Due to a perceived existential threat to Australia from China, defence spending is now forecast to exceed 2.3% of GDP by the end of the decade. The 2024-25 Budget sees Defence funding increase to $764.6 billion over the same time frame. At the centre of the Albanese Government’s renewed investment in Defence is the allocation of $330 billion over the decade to 2033-34 for the rebuilt Integrated Investment Program – a significant lift compared to the $270 billion allocated as part of the 2020 Defence Strategic Update and 2020 Force Structure Plan.

As a result of these significant investments, the annual Defence budget is expected to grow to an estimated $100 billion by 2033-34 compared to $53 billion this financial year.

Safeguarding Australia’s security into the future has put increased focus on ASX-listed defence stocks, many of which will be direct beneficiaries of these funding initiatives.

As well as border protection, much of the major ramp-up in defence spending is also being spent on Australia participating in the "Five Eyes" intelligence sharing network under a joint treaty with Canada, NZ, the U.K. and U.S.

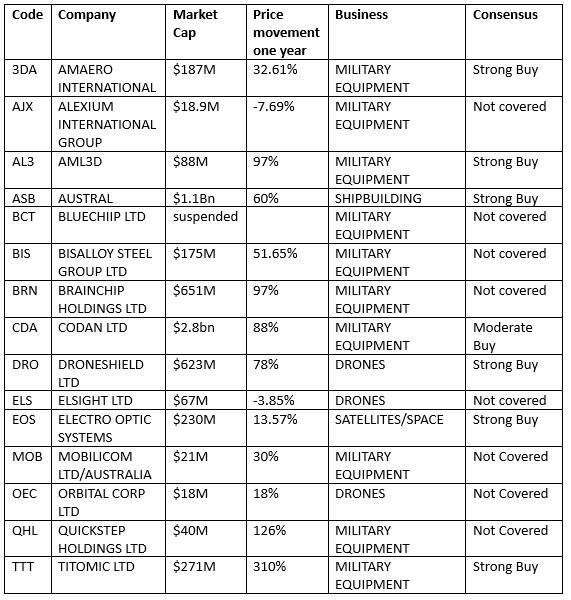

ASX-listed defence stocks

While 70% of the Australian government’s defence spending is typically allocated to foreign suppliers, there remains a sizeable pool for local suppliers to fight over. In recent years the number of ASX-listed companies with connections to the Australian defence sector has grown along with budget allocations. However, there are around a dozen-plus (15) listed stocks that also receive a sizable slice and in some cases all of their revenue from defence-related spending.

However, with governments everywhere ramping up military budgets due to increasing geopolitical tensions, the Australian Defence Force is by no means the only client for these stocks of war. Collectively, these 15 stocks operate within four military sub-sectors including military equipment, shipbuilding, robotics and drones and satellite/space.

Top heavy

Not unlike the ASX200, the ASX-listed Defence sector is top heavy, with two ($1bn-plus stocks) shipbuilder Austal Ltd (ASX: ASB) and metal detector manufacturer Codan Ltd (ASX: CDA) accounting for around 60% of the total market cap (around $6.2 billion). With market caps of $1.1 billion and $2.8 billion, Austal and Codan sit inside the ASX300 and ASX200 respectively.

