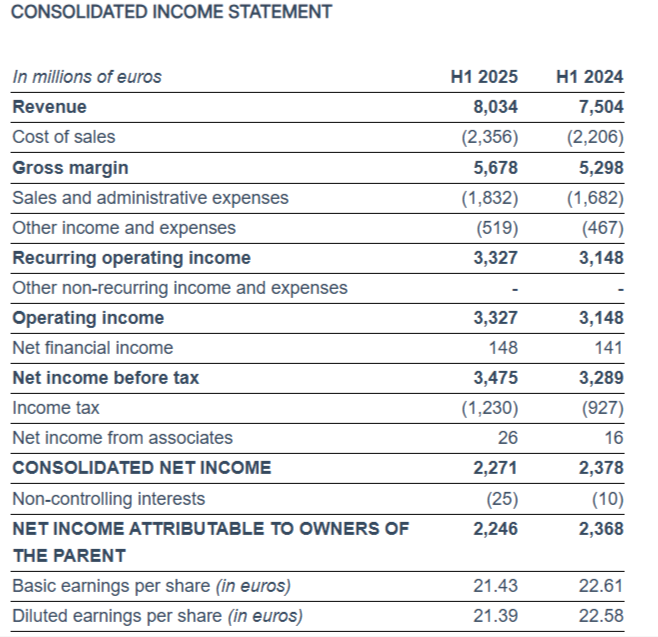

Hermès International reported consolidated revenue of €8.03 billion for the first half of 2025, marking an 8% increase at constant exchange rates and 7.1% at current rates compared to H1 2024.

Current operating profit rose 6% to €3.3 billion, representing 41.4% of sales, slightly down from 42.0% in the prior year. The company also achieved Q2 sales of €3.9 billion, in line with analyst expectations of a 10% increase.

Axel Dumas, Executive Chairman of Hermès, said: “The solid first-half results across all regions reflect the strength of the Hermès model. I would like to thank all our customers for their trust and all our employees for their commitment. We will continue to invest and recruit to ensure the group’s sustained success.”

Net profit attributable to the group was €2.2 billion, impacted by one-time corporate tax in France, while adjusted net profit excluding this charge reached €2.5 billion, up 6% year-over-year. Operating cash flow increased 4% to €2.3 billion.

All geographical regions posted growth, with standout performances in Japan (+16%), the Americas (+12%), and Europe excluding France (+13%). Asia excluding Japan grew 3%, supported by local customer loyalty. France saw a 9% increase.

By segment, Leather Goods and Saddlery led with 12% growth, driven by expanded production capacity and sustained demand. Clothing and Accessories rose 6%, while Silk and Textiles grew 4%. Perfume and Beauty declined 4% due to tough prior-year comparisons, and Watches fell 8% despite new launches.

Hermès added over 500 jobs in H1 2025, including 300 in France, bringing total employment to 25,700. A €4,500 bonus was distributed globally to employees, and the company maintained a 7.90% employment rate for people with disabilities in France.

Looking ahead, Hermès reaffirmed its medium-term goal of ambitious revenue growth at constant exchange rates, with Q3 2025 results scheduled for 23 October 2025 and full-year results on 12 February 2026.

At the time of writing, Hermes International SCA (EPA: RMS) stock was trading at €2,270.00, down €108 (4.54%) today. It has a market cap of around €242.1 billion.

All financials in Euros.