Re-live today's live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Microsoft beats revenue estimates by US$3 billion

- Nissan losses less than projected

- Hermès, Danone post solid sales growth worldwide

- Meta smashes estimates as user numbers rise

- Ford, Mercedes-Benz, L'Oreal, Adidas, Hershey expect tariff hits

- Allstate, Santander, Intesa Sanpaolo, Garmin post record profit

_______________________________________________________________________________________

8:49 am (AEST):

Good morning! Harlan Ockey here to walk you through today's earnings.

Starting off on the NASDAQ with Microsoft (MSFT), the company reported US$76.4 billion in Q4 FY25 revenue. This represents an 18% year-over-year increase, driven by explosive growth in Azure cloud services and artificial intelligence (AI) integrations.

In a nearly $3 billion beat, the U.S. software behemoth exceeded analyst expectations of US$73.81 billion, underscoring its dominance in the tech sector amid accelerating AI adoption.

The Intelligent Cloud segment, which includes its flagship Azure platform, generated US$29.9 billion, up 26% from the previous year.

Azure itself expanded by 39%, significantly outpacing competitors like Amazon Web Services, which reported 19% growth in its latest quarterly.

Read Cameron Drummond's full story here.

9:01 am (AEST):

Still with the NASDAQ, Robinhood (HOOD) reported a 105% surge in net income last quarter, reaching US$386 million.

Net revenues were up 45% to US$989 million. Cryptocurrencies brought in $160 million in revenue, rising 98%.

Robinhood's notional trading volumes were US$28 billion last quarter.

Read Cameron Drummond's full story here.

9:08 am (AEST):

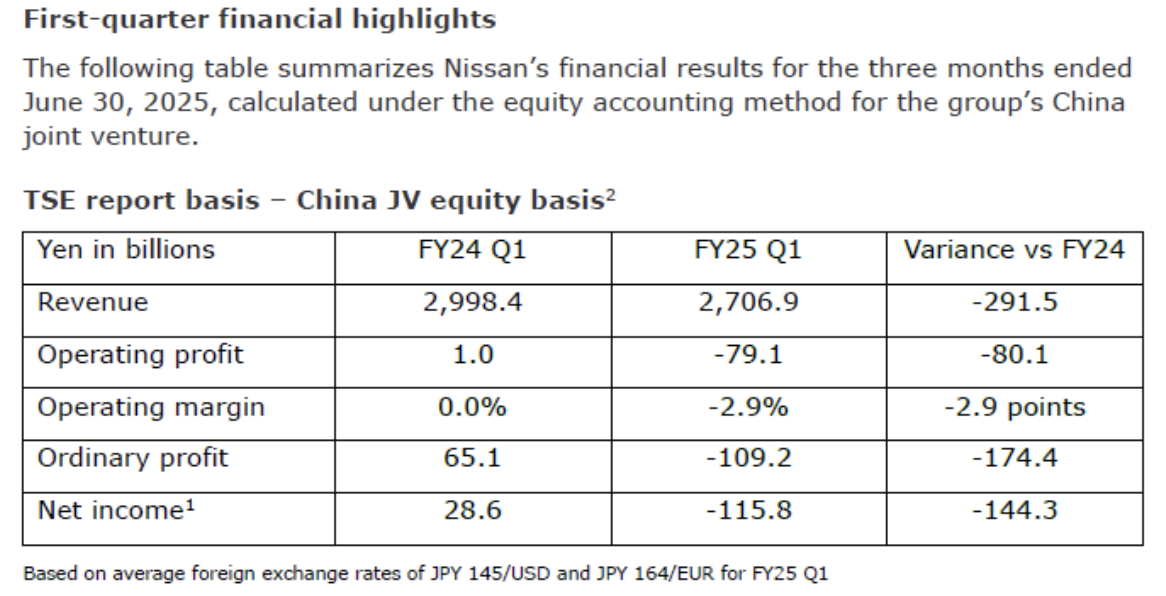

Crossing over to the TYO, Nissan Motor (7201) posted a consolidated operating loss of JP¥79.1 billion last quarter. This was above its original projections of a ¥200 billion loss.

Net revenues were JP¥2.7 trillion, sinking ¥291.5 billion from the first quarter of FY2024. It reported a net loss of ¥115.8 billion, falling ¥144.3 billion year-over-year.

The company is currently seeking to cut costs in a bid to return to profitability by FY2026. Nissan achieved more than JP¥30 billion in fixed cost reductions last quarter, it said.

“Over the past quarter, we’ve taken decisive first steps — cutting costs, redefining our product and market strategy, and strengthening key partnerships. We must now go further and faster to achieve profitability. Everyone at Nissan is united in delivering a recovery that will ensure a sustainable and profitable future," according to CEO Ivan Espinosa.

