Re-live today's live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Apple revenue reaches record high

- Amazon's profit rises, but cloud services slump

- Rolls-Royce, Reddit, Mastercard, ResMed, Euronext post major growth in revenue and income

- Shell profit sinks amid low gas prices, but beats estimates

- Paramount passes estimates ahead of Skydance merger

- BMW, Cloudflare profits drop

_______________________________________________________________________________________

8:45 am (AEST):

Good morning, everyone! Harlan Ockey here to walk you through today's earnings.

Kicking things off with the NASDAQ, Apple (AAPL) reported a 9.2% increase in net income last quarter, with revenue at a new record high.

Net income was US$23.43 billion in the June quarter, up from $21.5 billion year-on-year.

Diluted earnings per share also reached a quarterly record, rising 12% year-over-year to US$1.57. Revenue was up 10% to $94.0 billion.

“Today Apple is proud to report a June quarter revenue record with double-digit growth in iPhone, Mac and Services and growth around the world, in every geographic segment,” said CEO Tim Cook. “At WWDC25, we were excited to introduce a beautiful new software design that extends across all of our platforms, and we announced even more great Apple Intelligence features."

Sales in its Products segment grew from US$61.56 billion to $66.61 billion year-over-year, while Services sales were up from $24.21 billion to $27.42 billion.

The company recorded net sales increases across all geographical regions, and in both its iPhone and Mac product lines.

Apple is set to release its iPhone 17 family in the coming months, along with a new slate of operating systems incorporating its Liquid Glass software design.

Garry West has the full report.

8:59 am (AEST):

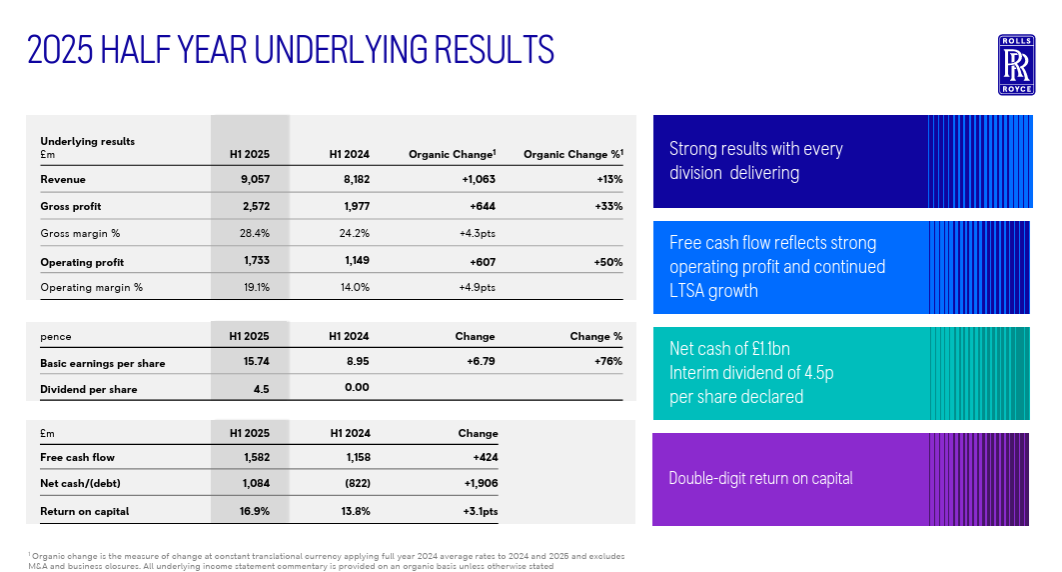

Over to the LON, Rolls-Royce has lifted its guidance after reporting double digit percentage growth in revenue and profit last half.

Revenue was up 13% year-over-year to UK£9.06 billion. Gross profit was £2.57 billion, rising 33%.

Earnings per share were UK£15.74, growing by 76%. Operating profit was £1.733, up 50%.

The company's full-year outlook projects UK£3.1-3.2 billion in operating profit.

