Northrop Grumman, a leading global aerospace and defence technology company, delivered a solid second-quarter performance in 2025, with sales rising 1% year-over-year to $10.4 billion and net earnings jumping 25% to $1.2 billion, or $8.15 per diluted share.

Earnings, adjusted for non-recurring gains, came to $7.11 per share. This exceeded Wall Street expectations. Based on nine analyst estimates, Zacks Investment Research expected earnings per share at $6.71.

Operating margin improved to 13.8%, driven by strong segment results and a $1.04 EPS benefit from the divestiture of its training services business.

Despite a 42% drop in free cash flow to $637 million due to higher net cash taxes, the company returned over $700 million to shareholders through dividends and buybacks, underscoring its commitment to capital returns.

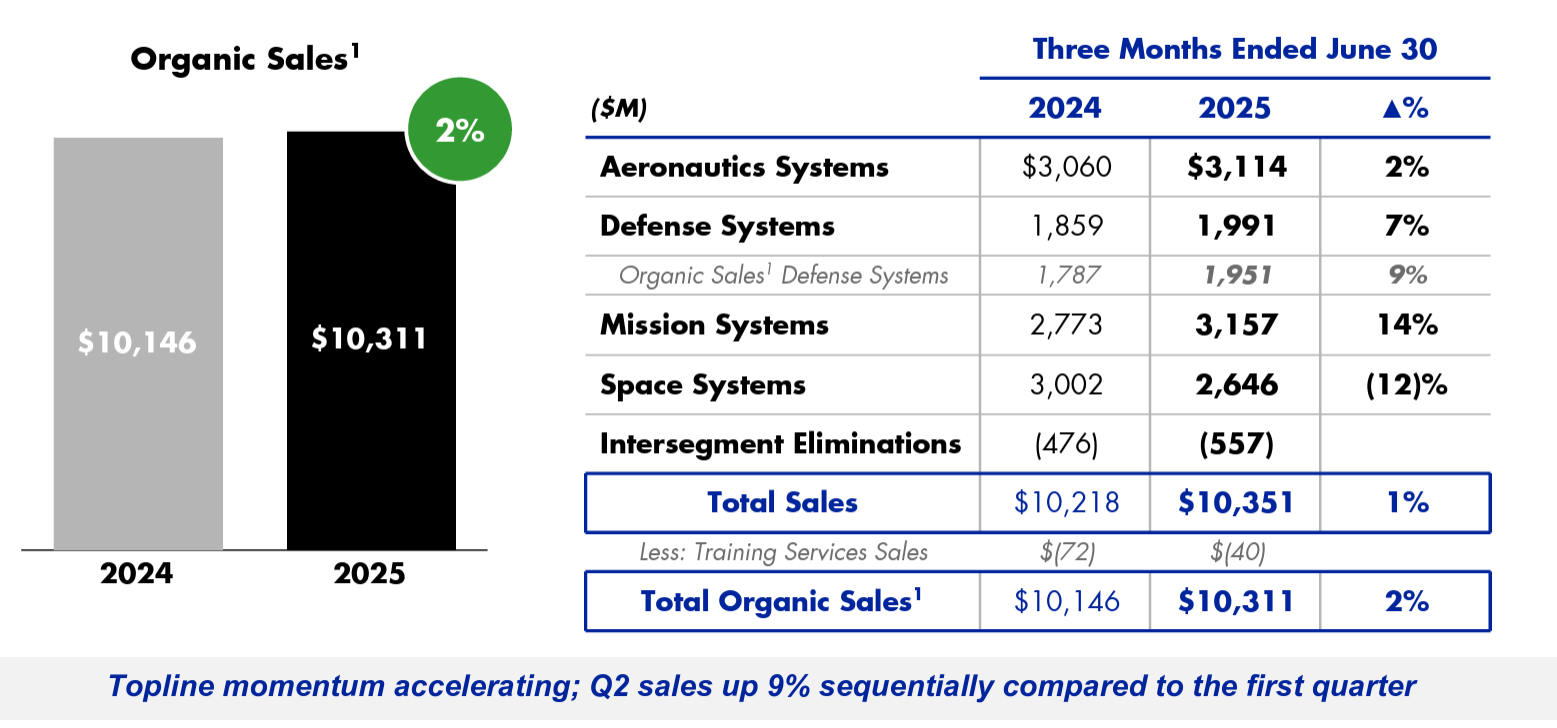

Segment results were mixed. Mission Systems led growth with a 14% increase in sales to $3.2 billion and a 22% rise in operating income, fuelled by radar and advanced technology demand. Defence Systems posted a 7% sales gain to $2.0 billion and a 32% jump in operating income, supported by progress on the Sentinel missile program.

Aeronautics Systems saw modest growth, while Space Systems declined 12% to $2.6 billion due to the wind-down of restricted programs and the loss of the Next Generation Interceptor contract to Lockheed Martin. These results reflect the company’s evolving portfolio and strategic realignments.

Northrop Grumman raised its full-year guidance, projecting sales between $42.05 billion and $42.25 billion, MTM-adjusted EPS of $25.00 to $25.40, and free cash flow of $3.05 billion to $3.35 billion.

The company ended the quarter with a backlog of $89.7 billion, bolstered by $7.4 billion in net awards, including $1.8 billion in classified programs and $500 million tied to the F-35 platform.

Chair, CEO and president Kathy Warden cited strong international momentum, with overseas sales up 18% in Q2, and reaffirmed confidence in long-term growth across the air, land, sea, space, and cyber domains.

“The Northrop Grumman team delivered a strong second quarter, with increased sales and outstanding operating performance,” said Warden. “We are working with our customers to accelerate capability delivery to enable their vision of peace through strength. We continue to see growing demand globally for our broad range of product offerings, which resulted in 18% international sales growth in the quarter. With confidence in our team and our ability to deliver for our customers, we are increasing our full-year guidance for segment operating income, EPS and free cash flow.”

Headquartered in Falls Church, Virginia, Northrop Grumman operates through four core segments: Aeronautics, Defence Systems, Mission Systems, and Space Systems.

It designs and manufactures advanced military aircraft, missile systems, radar, satellites, and cybersecurity solutions, with the U.S. Department of Defense as its largest customer.

The company is majority-owned by institutional investors, including State Street (9.3%), Vanguard (9.2%), and BlackRock (6.3%).

Its subsidiaries include Orbital Sciences, Scaled Composites, and Alliant Techsystems Operations, positioning it as a key player in global defence innovation.

At the time of writing, Northrop Grumman Corp (NYSE: NOC) stocks were trading at $563.79, up $47.52 (9.21%) today. In after-hours trading, it was $565, up $1.21 (0.21%). Its market cap is around $81.15 billion.

All financials in U.S. dollars.