Andrew Banks has the full story here.

9:18 am (AEST):

Now turning to the EPA, Hermès International reported revenue of EU€8.03 billion last half, an 8% year-over-year increase at constant exchange rates.

Adjusted net income attributable to the group was EU€2.25 billion, up 6% from one year ago. Diluted earnings per share were €21.39, dropping from €22.58 in H1 2024.

Sales grew across all geographical regions. The highest percentage increases were seen in Japan at 16% and the Other region, which primarily includes the Middle East, at 17%. The Americas and Europe excluding France also posted double-digit percentage growth.

Among its segments, Leather Goods & Saddlery saw the largest percentage sales increase at 12%. Perfume & Beauty and Watches reported sales decreases of 4% and 8%, respectively.

“The solid first-half results across all regions reflect the strength of the Hermès model. I would like to thank all our customers for their trust and all our employees for their commitment. We will continue to invest and recruit to ensure the group’s sustained success,” said Hermès executive chair Axel Dumas.

Read Andrew Banks' full report here.

9:28 am (AEST):

At the ETR: Adidas (ADS) saw currency-neutral revenues surge by 12% year-over-year, but shares dropped by 11.5% as the company flagged a major potential hit from tariffs this year.

Net sales were EU€6.0 billion. Net income from continuing operations was up 77% year-over-year to €375 million.

Its Performance and Lifestyle segments reported the strongest sales growth, at 12% and 18%. Currency-neutral sales rose across all markets.

“The year has started great for us and normally we would now be very bullish in our outlook for the full year. We feel the volatility and uncertainty in the world does not make this prudent. We still do not know what the final tariffs in the US will be,” said CEO Bjørn Gulden.

“We have already had a negative impact in the double-digit euro millions in Q2 and the latest indications of tariffs will directly increase the cost of our products for the US with up to € 200 million during the rest of the year. We do also not know what the indirect impact on consumer demand will be should all these tariffs cause major inflation.”

Adidas has reaffirmed its full-year guidance of EU€1.7-1.8 billion in operating profit.

9:57 am (AEST):

Returning to the ETR, Mercedes-Benz (MBG) has lowered its guidance amid a tariff-driven slump in sales.

Sales dropped 9% below the previous year’s level to 435,700 units in Q2 2025. This marks an 11% drop in revenue from EU€27.1 billion to €24.1 billion.

Group revenue and earnings before interest and tax were also impacted, falling 10% to EU€33.2 billion and 68% to EU€1.3 billion, respectively.

The U.S. currently has a 25% tariff on European-made vehicles. Mercedes-Benz does not currently expect a deal to be struck that would specifically exempt Mercedes-Benz from these tariffs, according to CEO Ola Källenius.

“We achieved robust financial results in the second quarter given the dynamic business environment. The best response is to stay on course to deliver desirable and intelligent products, while keeping a tight grip on costs. We’re adapting to new geopolitical realities by using our global production footprint intelligently and by executing our Next Level Performance programme, which goes beyond efficiency measures, to increase the resilience of our company,” said Källenius.

Its new guidance projects a carmaking margin of 4% this year, down from its previously expected 6%. The company predicts revenue this year will be “significantly below” 2024's.

Chloe Jaenicke has the full report.

10:07 am (AEST):

Back at the NASDAQ: Meta Platforms (META) surpassed revenue estimates last quarter, while net income surged.

Revenue was US$47.52 billion, above estimates of $44.80 billion and up 22% from one year ago. Net income was up 36% year-over-year to $18.34 billion.

Daily active user numbers also increased by 6% year-over-year, reaching 3.48 billion. Ad impressions increased by 11%.

Costs and expenses were US$27.08 billion last quarter, up 12%.

"We've had a strong quarter both in terms of our business and community," said CEO Mark Zuckerberg. "I'm excited to build personal superintelligence for everyone in the world."

The company expects revenue next quarter will be US$47.5-50.5 billion, with full-year expenses at $114-118 billion.

Read Mark Story's full report here.

10:27 am (AEST):

At the EPA, L'Oreal (OR) saw sales grow by 3% year-over-year to EU€22.47 billion, but warned it.could face pressure from U.S. tariffs.

Europe saw the largest growth in sales in the first half, growing 3.4% to €7.53 billion, with the business reporting “strong momentum” in Spain, Portugal, Germany and Switzerland. The company also saw a return to growth in China.

“The ongoing strength in emerging markets, the slight rebound in mainland China and the gradual recovery in North America more than offset the expected slowdown in Europe, once again validating our multi-polar model,” said CEO Nicolas Hieronimus.

U.S. tariffs on European goods are are set to be 15% under a new trade agreement. L'Oreal has stockpiled products, the company said, but may need to add slight price increases.

