Lockheed Martin, the world’s largest defence contractor, reported second-quarter 2025 earnings that fell sharply due to $1.6 billion in program-related losses.

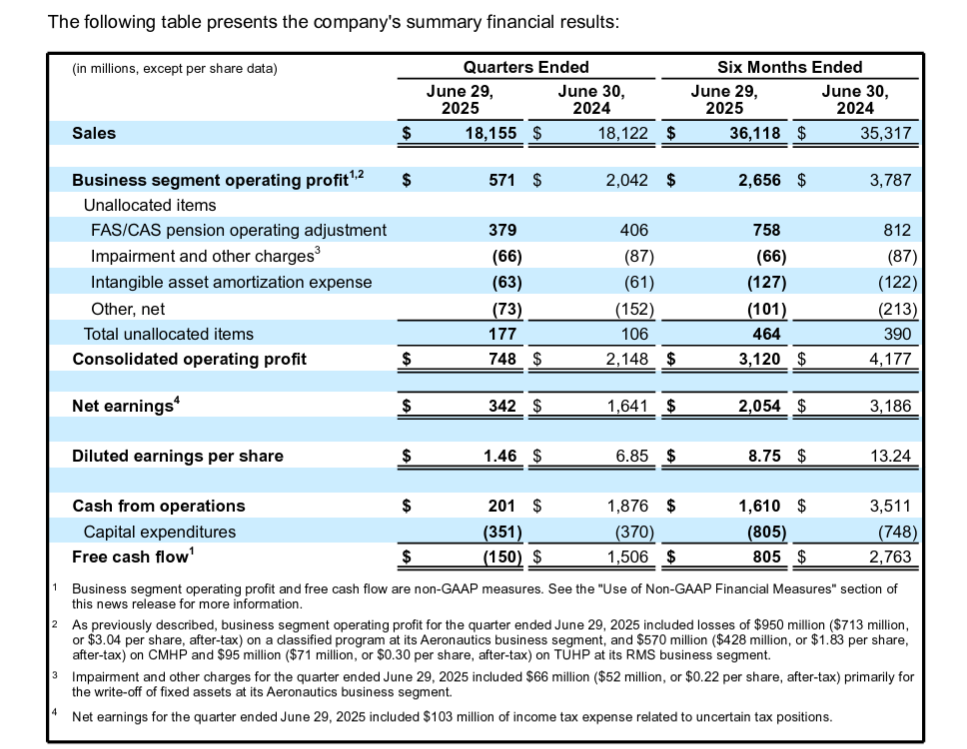

While sales edged up to $18.2 billion from $18.1 billion a year earlier, net earnings plunged 79% to $342 million, or $1.46 per share.

The adjusted earnings per share came in at $7.29, exceeding analysts' average estimate of $6.44, according to LSEG. Revenue fell short of forecasts, coming in at $18.16 billion instead of $18.57 billion.

The losses stemmed from three troubled programs: a classified Aeronautics project ($950 million), Canada’s Maritime Helicopter Program ($570 million), and Turkey’s Utility Helicopter Program ($95 million).

Additional charges included a $66 million asset write-off and a $103 million tax-related provision. Operating profit dropped 65% to $748 million, and free cash flow turned negative at $150 million.

Segment performance was mixed. Aeronautics posted $7.42 billion in sales, but swung to a $98 million operating loss.

Rotary and Mission Systems (RMS) also reported a $172 million loss on $3.99 billion in sales, down 12%. In contrast, Missiles and Fire Control (MFC) delivered strong results, with sales up 11% to $3.43 billion and an operating profit of $479 million.

The Space segment grew 4% to $3.31 billion in sales, generating $362 million in profit. Despite the setbacks, Lockheed returned $1.3 billion to shareholders through dividends and buybacks, underscoring its commitment to capital returns.

Lockheed Martin reaffirmed its full-year guidance, projecting sales between $73.75 billion and $74.75 billion. However, it revised its earnings outlook downward, with diluted EPS now expected between $21.70 and $22.00, compared to earlier estimates above $27.

The company’s backlog fell 5.4% to $166.5 billion, driven by a 17% drop in Aeronautics orders. MFC’s backlog rose to $40.25 billion, while Space dipped slightly to $35.53 billion. Management cited increased global demand for systems like the F-35, PAC-3, and THAAD, but acknowledged execution risks and cost overruns for legacy programs.

Lockheed Martin Chairman, President and CEO Jim Taiclet said: “We are maintaining full year 2025 guidance for sales, cash from operations, capital expense, free cash flow, and share repurchases. The program charges taken in the quarter – which resulted from our ongoing rigorous monitoring and review processes – are a necessary step as we continue to take action to improve program execution. We're investing in emerging technologies, and as a proven mission integrator, we remain well positioned to support critical programs like the Golden Dome for America. Our relentless focus on operational performance combined with our disciplined capital allocation strategy will enable us to deliver value to our shareholders, while providing the advanced solutions that America and its allies need to maintain peace through strength for decades to come.”

Lockheed Martin is headquartered in Bethesda, Maryland, and operates across four core segments: Aeronautics, RMS, MFC, and Space.

It produces advanced military aircraft, missile systems, satellites, and naval platforms, with the U.S. Department of Defense as its largest customer.

The company is majority-owned by institutional investors including State Street (14.7%), Vanguard (9.1%), and BlackRock (7.2%).

Lockheed also owns over 100 subsidiaries globally, including Sikorsky Aircraft and Zeta Associates, and manages its pension assets through Lockheed Martin Investment Management Co.

At the time of writing, Lockheed Martin Corp (NYSE: LMT) stock traded at $410.74, down $50.47 (10.94%) today, but after hours it was $414.70, up $3.96 (0.96%). It has a market cap of around $96.23 billion.

All financials in U.S. dollars.