"We delivered continued strong operational and strategic progress in the first half of 2025. In Civil Aerospace, we achieved significant time on wing milestones and delivered improved aftermarket profitability. In Power Systems, where we now see further growth potential, we continued to capture profitable growth across data centres and governmental," said CEO Tufan Erginbilgic.

Read Andrew Banks' full story here.

9;10 am (AEST):

Turning to the NYSE, Reddit (RDDT) saw major revenue growth last quarter, driven by a surge in international users.

Revenue was US$500 million, up 78% year-over-year. Net income was $89 million, compared with a loss of $10 million one year ago.

Basic earnings per share were US$0.48, rising from $0.06 in 2024's June quarter.

Its Daily Active Unique users were up 21% to 110.4 million. United States users grew by 11% to 50.3 million, while international users rose by 32% to 60.1 million. International active user numbers surged across both logged-in and logged-out users.

The company's guidance projects revenue of US$535-545 million next quarter.

Andrew Banks' full report is here.

9:22 am (AEST):

At the EBR, Anheuser-Busch InBev (ABI) recorded an increase in revenue last quarter, despite volumes declining.

Revenue rose by 3% year-over-year to US$15.33 billion. Gross profit was $8.57 billion, up 4%.

Underlying earnings per share were US$0.90, down from $0.98 one year ago. Normalised EBITDA was up 6.5%, reaching $5.30 billion.

Volumes fell by 1.9%, however, driven by a decline of 2.2% in its Beer segment. This was significantly larger than the 0.3% drop expected by analysts.

The fall in volumes was largely due to Brazil and China, with a year-over-year declines of 1,770,000 hectolitres in Latin America and 1,683,000 hectolitres in the Asia Pacific.

“While the operating environment remains dynamic, the consistent execution of our strategy by our teams and partners drove a solid first half of the year and reinforces our confidence in delivering on our outlook for 2025,” said CEO Michel Doukeris.

The company's guidance projects EBITDA growth of 4-8% across 2025.

9:28 am (AEST):

Back at the NASDAQ, Amazon (AMZN) increased profits and revenue in the second quarter of the 2025 financial year, but its shares fell as the performance of its cloud-based business fell short of expectations.

The United States-based technology company said net income surged 35% to US$18.2 billion and diluted earnings per share (EPS) jumped 33% to $1.68 per on net sales which rose 13% to $167.7 billion in the three months ended 30 June 2025.

Amazon said net sales were expected to be between US$174 billion and $179.5 billion in Q3, or to grow between 10% and 13% from Q3 FY24, and operating income was expected to be between $15.5 billion and $20.5 billion, compared with $17.4 billion.

Jassy also said Amazon had not seen demand falling as a result of United States tariffs in the first half of the year, and the two million-plus sellers in its marketplace had different strategies about passing on higher costs to consumers.

Although the Q3 forecast was higher than expected, the Q2 results for the AWS cloud computing unit disappointed with margins falling to 32.9% in Q2 from 39.5% in Q1 and 35.5% in Q3 FY24.

Amazon shares (NASDAQ: AMZN) closed up US$3.92 (1.70%) at $234.11, capitalising the company at $2.49 trillion, but plunged to $2.92 in after-hours trading

Thank you to Garry West for that write-up! Read the full story here.

9:37 am (AEST):

And back to the NYSE, Mastercard (MA) posted double digit percentage growth in revenue and net income, beating estimates.

Revenue was US$8.1 billion, rising 17% year-over-year on a reported basis. This is above Visible Alpha estimates of $7.97 billion.

Net income was up 14% year-over-year to US$3.7 billion. Diluted earnings per share grew by 16% year-over-year to $4.07, beating estimates of $4.03.

Cross-border volume rose by 15%, while gross dollar volume was up 9%.

“Overall, the second quarter was another strong one for Mastercard, with net revenue growth of 17% year-over-year, or 16% on a currency-neutral basis. These results reinforce how our teams are executing every day and delivering value in every transaction and beyond. We're well positioned for the opportunities ahead and continue to drive new innovation like the Mastercard Collection and Mastercard Agent Pay," said CEO Michael Miebach.

Andrew Banks has the full story here.

9:49 am (AEST):

Still at the NYSE (or the ASX), ResMed (RMD) recorded major growth in revenue and net income last quarter, driven by demand for sleep devices.