Read Chloe Jaenicke's full story here.

10:57 am (AEST):

Still with the EPA, Airbus (AIR) reported increases in revenue and EBIT last half, though its commercial aircraft deliveries have fallen.

Revenues grew 3% year-over-year to EU€29.6 billion. Consolidated adjusted EBIT was €2.20 billion, up from €1.39 billion.

The company delivered 306 commercial aircraft, lower than the 323 seen in H1 2024. The vast majority were from the A320 family, at 232 deliveries, with the second most popular being the A220 at 41 deliveries.

Net aircraft orders increased to 402 last half, rising from 310 year-over-year. Its order backlog was 8,754 aircraft at the end of the half.

“Our H1 financials reflect transformation progress in our Defence and Space division and the lower commercial aircraft deliveries compared to a year ago. We are producing aircraft in line with our plans but deliveries are backloaded as we face persistent engine supply issues on the A320 programme," said CEO Guillaume Faury.

Airbus reaffirmed its full-year guidance, which projects 820 aircraft deliveries and adjusted EBIT of around EU€7.0 billion. This projection excludes the impact of tariffs, with the U.S. agreeing to remove tariffs on civil aircraft.under an agreement with the European Union.

11:19 am (AEST):

Back to the NYSE, The Hershey Company (HSY) reported mixed results last quarter, and has lowered its guidance to reflect tariff impacts.

Consolidated net sales were US$2.61 billion, up 26.0% year-over-year. Net income was US$62.7 million, down 65.2%, and earnings per diluted share declined to $0.31.

Its North America Confectionary segment saw the largest percentage growth in sales, at 32.0%.

“Investments in our brands and impactful innovation, coupled with effective execution, are driving solid sales and share gains across both our U.S. confection and salty snacking business. Looking ahead, we remain committed to delivering balanced growth and have taken pivotal steps toward mitigating cocoa inflation through strategic pricing, enhanced productivity, and technology enabled efficiency and speed," said CEO Michele Buck.

The company now predicts its earnings per share will drop by around 50% across 2025, compared with prior guidance of a drop in the high 40% range.

11:22 am (AEST):

