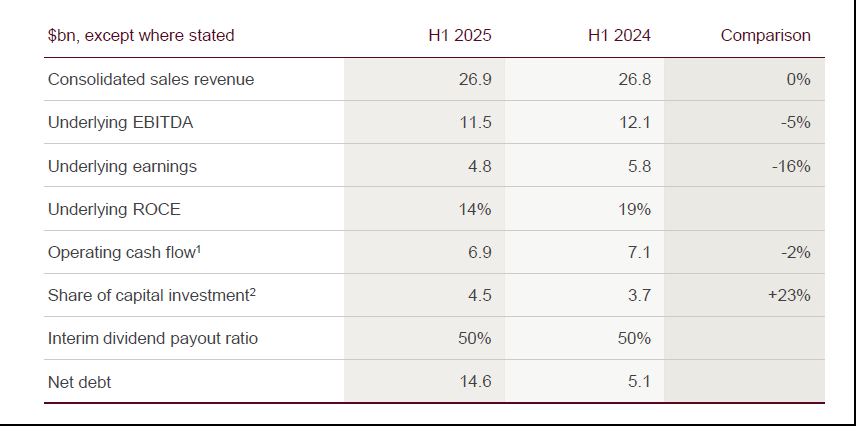

Rio Tinto reported first-half 2025 net earnings of $4.5 billion, down 22% from $5.8 billion a year earlier, as lower iron ore prices and higher closure provisions weighed on results.

Underlying EBITDA fell 5% to $11.5 billion, while operating cash flow dipped slightly to $6.9 billion. Net debt surged 166% to $14.6 billion, largely due to the $6.7 billion acquisition of Arcadium Lithium.

Despite the earnings decline, the company maintained a 50% payout ratio, declaring a $2.4 billion interim dividend.

Operationally, Rio Tinto delivered a 6% year-over-year increase in copper-equivalent production, with record bauxite output and a 54% jump in copper volumes at Oyu Tolgoi.

Pilbara iron ore production rebounded strongly in Q2, marking its best quarterly output since 2018. The company reaffirmed its 2025 production guidance, with Pilbara shipments expected at the lower end of the 323–338 Mt range and bauxite at the higher end of 57–59 Mt. Copper guidance remains unchanged at 780–850 kt, with unit costs for Pilbara iron ore projected at $23.00–$24.50 per wet metric tonne.

Strategically, Rio Tinto advanced its ESG and growth agenda, investing $72 million in decarbonisation and signing co-management agreements with Indigenous communities.

The Simandou iron ore project in Guinea is on track for first shipment in November 2025. Market conditions remain mixed: iron ore prices fell 14% year-on-year, while copper and aluminium rose 4% and 8%, respectively.

Lithium carbonate prices dropped 34% amid oversupply, despite strong EV demand.

Free cash flow declined 31% to $2.0 billion, and total financing liabilities reached $23.6 billion following a $9 billion bond issuance.

Rio Tinto Chief Executive Jakob Stausholm said: "We are delivering very resilient financial results with an improving operational performance helped by our increasingly diversified portfolio. Underlying EBITDA of $11.5 billion and operating cash flow of $6.9 billion, despite a 13% lower

iron ore price, demonstrate the growing contribution from our Aluminium and Copper businesses and our Pilbara operations' strong recovery from the four cyclones in the first quarter. We are reporting underlying earnings of $4.8 billion (after taxes and government royalties of $4.8 billion).

"Our strong cash flow enables us to maintain our practice of a 50% interim payout with a $2.4 billion ordinary dividend, as we continue our disciplined investment in profitable growth while retaining a strong balance sheet.

"We are well positioned to generate value from our best-in-class project execution, together with growing demand for our products, now and over the coming decades. We remain on track to deliver strong mid-term production growth, with solid foundations in place and a diverse pipeline of options for the future."

At the time of writing, Rio Tinto Ltd (ASX: RIO) stock was $115.81, down $1.12 (0.96%) today. It has a market cap of around $161.91 billion.