Revenue grew by 10% year-over-year to US$1.3 billion, while net income was up 30% to $379.7 million. Diluted earnings per share were $2.58.

Sales in both its U.S., Canada, and Latin America segment and its Europe, Asia, and Other Markets segment increased 9% each on a constant currency basis. International revenue for its Residential Care Software segment also was up 9%.

“Our strong finish to fiscal year 2025 reflects ongoing momentum across our business, driven by robust global demand for our market-leading sleep and breathing health devices, as well as our expanding digital health ecosystem," said CEO Mick Farrell.

“As we move into fiscal year 2026, we will continue to invest in innovation, scale our digital health capabilities, and partner with patients, providers, payers, and policymakers to ensure more people around the world have access to the care they need to sleep better, breathe better, and live longer and healthier lives.”

Read Mark Story's full article here.

9:57 am (AEST):

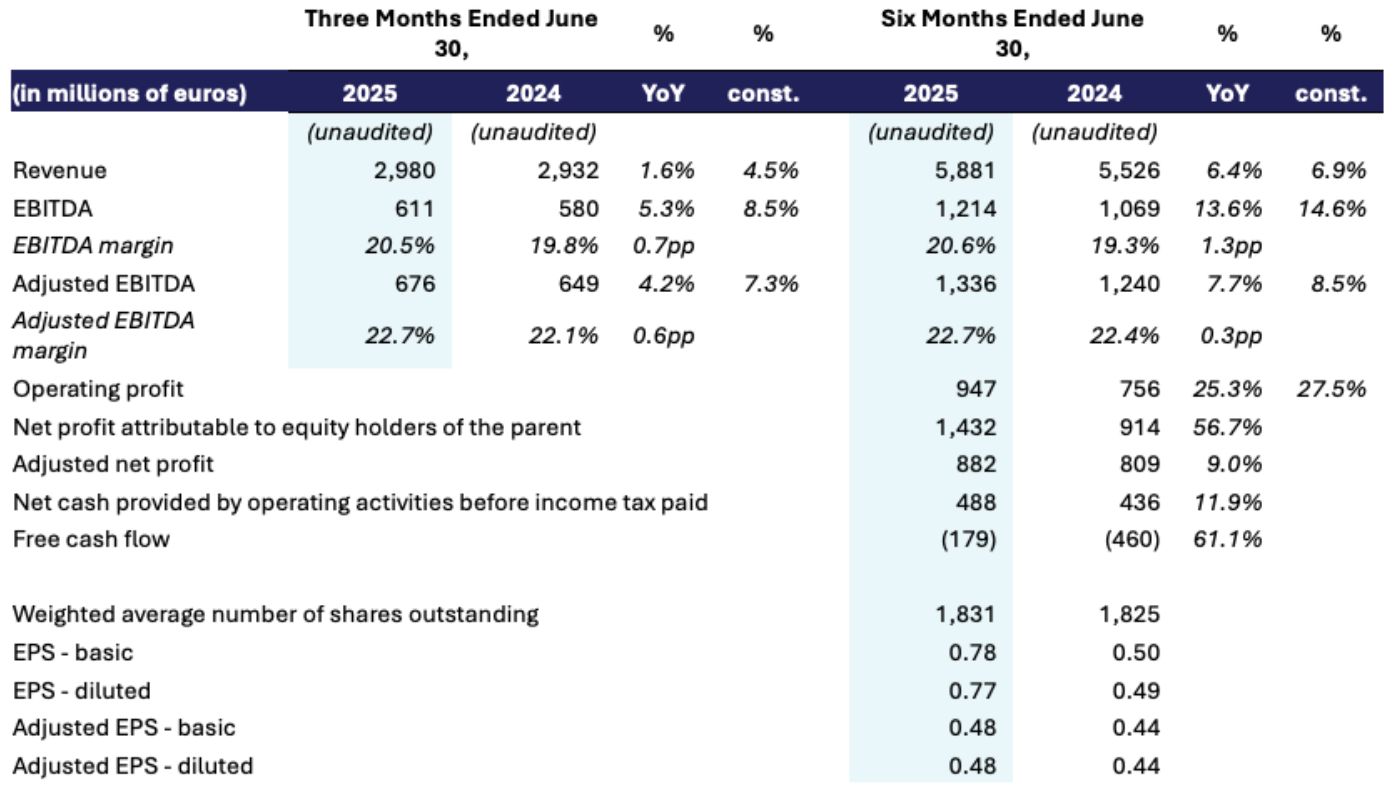

At the AMS, Universal Music Group (UMG) reported a surge in music publishing revenue last quarter, though merchandising revenue sank.