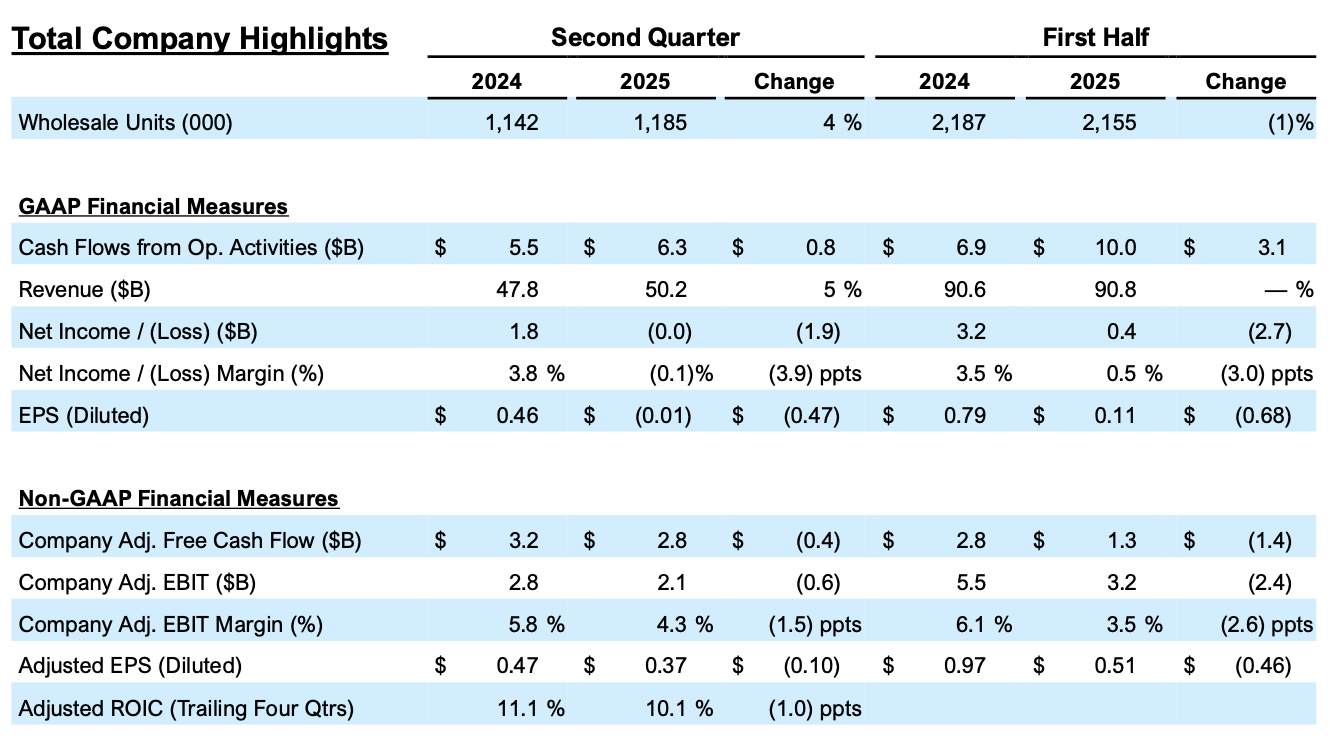

Still at the NYSE, Ford Motor (F) reported a net loss of US$29 million due to U.S. tariffs, even as its revenue beat estimates.

Revenue was US$46.94 billion, above LSEG estimates of $43.21 billion and up from $44.81 billion one year ago. Its net income in Q2 2024 was $1.83 billion.

Adjusted EBIT last quarter was US$2.1 billion, down from $2.8 billion one year ago.

The company had suspended its full-year guidance in May, projecting a US$2.5 billion hit from U.S. tariffs on goods like steel and aluminium with around $1 billion that could be offset. It now expects a $3 billion tariff hit, and aims to offset $1 billion.

Ford's new full-year guidance projects adjusted EBIT of US$6.5-7.5 billion, down from its February guidance of $7.0-8.5 billion.

“We recorded our fourth consecutive quarter of year-over-year cost improvement, excluding the impact of tariffs, building on progress we made last year when we closed roughly $1.5 billion of our competitive cost gap in material cost. Our balance sheet keeps getting stronger, further enabling our ability to invest in areas of strength. We are remaking Ford into a higher-growth, higher-margin and more durable business — and allocating capital where we can compete, win and grow,” said Ford CFO Sherry House.

Ford's retail prices have risen by around 1% this year, House said, and will likely remain at that rate for the rest of 2025. It sold 1,185,000 units last quarter, up 4% year-over-year.

Read Cameron Drummond's story here.

11:27 am (AEST):

Turning to the LON, BAE Systems (BA) delivered a sturdy financial performance in the first half of 2025, with total revenue rising 9% year-on-year to UK£13.57 billion.

Sales on a defined basis increased 11% to £14.62 billion, supported by growth across all segments. Underlying EBIT rose 13% to £1.55 billion (beating a consensus forecast of £1.52 billion), yielding a return on sales of 10.6%.

Basic EPS increased to 32.3p, while underlying EPS reached 34.7p, up 12% on a constant currency basis. Net profit attributable to shareholders was £969 million, and adjusted profit stood at £1.04 billion.

“In this heightened global threat environment, we continue to deliver mission critical capabilities to armed forces around the world and invest in our people, technologies and facilities to drive the improved efficiency, capacity and agility needed to meet the increasing demand for our highly relevant products and services,” said CEO Charles Woodburn.

BAE Systems upgraded its full-year guidance, now expecting sales growth of 8–10% and EBIT growth of 9–11%, while maintaining EPS growth at 8–10% and a free cash flow target above £1.1 billion.

Thank you to Andrew Banks for the write-up; read the full report here.

11:45 am (AEST):

Hi all, Chloe Jaenicke here to cover the blog for a little bit.

Moving to the NASDAQ, Qualcomm (QCOM) saw shares slide 6% following the announcement of its Q3 earnings.

This is despite the 10% year-on-year revenue increase experienced by the business to US$10.4 billion.

While handset revenues rose 7% from the same time last year to US$6.33 billion, this was still short of analysts' estimates of US$648 billion, raising concerns about smartphone demand and the impact of global trade in the sector.

The company returned US$3.8 million to shareholders, including US$967 or US$0.89 per share of cash dividends.

“Another quarter of strong growth in QCT Automotive and IoT revenues further validates our diversification strategy and confidence in achieving our long-term revenue targets,” Cristiano Amon, President and CEO of Qualcomm Incorporated said.

