

Comparative cost metrics

The stability of raw material pricing is the most significant commercial driver for the adoption of sodium-based systems.

Sodium carbonate trades at approximately $300-$400/t, whereas lithium carbonate remains volatile, trading between $10,000-$15,000/t in early 2026.

A distinct engineering advantage is the ability to utilise aluminium foil current collectors for the anode and cathode.

Lithium-ion cells require copper foil for the negative collector because lithium alloys with aluminium; sodium does not, allowing manufacturers to remove expensive copper from the bill of materials.

Real world performance

Field data from 2026 deployments confirms that sodium-ion packs retain high efficiency in extreme sub-zero environments where lithium-ion range typically degrades.

CATL’s sodium-ion packs are standard in several "A-segment" city cars, allowing for consistent winter performance without the need for intensive thermal management systems.

The technology is also gaining traction in uninterrupted power supply (UPS) infrastructure for data centres due to its superior thermal stability and lower fire risk.

As global production capacity scales, the cost per kilowatt-hour is projected to reach a level that makes long-duration grid storage economically viable without subsidies.