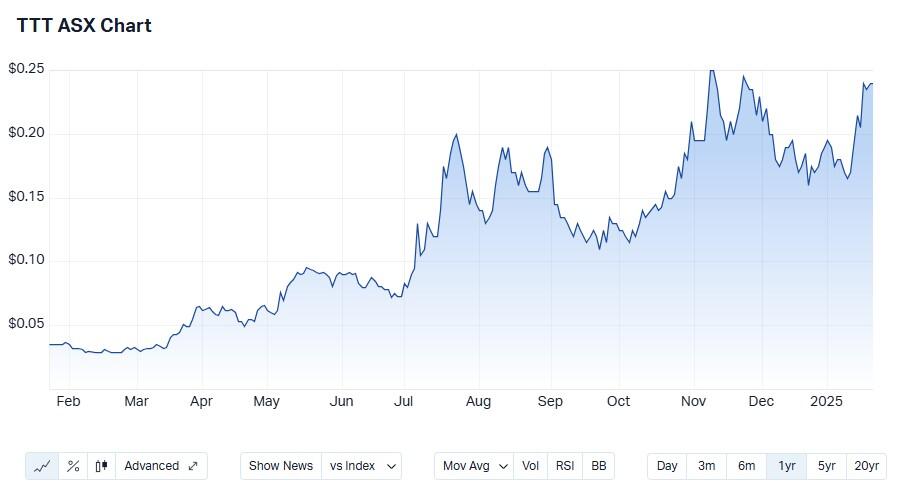

But while these two stocks delivered one year returns of 60% and 88% respectively, smallcap Titomic Ltd (ASX: TTT) was the sector’s standout performer delivering a one year return of 310%.

While the sector delivered an average 12-month return of over 60%, the only other stock to more than double its 12-month return (at time of writing) was smallcap ($40 million) Quickstep Holdings (ASX: QHL) an independent aerospace composite business which returned 126% over one year.

The sector trades at a median PE ratio of 13.1x, compared with an average PE ratio of 16.4x.

Due to their size, consensus fails to cover the vast majority of stocks in this sector. However, based on Morningstar’s analysis, every stock in the Defence sector is undervalued.

Two bigcaps

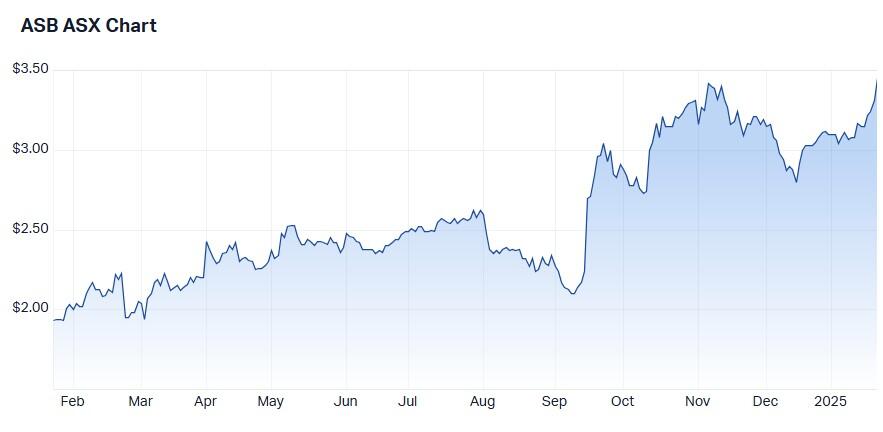

Austal Ltd (ASX: ASB)

Bell Potter considers Austal an ASX 300 stock to buy in 2025. Austal is a world-renowned shipbuilder with operations in five countries – Australia, China, the Philippines, the U.S. and Vietnam.

The shipbuilder has established itself as a key contributor to both the US and Australian naval industrial bases. This is reflected in its record contract order book of $12.7 billion comprising 14 different vessel programs.

The company was recently announced as the Australian Government's shipbuilder of choice in WA. Bell Potter expects this to result in the award of several additional contracts (circa $7 billion to $10 billion) as part of the renewal of the Royal Australian Navy (RAN) fleet.

Having recently navigated the transition from legacy contracts to the current orderbook the broker expects to see material earnings growth from FY25 onwards as these updated programs mature.

Originally designed by Austal Australia and constructed by Austal USA, the USS Canberra (LCS 30) – which was commissioned in Sydney in July 2023 - is the first US Navy ship to be commissioned outside of the U.S.

During the company’s AGM last November, CEO Gregg Paddy noted that the company had carved a unique space in the U.S. defence industrial base - building its own vessel programs - and hopes the Strategic Shipbuilding Agreement in Australia will place the Australian business in the same position as in the U.S.

The company is well ahead of its target of $500 million in revenue by FY2027.