Overall revenue was EU€2.98 billion, up 1.6% from one year ago. Recorded Music revenue rose by 1.1% to €2.22 billion; driven by growth in music service subscriptions and digital downloads.

Revenue for its Music Publishing segment increased by 11.5% year-over-year to EU€570 million, with digital revenue leading by percentage growth at 12.9%.

Merchandising and Other revenue fell by 15.4% to EU€192 million, which the company said was due to unusually strong direct-to-consumer sales in 2024's June quarter.

“The breadth and diversity of our business has positioned us to deliver solid growth in revenue and Adjusted EBITDA again this quarter. We remain confident in our growth trajectory as we continue to invest with a focus on maximizing long-term value and driving attractive returns in the coming years,” said UMG COO Boyd Muir.

Chloe Jaenicke has the full story.

10:15 am (AEST):

Back to the LON, Shell (SHEL) beat profit estimates, despite a drop in earnings driven by lower oil and gas prices.

Its adjusted earnings were US$4.26 billion, falling from $6.29 billion year-over-year, but above LSEG estimates of $3.87 billion.

Integrated Gas earnings were US$1.74 billion, down from $2.68 billion one year ago, while its Upstream earnings declined from $2.34 billion to $1.73 billion.

The company said in March that it would raise its structural cost reduction target to US$5-7 billion by the end of 2028, as well as grow liquefied natural gas sales by 4-5% annually to 2030.

Total Integrated Gas production was 913 thousand barrels of oil equivalent, down from 980 one year ago. Upstream production was 1,732 thousand barrels of oil equivalent, falling slightly from 1,783.

“Shell generated robust cash flows reflecting strong operational performance in a less favourable macro environment. We continued to deliver on our strategy by enhancing our deep-water portfolio in Nigeria and Brazil, and achieved a key milestone by shipping the first cargo from LNG Canada,” said CEO Wael Sawan.

"Our continued focus on performance, discipline and simplification helped deliver $3.9 billion of structural cost reductions since 2022, with the majority delivered through non-portfolio actions. This focus enables us to commence another $3.5 billion of buybacks for the next three months, the 15th consecutive quarter of at least $3 billion in buybacks."

Read Chloe Jaenicke's report here.

10:37 am (AEST):

At the NYSE, S&P Global (SPGI) has raised its 2025 guidance after strong increases in revenue and income last quarter.

Revenue rose by 6% year-over-year to US$3.76 billion, driven by growth in its Market Intelligence and Dow Jones Indices segments.

Its Mobility segment saw revenue grow by 10% to US$438 million. The Mobility segment will soon separate into a standalone public company, S&P Global announced in April.

GAAP net income was up 6% to $1.07 billion, with GAAP diluted earnings per share increasing by 9% to $3.50.

“S&P Global delivered better than expected financial results in the second quarter, supported by execution in our customer initiatives and resilience in the debt and equity markets,” said CEO Martina Cheung.

“We continued to demonstrate discipline and operational excellence, while striking a balance between expense management and investing for future growth. This approach has allowed us to make important investments in technology, AI, and products while expanding margins.”