12:10 pm (AEST):

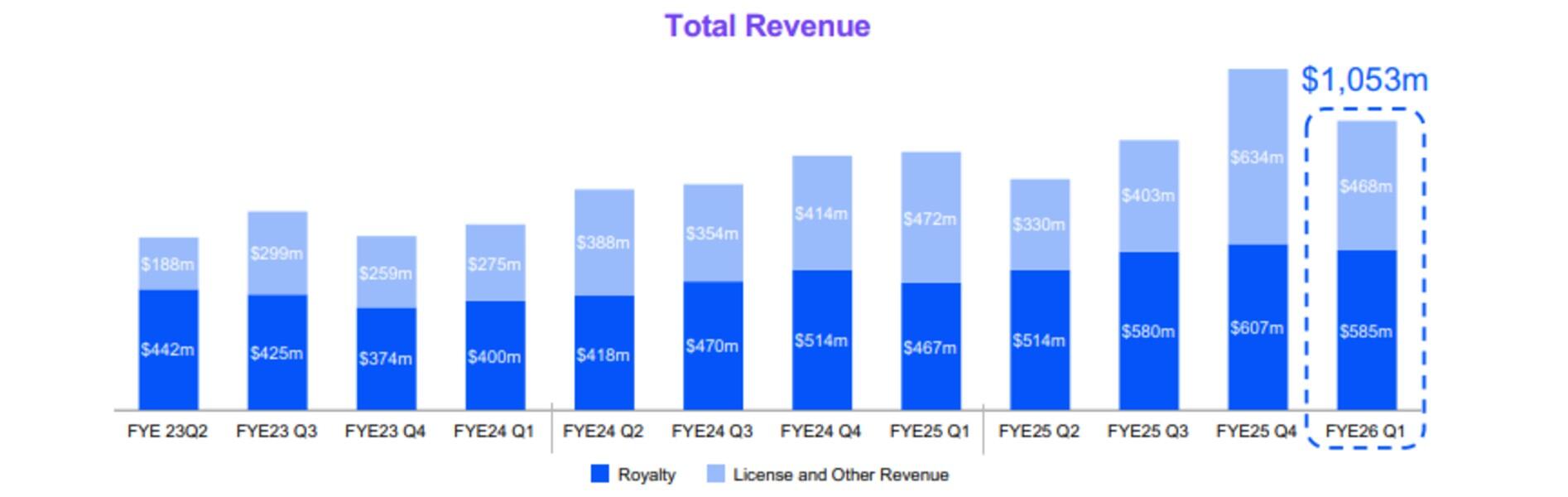

Staying on the NASDAQ, Arm (ARM) surpassed US$1 billion in quarterly revenue for the second quarter in a row.

Its total revenue for Q1 2026 was up 12% year-over-year to US$1.05 billion, with royalty revenue rising 25% to US$585 million, while license and other revenue fell by 1% to US$468 million.

The royalty revenue was driven by continued adoption of the Armv9 architecture, the ramp of chips based on Arm CSS and increased usage of Arm-based chips in data centres.

Despite the rise in revenue, shares in the company dipped 9%, with revenue falling behind analysts' expectations of US$1.06 billion. However, earnings per share remained on par with analysts' expectations of 35 cents.

Arm CFO, Jason Child, said the company was underwhelmed by the results.

“The growth wasn’t quite as strong in the smartphone sector as maybe we’d expected,” Child said.

The company now estimates at least 70,000 enterprises are running data centre workload off Arm Neoverse-based chips, representing a 14x increase since 2021.

The business expects revenues of US$1.01 billion to US$1.11 billion in Q2 2026.

12:27 pm (AEST):

Allstate (NYSE: ALL) reported record second-quarter profit driven by underwriting performance and increased investment returns.

Revenues for Q2 2025 rose 5.8% year-over-year to US$16.6 billion. Adjusted net income came in a US$1.6 billion or US$4.94 per diluted share.

Underwriting income in Allstate's property-liability segment skyrocketed to US$1.28 billion from a loss of US$145 million in the same period a year ago.

As for the first half of 2025, revenues rose by 6.8% from US$30.9 billion to US$33.1 billion.

“Allstate had strong operating and financial performance in the second quarter while executing our growth strategies,” Tom Wilson, who leads The Allstate Corporation, said.

“In addition to strong financial results, we are creating shareholder value by increasing growth and proactively managing investments and capital.”

12:50 pm (AEST):

Financial services company, Banco Satander SA (BME: SAN) reported their strongest first half on record, with attributable profit of €6,833 million, an increase of 13% from last year.

The second quarter also saw a net profit rise of 7% from last year to €3.43 billion.

Revenue for the first half was also stable, growing 3% year-over-year to €31 billion.

The banks' transition towards a digitally integrated model saw operating expenses fall by 4.1%.

However, on the back of U.S. tariffs, net profit in Mexico, the bank's fourth biggest market, fell 6.8%, while net profit in Brazil, the company's second biggest market following Spain, declined 16%.

Counteracting this, Santander’s biggest market, Spain, saw net profit rise by 13% and the U.S. net profit rose 10% amid higher fees.

1:14 pm (AEST):

Thank you so much, Chloe! Harlan Ockey back with you now.

At the KRX, Samsung (005930) recorded a drop in operating profit last quarter, amid a major decline in its Device Solutions segment.