Consensus recommendation for the stock is BUY.

The stock is currently trading with 7.6% upside to $3.23.

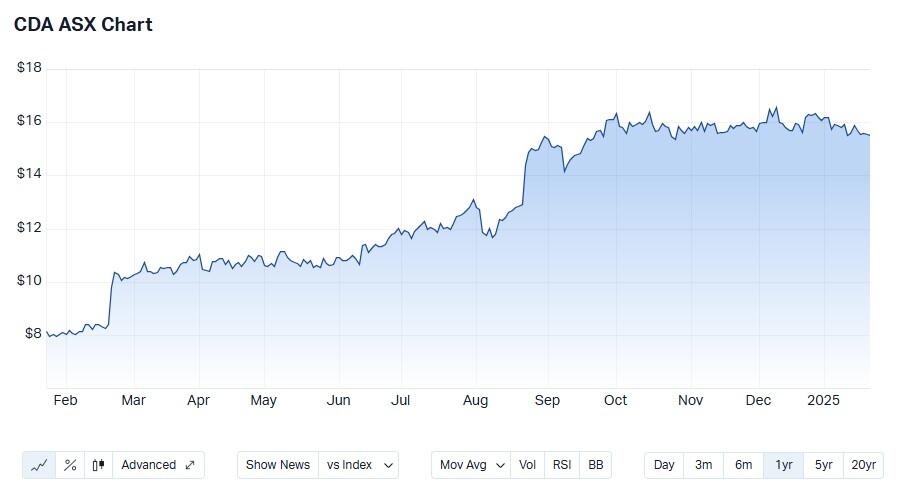

Codan Ltd (ASX: CDA)

Listed on the ASX in 2003, Codan produces landmine detectors for defence and security forces globally. Likely to benefit from growing military spending, especially on Five Eyes Intelligence initiatives, Codan also sells tactical communications equipment and push-talk two-way communication between radio transceivers - aka land mobile radio systems.

The company's electronics expertise powers three product pillars: tactical communications, critical communications, and metal detection.

Following a string of acquisitions, Codan now generates around 60% of its revenue from products used by the military, law enforcement, and public safety.

The Company’s products are sold in more than 150 countries through a global network of dealers, distributors and agents.

A few weeks ago, Goldman Sachs initiated coverage of Codan with a Buy rating and a $18 target price.

The company aims to deliver 10-15% organic revenue growth and profit margins of 30% for its communications segment over the next two to three years. Based on recent acquisitions and expected US government spending of US$10 billion to US$15 billion on next-generation 911 emergency call upgrades, the broker believes these goals are doable.

When it comes to hand held metal detection technology, Minelab, which the acquired in 2008 is expected to grow via online platforms such as Walmart and Amazon, and expansion into India.

Based on Goldman’s estimates around $400 million was spent on seven acquisitions between FY21 and FY25, generating incremental earnings of $80 million to $100 million.

Meanwhile, low net gearing allows the company to make acquisitions.

Two midcaps

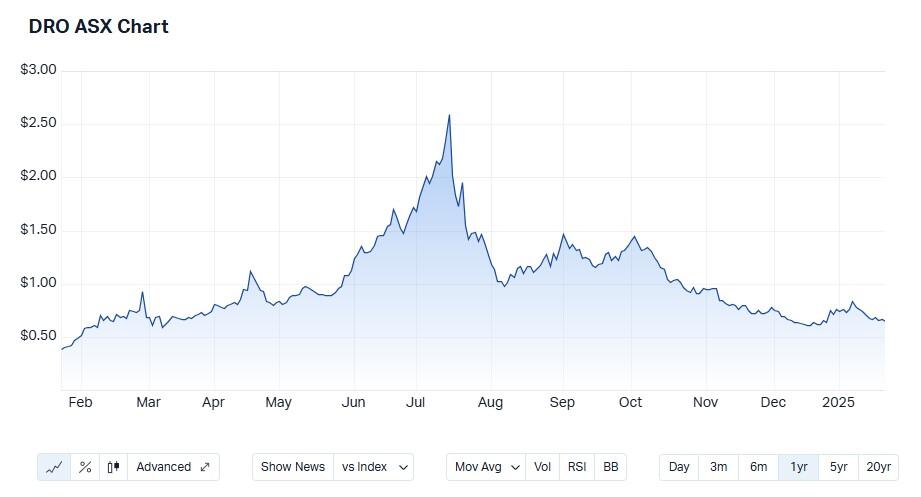

Droneshield (ASX: DRO)

