Boeing reported a significantly smaller quarterly loss as aircraft deliveries surged to their highest levels since 2018, marking a notable step forward in the aerospace giant’s ongoing recovery.

The company posted a net loss of $176 million for the three months ended 30 June, a sharp improvement from the $1.09 billion loss a year earlier.

Adjusted losses per share came in at $1.24, better than the $1.48 forecast, while revenue rose 35% to US$22.75 billion, beating market expectations of $21.84 billion.

"Our fundamental changes to strengthen safety and quality are producing improved results as we stabilise our operations and deliver higher quality airplanes, products and services to our customers," said Kelly Ortberg, Boeing president and chief executive officer.

"As we look to the second half of the year, we remain focused on restoring trust and making continued progress in our recovery while operating in a dynamic global environment."

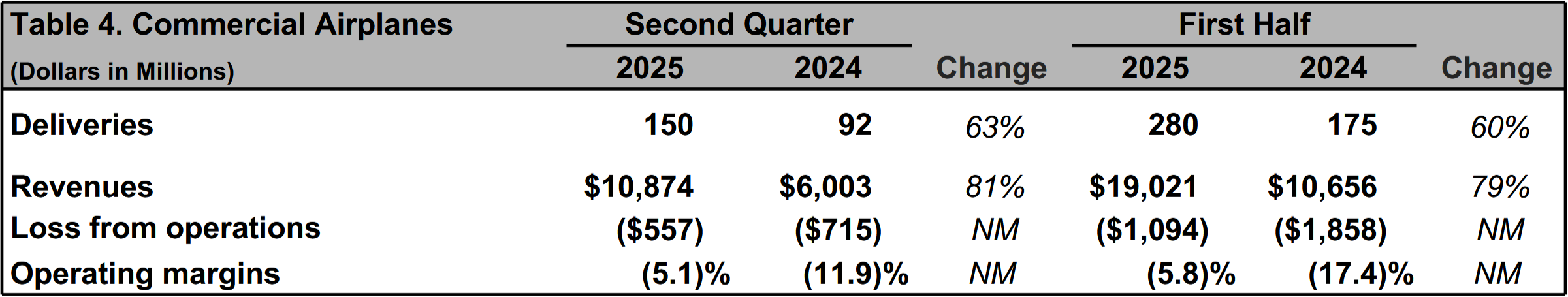

Ortberg, who assumed leadership in August last year, has been credited with bringing greater operational stability. Aircraft deliveries rose significantly during the quarter, with Boeing handing over 150 jets, the highest second-quarter total since 2018, which was also the last year the company recorded a full-year profit.

Revenue in Boeing’s commercial airplane division surged 81% to $10.87 billion. The unit’s operating margin improved as well, though it remained at -5.1%, more than halving from the previous year.

The company increased output of its 737 Max jets to 38 per month, in line with current limits set by the Federal Aviation Administration (FAA) following a door plug incident in January 2024. Ortberg has indicated Boeing will seek approval later this year to raise that cap.

Despite the progress, challenges persist. Boeing recorded a $445 million charge tied to a deferred prosecution agreement with the U.S. Justice Department over two fatal crashes involving the 737 Max. The company also burned through $200 million in the quarter, a substantial reduction from $4.3 billion in outflows during the same period last year.

Certification of the long-delayed 737 Max 7 and Max 10 models has now been pushed to 2026, delaying earlier guidance from Ortberg that targeted approval in 2025. Boeing engineers are currently addressing design changes related to the aircrafts’ anti-ice systems.

Labour tensions may add further pressure. The company's defence unit, already impacted by past charges, could be disrupted after a 3,200-strong group of workers voted against a new labour contract, opening the door to a possible strike.

Nonetheless, Boeing’s defence and space division posted a 10% year-on-year revenue increase to more than $6.6 billion, while its global services business grew by 8% to $5.3 billion.

Shares of Boeing (NYSE: BA) fell 4.4% on Tuesday to close at US$226.08, down from Monday’s $236.41. The stock edged up 0.3% to $226.81 in after-hours trading, giving the company a market capitalisation of approximately US$170.47 billion.