Operating profit was KR₩4.7 trillion, below LSEG estimates of ₩5.33 trillion and falling from ₩10.44 trillion one year ago.

Revenue was KR₩74.6 trillion, up from ₩74.07 trillion year-over-year and beating estimates of ₩74.43 trillion.

Its Device Solutions segment, which includes its semiconductor and foundry divisions, saw operating plummet from KW₩6.5 trillion to ₩4 billion year-over-year. “Inventory value adjustments in memory and one-off costs related to the impacts of export restrictions related to China in non-memory had an adverse effect on profit,” the company said.

The Device eXperience segment, including consumer electronics, reported an increase in operating profit from KR₩2.7 trillion to ₩3.3 trillion. This was driven by year-over-year growth of ₩0.9 billion in its Mobile eXperience sub-segment.

Device Solutions revenue fell by 2% year-over-year to KR₩27.9 trillion, while Device eXperience revemue grew by 1% to ₩74.6 trillion.

“Looking ahead to H2, the DS Division plans to proactively meet the growing demand for high-value-added and AI-driven products and continue to strengthen competitiveness in advanced semiconductors. The DX Division will seek to minimize the impact of uncertainties stemming from tariff policies that are likely to persist,” wrote Samsung.

1:40 pm (AEST):

Moving to the BIT, Intesa Sanpaolo (ISP) posted record high income last half.

Net income was EU€2.60 billion last quarter, passing Visible Alpha estimates of €2.4 billion. Across H1 2025, its revenue was €5.22 billion, a new record.

Operating income was EU€13.79 billion last half, rising €152 million year-over-year. Its net interest income was €7.43 billion, declining from €7.98 billion one year ago.

"The results for the first half of 2025 highlight that Intesa Sanpaolo is able to generate solid sustainable profitability, with a net income of €5.2bn. The net income outlook for 2025 is upgraded to well above €9 billion including managerial actions in the fourth quarter of 2025 to further strengthen the future sustainability of the Group’s results," wrote Intesa Sanpaolo.

1:59 pm (AEST):

Turning to the NSE, Mahindra & Mahindra (M&M) saw total revenue rise to IN₹467.6 billion (US$5.3 billion) from ₹382.23 billion one year ago, amid major increases in its Automotive segment.

Profit after tax was IN₹43.76 billion last quarter, up from ₹35.45 billion year-over-year.

Automotive revenue increased to IN₹260.00 billion, compared with ₹197.78 billion one year ago. Revenue grew year-over-year across all segments.

2:26 pm (AEST):

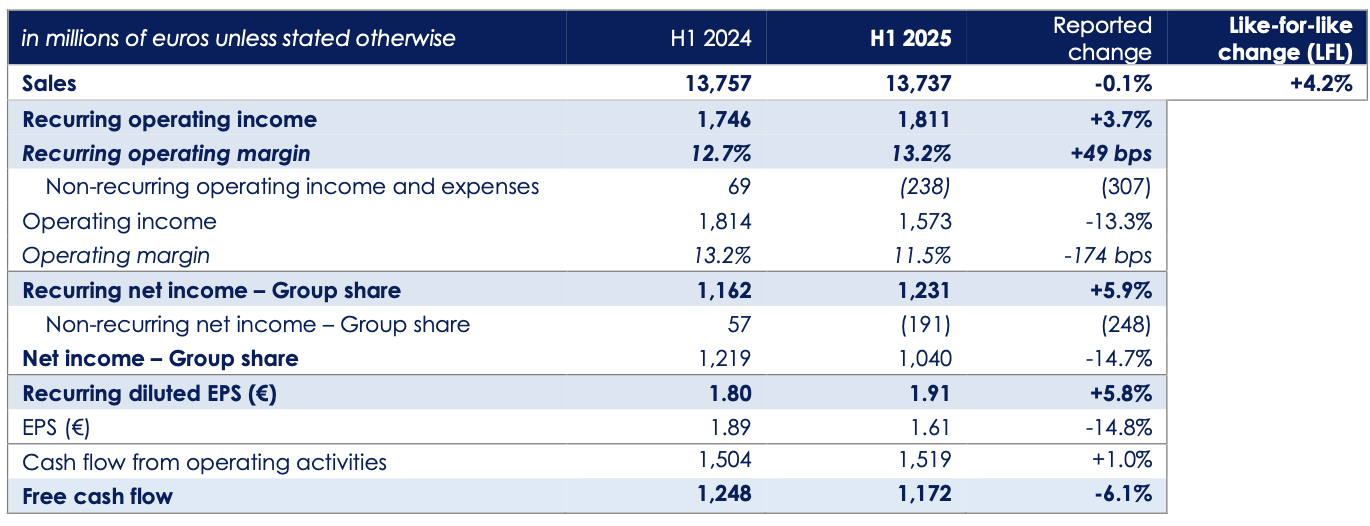

Back at the EPA, Danone (BN) reported like-for-like sales growth across all segments and regions last half.