Droneshield’s advanced detection and counterdrone products are designed to bolster location security and support security personnel in addressing the increasing and diverse range of uncrewed aircraft system (UAS) threats.

The company has entered into a number of key partnerships including with the Australian Department of Defence, US Department of Homeland Security, US Army and Airforces. On the back of a string of good news the stock’s share price rallied strongly to a high of $2.60 in mid-July last year.

However, since then the share price has been down 74%. Investors are now asking if the current valuation truly reflects the company’s potential or signals an undervalued opportunity.

Late October last year Bell Potter upgraded Droneshield's shares to a buy rating with a revised price target of $1.20. While the broker’s outlook suggests the stock is significantly undervalued, the growing number of investors shorting the stock (6.67%) would suggest otherwise.

Meanwhile, the trading downtrend, confirmed multiple times, suggests market participants see better opportunities elsewhere.

The stock does not pay dividends.

Brainchip Holdings (ASX: BRN)

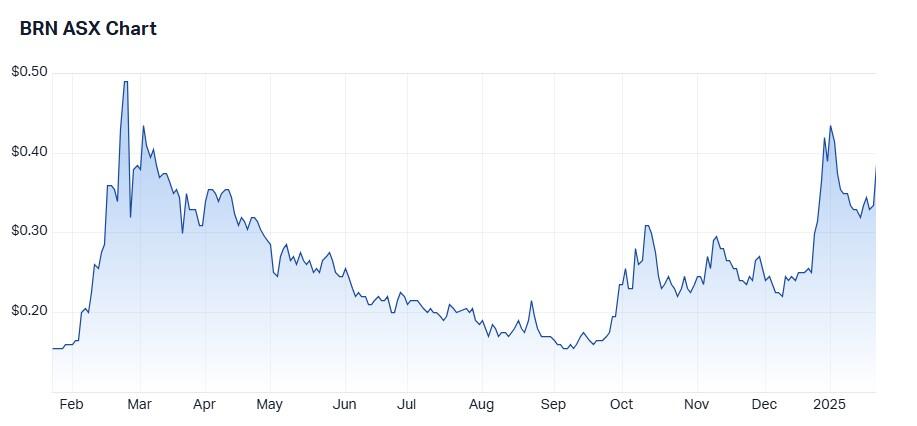

Brainchip Holdings is a global leader in edge AI on-chip processing and learning. The stock has been on a rollercoaster ride in 2024 with the share price hitting 49 cents in late February before plunging to 16 cents in September. Brainchip's Akida 1.0 technology captured the market’s enthusiasm for the sky-high potential of artificial intelligence (AI) which is expected to be used in upcoming European space missions.

However, the share price fell sharply following revelations that cash outflows eclipsed cash inflows.

For the six months to 30 June, the company reported an 8% year-on-year reduction in revenue from continuing operations to US$106,693. Net losses decreased by 33% to US$11.52 million. However, the company held only US$10.9 million in cash and equivalents at 30 June.

The share price jumped from $0.25 20 early December to $0.43.5 in early January. This was after the company won a US$1.8 million contract from the Air Force Research Laboratory (AFRL) for neuromorphic radar signalling processing.

Also driving the price higher were two licence agreements totalling €190,000 between Frontgrade Gaisler and Airbus Defence and Space. These agreements were for Brainchip’s Akida 1.0 technology.

"This collaboration with Frontgrade Gaisler to license Akida IP for implementation into space SoCs represents an important step in space-based AI deployments, turning into reality what once was considered unattainable," Brainchip CEO Sean Hehir said.

