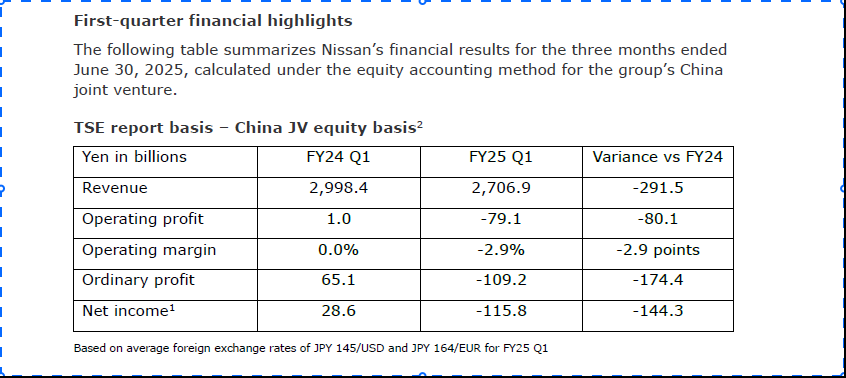

Nissan Motor Co. posted a consolidated operating loss of ¥79.1 billion for the first quarter of fiscal 2025, outperforming its earlier forecast of a ¥200 billion loss.

The result was aided by an improved product mix and fixed cost reductions, despite continuing pressure from lower global sales volumes (707,000 units), adverse exchange rates, and United States tariffs.

Net revenue for the quarter reached ¥2.7 trillion, while net loss totalled ¥115.8 billion.

Liquidity remained strong, with ¥3.1 trillion in cash and an additional ¥1.8 trillion in unused credit lines.

While Nissan reaffirmed its full-year net revenue target of ¥12.5 trillion, it withheld guidance on operating profit, net income, and automotive free cash flow due to ongoing market volatility.

For Q2 FY2025, the company anticipates ¥2.8 trillion in revenue, a ¥100 billion operating loss, and negative free cash flow of ¥350 billion.

CEO Ivan Espinosa highlighted the urgency of the Re:Nissan recovery plan, citing early progress in cost discipline and strategic realignment as foundational steps toward restoring profitability.

Espinosa said: “Over the past quarter, we’ve taken decisive first steps — cutting costs, redefining our product and market strategy, and strengthening key partnerships. We must now go further and faster to achieve profitability. Everyone at Nissan is united in delivering a recovery that will ensure a sustainable and profitable future.”

Under the Re:Nissan transformation initiative, the company aims to return to profitability and generate positive free cash flow by FY2026.

Nissan has implemented over 1,600 cost-saving measures and achieved more than ¥30 billion in fixed cost reductions in Q1 alone.

Production site consolidation is underway, including the transfer of operations from the CIVAC plant in Cuernavaca to Aguascalientes, Mexico.

Strong sales of regionally tailored models like the N7 in China and Magnite in Mexico reflect Nissan’s strategy to align offerings with local market dynamics.

At the time of writing, Nissan Motor Co Ltd (TYO: 7201) stock was trading at ¥316, down 1.25%. It has a market cap of ¥1.17 trillion.

All financial amounts in Japanese yen.