BAE Systems plc delivered a sturdy financial performance in the first half of 2025, with total revenue rising 9% year-on-year to £13.57 billion.

A British multinational firm, BAE Systems produces aerospace, defence, and security products. They develop and manufacture aircraft, warships, submarines, weapons systems, and electronic warfare systems, among other products and services. As well as cyber security and intelligence solutions, they also offer digital and data services.

Charles Woodburn, Chief Executive, said: "Our teams have delivered another strong operational and financial performance in the first half of the year, giving us the confidence to upgrade our guidance.

"In this heightened global threat environment, we continue to deliver mission critical capabilities to armed forces around the world and invest in our people, technologies and facilities to drive the improved efficiency, capacity and agility needed to meet the increasing demand for our highly relevant products and services.

"The breadth and depth of our geographic and product portfolio, together with our trusted track record of delivery, strengthen our confidence in the positive momentum of our business.”

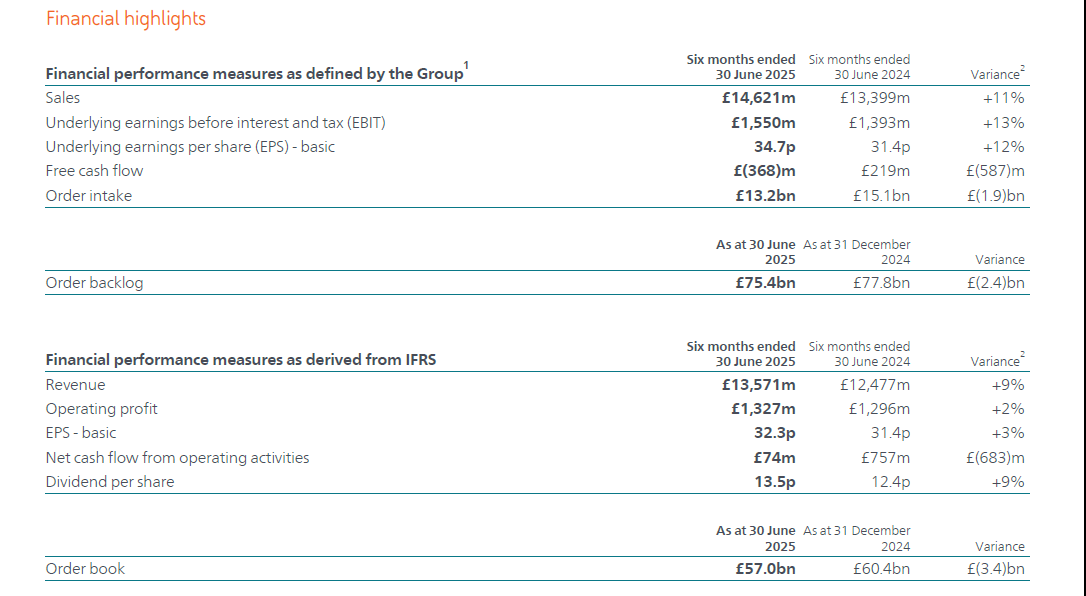

Sales on a defined basis increased 11% to £14.62 billion, supported by growth across all segments.

Underlying EBIT rose 13% to £1.55 billion (beating a consensus forecast of £1.52 billion), yielding a return on sales of 10.6%.

Basic earnings per share (EPS) increased to 32.3p, while underlying EPS reached 34.7p, up 12% on a constant currency basis.

Net profit attributable to shareholders was £969 million, and adjusted profit stood at £1.04 billion. However, free cash flow turned negative at £368 million, reflecting timing-related working capital movements.

BAE Systems advanced several key programs, including laying the keel for HMS Dreadnought and securing £1 billion UK funding for the Global Combat Air Programme (GCAP).

The company also won a $1.2 billion contract with the U.S. Space Force for missile-tracking satellites and marked the 500th delivery of the Armored Multi-Purpose Vehicle to the U.S. Army. Investments include a $250 million ship repair complex in Florida, a new artillery factory in Sheffield, and Janet Harvey Hall for Type 26 frigate construction in Glasgow. Recruitment efforts are underway to onboard over 2,400 graduates and apprentices in the UK.

BAE Systems upgraded its full-year guidance, now expecting sales growth of 8–10% and EBIT growth of 9–11%, while maintaining EPS growth at 8–10% and a free cash flow target above £1.1 billion. Order intake for H1 2025 was £13.2 billion, down from £15.1 billion in 2024, with backlog at £75.4 billion.

Segment performance varied: Air and Platforms & Services posted double-digit EBIT growth, while Maritime and Cyber & Intelligence saw modest declines. Rising global defence budgets — driven by NATO commitments, UK strategy, and increased US and Asia-Pacific spending — continue to support long-term demand.

At the time of writing, BAE Systems plc (LON: BA) shares were trading at £1,778.83, down £42.17 (2.32%) today. It has a market cap of around £53.59 billion.