The company recently completed a $25 million capital raise, including a $20 million institutional placement and an additional share purchase plan. While consensus doesn’t cover Brainchip the stock is in a strong bullish trend with the 5-day moving average of the stock price above the 50-day moving average.

Two smallcaps

Titomic Ltd (ASX: TTT)

A specialist in the defence, aerospace and mining sectors, Titomic develops large integrated solutions for industrial scale metal additive manufacturing, using its patented cold spray additive manufacturing (Cold Spray AM) technology.

Last December the small-cap announced that it had successfully co-developed and sponsored a new cold spray standard for aerospace with SAE International. The company’s U.S.-based president, Jim Simpson believes SAE compliance validates Titomic's cold spray technology.

Simpson also believes the SAE nod of approval strategically positions the company to capitalise on a range of U.S. Government opportunities, including Department of Defense contracts for military asset repairs, NASA programs for lightweight aerospace components.

The company recently expanded its portfolio to include anti-corrosion and metal repair solutions, specifically targeting the defence and mining industries to prolong infrastructure lifespan.

The company’s FY2024 revenue grew 127% to $5.9 million and total orders reached $10.0 million. By continuing to optimise its financial performance, the company has reduced its statutory net loss after tax from 15.7 million in FY2023 to 11.9 million.

The stock is not covered by a major broker and does not pay dividends.

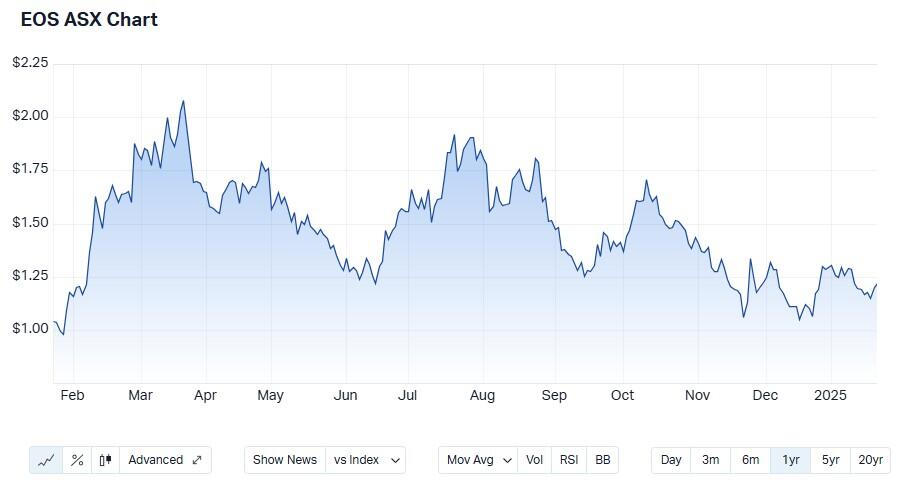

Electro Optic Systems Holdings (ASX: EOS)

As an aerospace company involved in space defence, the company’s defence systems include laser physics, advanced optics, precision control systems, space domain sensors and communications technologies, and remote-operated combat vehicles.

The stock’s share price received a kicker late last year following news that the defence and space systems company secured new orders amounting to approximately $33.7 million. Orders comprise remote weapon system spares worth $20.1 million and Counter-Drone Container Based Remote Weapon Systems valued at roughly $13.6 million.

At the half year the company reported a 92% rise in revenue to $142 million. It also reported gross margin of 44% up 9% on the previous period. It also reported underlying earnings of $11.5 million, up $26.3 million on the previous period.

Stay vigilant

Given the lack of broker analysis on defence stocks, it’s incumbent on you to watch out for price sensitive announcements. This could boost the fortunes of any stocks in this sector.

For example, given the massive change in how the Australian military adopts drone technology, stocks in this space are likely to receive their fair share of future government contracts.

If the Russian/Ukrainian war is any proxy, small drones for battlefield surveillance are on the rise.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.