Fintech starlett Robinhood (NASDAQ : HOOD) has reported a staggering 105% surge in net income to US$386 million for Q2 2025, propelled by record crypto trade volumes and user growth.

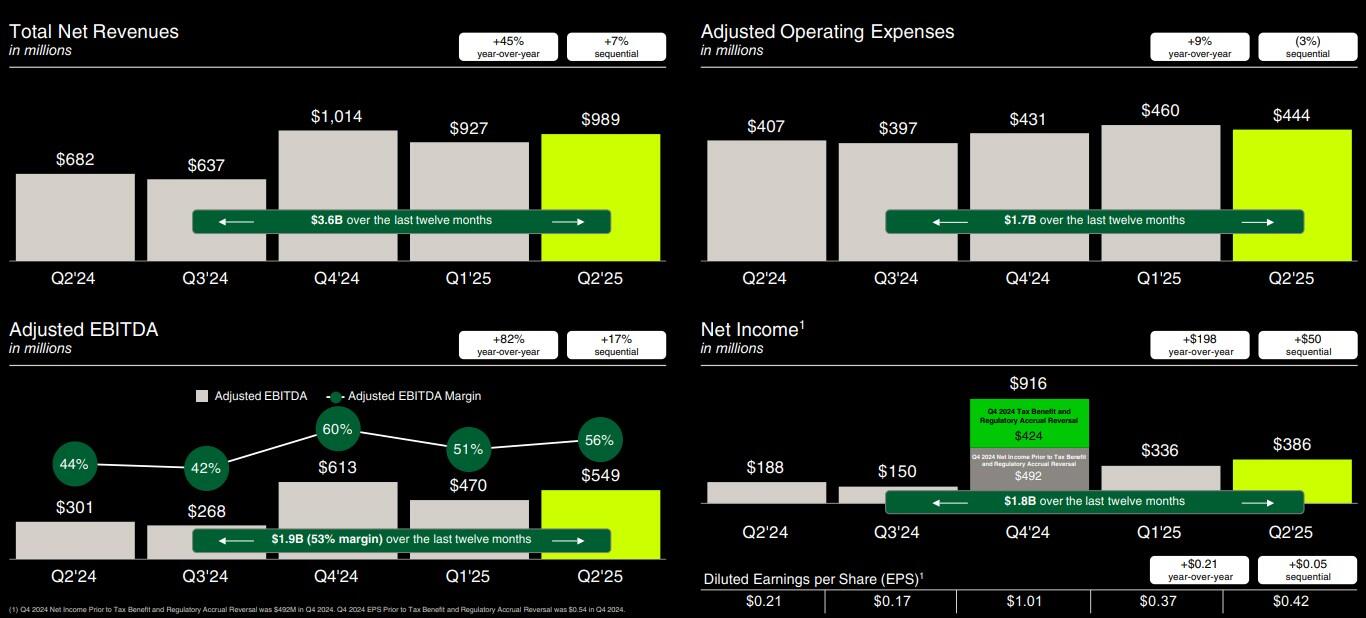

- Total net revenues climbed 45% year-over-year to $989 million, with transaction-based revenues jumping 65% to $539 million.

- Cryptocurrencies led the charge, generating $160 million - up 98% from Q2 2024 - as notional trading volumes hit $28 billion on the app.

- Options and equities also set records, with 515 million contracts traded and $517 billion in equity volumes, respectively.

- Net interest revenues rose 25% to $357 million, bolstered by a 90% increase in margin balances to $9.5 billion.

- Funded customers expanded 10% to 26.5 million, while Robinhood Gold subscribers soared 76% to 3.5 million, driving average revenue per user up 34% to $151.

Robinhood's assets under custody nearly doubled to $279 billion, reflecting $13.8 billion in net deposits and higher market valuations.

Compared to Q1 2025, revenues grew 7%, but the year-over-year leap underscores the accelerating momentum in fintech.

The firm closed its Bitstamp acquisition in June 2025 and announced a pending deal for WonderFi, expanding into global crypto markets.

New products, including crypto staking in the U.S. and stock tokens in Europe, position Robinhood for broader adoption.

E-brokerage strength

The brokerage industry anticipates steady growth, with the global e-brokerage market projected to expand at a 9.4% CAGR from 2025 to 2034, reaching beyond $22 billion by 2030.

Fintech revenues will outpace traditional financial services in 2024, growing 21% amid stabilising valuations and AI-driven innovations.

Retail investing trends favour app-based platforms, as Gen Z investors - wielding $360 billion in spending power - prefer fintech over legacy brokerages like Charles Schwab and Fidelity.

Competitors dominate in assets under management; Fidelity and Schwab manage trillions, dwarfing Robinhood's $279 billion, yet the platform captures younger demographics with zero-commission trading.

HOOD shares shot up around 7% in after market trading to ~$110 per share, before pulling back to around the $106 mark at the time of writing.