11:17 am (AEST):

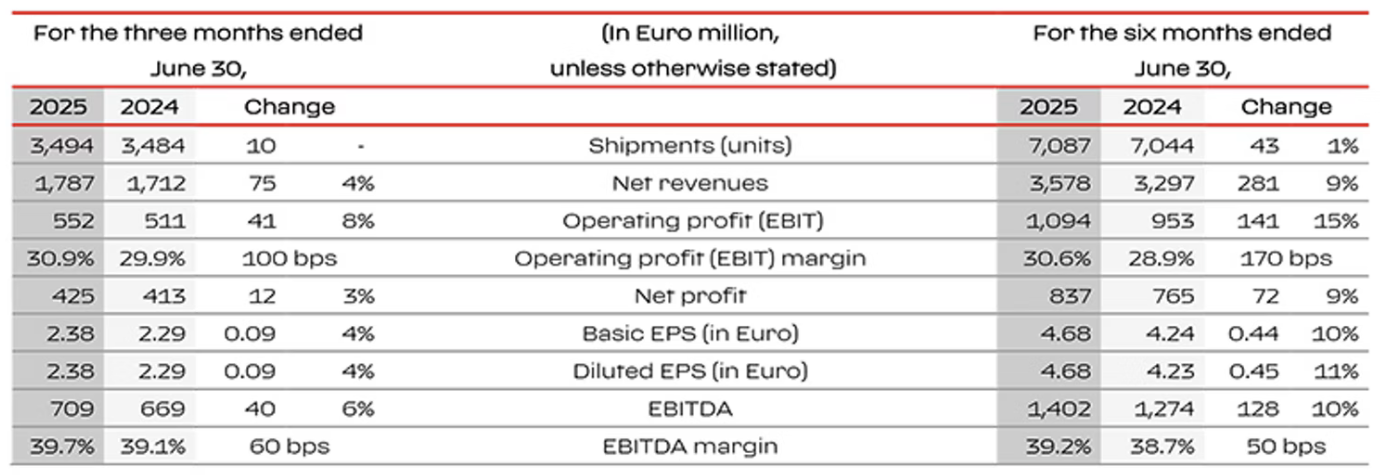

Over to the BIT, Ferrari (RACE) posted an increase in revenue last quarter, but missed estimates.

Net revenues were EU€1.79 billion, up 4.4% year-over-year. This missed Zacks estimates by 0.45%, however.

The company shipped 3,494 units last quarter, rising from 3,484 one year ago. While the Europe, Middle East, and Africa region led with 1,646 shipments, these declined by 1% year-over-year. The Americas and the Asia Pacific (excluding China, Taiwan, and Hong Kong) saw 1% and 2% shipment growth, respectively.

Earnings per share were EU€2.38, growing by 4%. Net profit was €425 million, up 3%.

“The first semester of 2025 reminded us once more about the importance of agility and flexibility in the management of our Company. Today’s strong results reflect our commitment to execute our strategy with discipline and focus, said CEO Benedetto Vigna. “Testament to that is the overwhelming demand for the 296 Speciale family and the excellent initial feedback on the newly launched Ferrari Amalfi, a coupé that redefines the concept of the contemporary grand tourer.”

Ferrari projects that there will be no significant impact from the U.S.' new tariffs on European vehicles imports. Its full-year 2025 guidance expects above EU€7.0 billion and adjusted diluted earnings per share greater or equal to €8.60.

11:37 am (AEST):

At the ETR, BMW (BMW) reported a drop in revenue and profit, but reaffirmed its full-year guidance.

Revenues were EU€33.93 billion last quarter, down 8.2% year-over-year. Automotive revenues declined by 8.2% to €29.44 billion, while Financial Services was its only major segment to see growth at 2.4%.

Net profit was EU€1.84 billion, falling by 31.9%, and profit before tax dropped by 32.3% to €2.61 billion. Earnings per share were €2.85, down 29.6%.

The company delivered 621,377 units last quarter, up 0.4% year-over-year. Deliveries of BMW-brand vehicles sank by 2.6%, while MINI vehicles were up 33.2%.

"Even despite higher tariffs, the BMW Group’s business model remains intact — our popular premium vehicles, global competitive strength and high level of resilience provide us with a strong and sustainable foundation. Our footprint in the U.S. is helping us limit the impact of tariffs," said board of management member responsible for finance Walter Mertl.

BMW said it remained on track to meet its full-year guidance, which projects earnings before tax to be in line with the prior year's figure of EU€10.97 billion.