Total sales were EU€13.74 billion last half, falling by 0.1% year-over-year on a reported basis but up 4.2% on a like-for-like basis. The decrease on a reported basis was due to negative currency impacts and Danone's sale of Horizon Organic and Wallaby last year, the company said.

Recurring net income rose by 5.9% to EU€1.23 billion. Recurring diluted earnings per share were €1.91.

"In a volatile and uncertain environment, we are consistently doubling down on our fundamentals, further fueling our winning platforms such as high protein, medical nutrition, Alpro and Aptamil, while moving forward with this next chapter of our strategy. We started actively complementing our portfolio, further investing in medical nutrition, acquiring Kate Farms in the US, and in next-generation biotics through The Akkermansia Company," said CEO Antoine de Saint-Affrique.

Sales grew across all regional markets on a like-for-like basis last half, with China, North Asia & Oceania seeing the largest year-over-year percentage growth at 11.3%. Sales in Europe, Danone's largest market, were up 2.1% to EU€4.89 billion.

Sales also rose on a like-for-like basis across all segments. Its Specialized Nutrition segment reported the highest percentage growth, at 7.0%.

The company reaffirmed its full-year guidance, and projects like-for-like sales growth of 3-5%.

3:00 pm (AEST):

At the NYSE, Garmin (GRMN) has lifted its guidance after posting record revenue and operating income last quarter.

Consolidated revenue was US$1.81 billion, up 20% year-over-year and above FactSet estimates of $1.7 billion. Operating income rose by 38% to $472 million.

Earnings per share were US$2.17, a 37% increase and exceeding estimates of $1.90. Gross profit was up 24% to $1.07 billion.

Sales grew by double digit percentages across all segments last quarter. Fitness, its largest segment by revenue, also posted the highest year-over-year percentage growth at 41% to reach US$605.4 million. This was due to high demand for wearables, the company said.

"We delivered another quarter of outstanding financial results with double-digit growth in every segment, driven by our strong lineup of innovative and highly differentiated products that customers desire. We are very pleased with our results so far in 2025, which have exceeded our expectations and give us confidence to raise our full year guidance," said CEO Cliff Pemble.

The company's full-year guidance now projects revenue of US$7.1 billion and earnings per share of $8.00. Previous guidance expected $6.85 billion in revenue and earnings per share of $7.80.

Garmin's share price dropped by 7.4%, however, with investors taking advantage of recent increases.

3:30 pm (AEST):

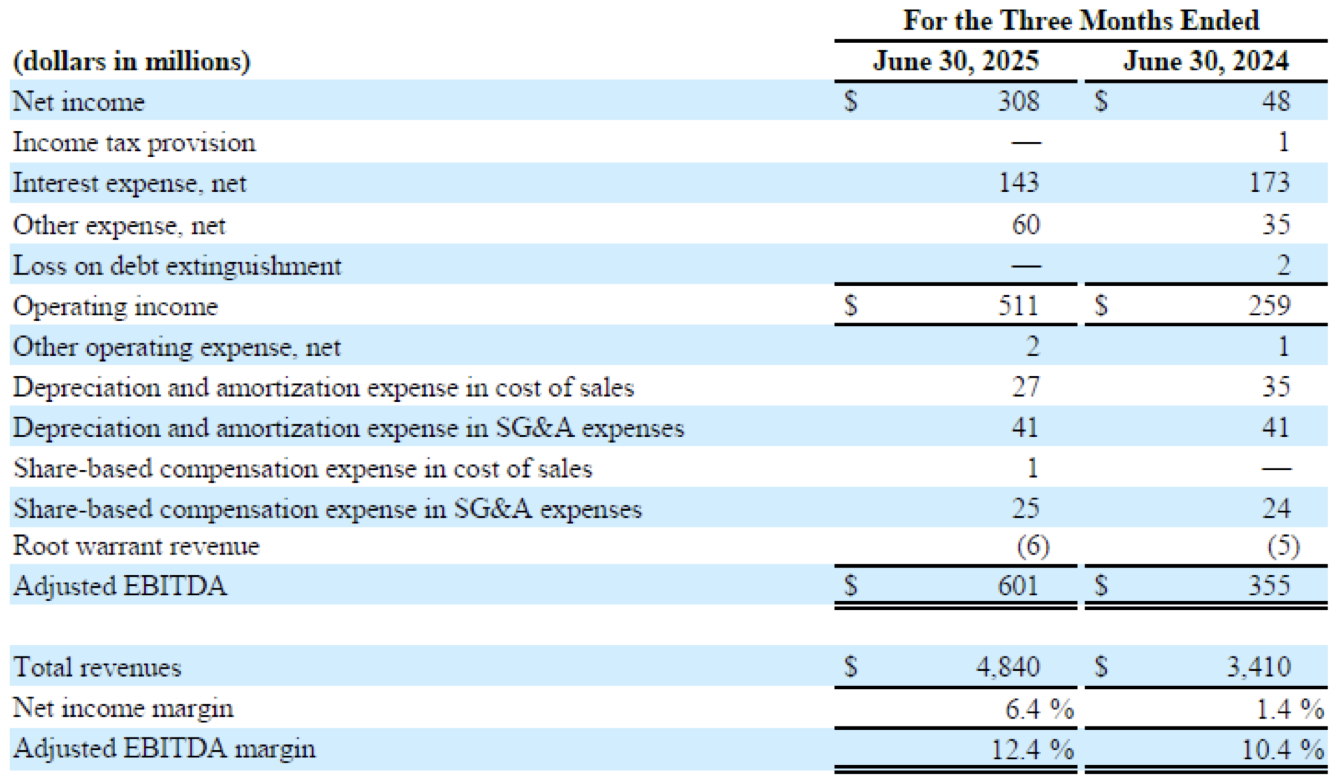

Still with the NYSE, Carvana (CVNA) reported record revenue and sales last quarter.

Revenue was US$4.84 billion, up 42% year-over-year. It sold 143,280 vehicles, rising 41%.

Net income was US$308 million, growing from $48 million one year ago. GAAP operating income was $511 million, almost doubling from the $259 million seen last year.

Adjusted EBITDA was US$601 million, another record, having risen from $355 million one year ago.

"Carvana’s industry-leading growth is the result of delivering an experience that customers love, and our industry-leading profitability is driven by our unique, efficient, and vertically integrated business model. As we tackle the enormous opportunity ahead, we continue to unlock the scale benefits of our model, driving profitable growth and even better customer experiences," said CEO Ernie Garcia.

It projects a sequential increase in vehicles sold next quarter, with adjusted EBITDA of US$2.0-.2.2 billion across 2025.

3:51 pm (AEST):

Back to the NASDAQ, Kraft Heinz (KHC) saw net sales and income drop last quarter, driven by a fall in North American sales.

Net sales fell by 1.9% year-over-year to US$6.352 billion. In North America, its largest market, net sales declined 3.3% to $4.76 billion.

Kraft Heinz's net loss last quarter was US$7.82 billion, plummeting from net income of $100 million one year ago.

The company also posted an operating loss of US$7.97 billion, down from income of $522 million in Q2 2024. This was due to non-cash impairment losses of of $9.3 billion this year, the company said, which stemmed from major declines in its share price and market capitalisation.

Adjusted earnings per share were $0.69, down 11.5%.

“We are proud to play a vital role in families’ lives, and our commitment to delivering superior, affordable, and accessible products is unwavering,” said CEO Carlos Abrams-Rivera. “Our second quarter top line results reflect this dedication, improving from the first quarter.”

“As announced in May, Kraft Heinz has been evaluating potential strategic transactions to unlock long-term shareholder value. The Company is actively progressing with its evaluation which includes a rigorous review of a broad range of options,” Kraft Heinz wrote.

Its full-year outlook projects a drop of 1.5-3.5% in organic net sales, and adjusted earnings per share of US$2.51-2.67

4:17 pm (AEST):

And still at the NASDAQ, eBay (EBAY) beat estimates on earnings per share and revenue.

Revenue was US$2.73 billion, up 6% year-over-year and passing LSEG estimates of $2.64 billion. Earnings per diluted share were $1.37, rising 16% and above estimates of $1.30.

Net income was US$368 million, up from $224 million in Q2 2024. Gross merchandise volume grew by 6% to $19.5 billion.

Operating expenses were US$1.47 billion last quarter, compared with $1.29 billion one year ago.

“eBay delivered another strong quarter, with results exceeding expectations across the board,” said CEO Jamie Iannone. “Our momentum reflects the strength of our strategic execution and the resilience of our marketplace. We remain focused on driving long-term growth and creating lasting value for our shareholders.”

Its third quarter guidance projects revenue of US$2.69-2.74 billion, with gross merchandise volume of $19.2-19.6 billion and earnings per diluted share of $1.29-1.34. This includes expected impacts from tariffs; the company has “forward deployed” around 75% of its inventory from China into the U.S., as the U.S. has eliminated the “de minimis” provision allowing packages worth less than $800 to be imported duty-free.

Thank you for joining us for our live coverage today. Tomorrow, we'll have results from companies like Apple, Amazon, and Mastercard. See you next time!