11:56 am (AEST):

And at the NASDAQ, Comcast (CMCSA) beat estimates on earnings per share and revenue, though its broadband customer numbers declined.

Adjusted earnings per share were US$1.25, up 3.3% year-over-year and besting LSEG estimates of $1.18. Revenue climbed 2.1% to $30.31 billion, above estimates of $29.81 billion.

Its adjusted net income was US$4.65 billion, falling 1.7%.

Comcast's Connectivity & Platforms segment saw an 0.1% decline in revenue to US$17.81 billion. Total customer relationships across the segment dropped by 349,000 to 51.16 million, with domestic broadband customers sinking by 226,000 to 31.54 million.

"We delivered solid financial results in the second quarter, growing Adjusted EPS by 3% and generating $4.5 billion of free cash flow, while continuing to invest in our growth businesses and returning $2.9 billion to shareholders," said CEO Brian L. Roberts. “Importantly, we're pleased with the early progress we are seeing with our go-to-market pivot in residential broadband. In addition, our wireless business had its best quarter ever, adding 378,000 lines, further demonstrating our competitive advantage in convergence.”

12:24 pm (AEST):

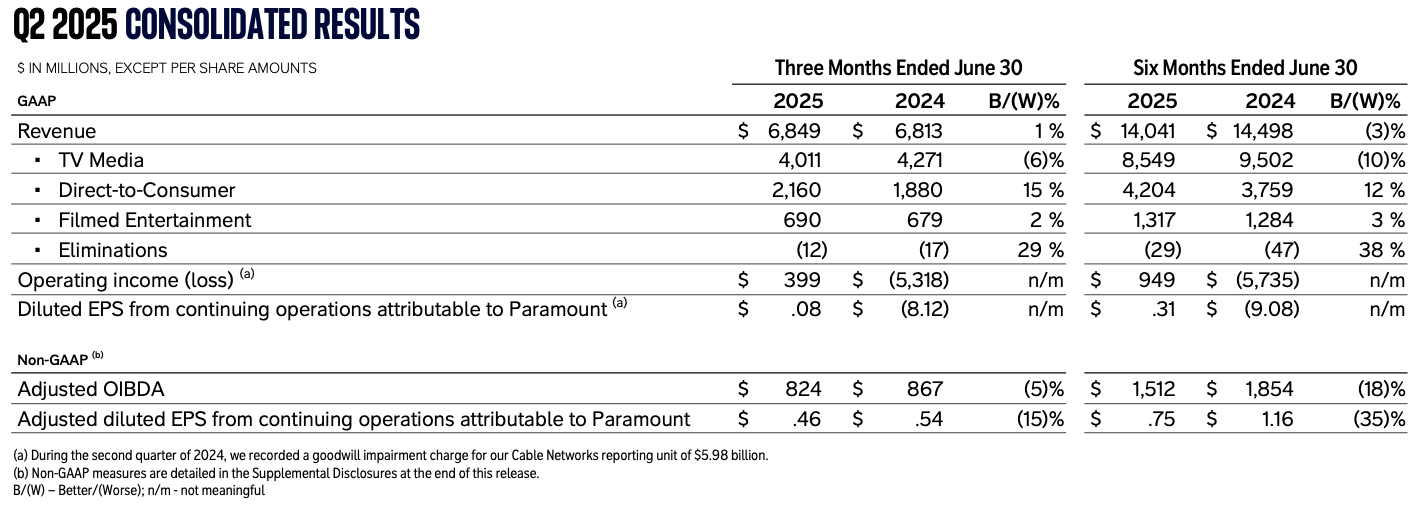

Still with the NASDAQ, Paramount Global (PARA) surpassed estimates on earnings per share and revenue last quarter, ahead of its merger with Skydance.

Revenue was US$6.85 billion, up 1% year-over-year and above LSEG estimates of $6.84 billion. Adjusted earnings per diluted share were $0.46, falling 15% but passing estimates of $0.36.

Its TV Media segment, Paramount's largest by revenue, saw a drop in revenue of of 6% to US$4.01 billion. Advertising, affiliate & subscription, and licensing & other revenue declined by 4%, 7%, and 9%.

The company's Direct-to-Consumer segment, however, posted a 15% revenue increase to $2.16 billion. Subscription revenue was up 22%, with global viewing hours rising 29% across Paramount+ and Pluto TV, though Paramount subscribers fell by 1.3 million.

“Despite an increasingly challenging environment, the talented co-CEOs and teams across the Company have continued to strengthen and grow the business. As a testament to their success and driven by the power of exceptional content, we have seen the impressive growth of Paramount+, the ongoing leadership of CBS, and the continued stream of franchise growth at Paramount Pictures," said non-executive chair Shari Redstone.

"At the same time, substantial progress has been made in streamlining the Company’s cost structure. I am proud that when the Skydance transactions close we will be turning over a healthy business with a strong foundation for long-term growth and value creation.”

Paramount's US$8.4 billion merger with Skydance is set to close on 7 August, after its approval by the U.S. Federal Communications Commission last month. The newly-formed company Paramount Skydance will be helmed by Skydance CEO David Ellison.

12:48 pm (AEST):

Chloe Jaenicke here to take you through some of the afternoon earnings!

Unilever (LON: ULVR) reported underlying sales growth of 3.4%, alongside volume growth of 1.5% and price of 1.9%.

The 3.4% growth is marginally higher than analysts expectations.

This was due to growth within Q2 of 2025.

“Our continued outperformance in developed markets and the positive impact of our decisive interventions in emerging markets, accelerated our growth in the second quarter to 3.8%, with positive volume growth across all business groups,” CEO Fernando Fernandez said.

However, underlying profit for the company was down 4.8% from the same period last year to €5.8 billion within the first half.

The second quarter results saw underlying sales growth accelerate 3.8% to €15.4 billion, while still being 4.6% down year-on-year.

Fernandez said this the due to outperformance in developed markets and positive impact of “decisive interventions” in emerging markets.

Unilever has made its intentions for the future clear, as it expects underlying sales growth to be within a 3% to 5% range in the second half.

“Looking ahead, our priorities are clear: more Beauty & Wellbeing and Personal Care; disproportionate investment in the US and India; and, a sharper focus on premium segments and digital commerce,” Fernandez said.

“We are building a marketing and sales machine that drives desire at scale in our power brands and ensures execution excellence across all channels to deliver consistent volume growth and gross margin expansion.”

1:09 pm (AEST):

On the NASDAQ, Strategy (MSTR), formally known as MicroStrategy has beaten analysts expectations by 35,447.83%, with earnings per share reaching US$32.53 in Q2 2025.

This marks a 4,378.95% increase from the US$0.76 per share loss posted during the same period last year.

“These financial results, built upon the scale and performance of our bitcoin balance sheet, are at all-time highs for the company and rank among the most successful quarterly results across the largest public companies in the world,” Strategy CEO Andrew Kang said.

The Bitcoin treasury company also reported sales of US$114.49 million, representing a 2.73% year-over-year increase and surpassing analyst projections by 1.35%.

For the full year in 2025, the company is currently expecting diluted earnings per share of US$80 and net income of US$24 billion.

1:29 pm (AEST):

Moving to the NYSE, CVS Health Corp (CVS) beat Wall Street predictions in Q2 2025, sending its stock up more than 7% more than in premarket trading.

The healthcare giant reported revenues of US$98.9 billion, which is 8.4% higher than the same time last year. This is also above estimates of US$94.6 billion.

Adjusted earnings per share also beat expectations, coming in at US$1.81.

The company attributes the positive results to the rebound of insurance brand Aetna and growth in other areas.

“Our strong performance demonstrates the continued focus we have on operational and financial improvement across our businesses, led by a significant and durable recovery at Aetna, strong retention at CVS Caremark and growth and momentum at CVS Pharmacy,” CEO and president David Joyner said.

CVS has also revised its 2025 full-year guidance and is now expecting adjusted earnings per share of US$6.30 to US$6.40 instead of the previously expected US$6.00 to US$6.20.

1:50 pm (AEST):

Thank you, Chloe! Harlan Ockey back with you this afternoon.

At the ASX, Champion Iron (CIA) missed estimates on revenue and earnings per share last quarter.

Revenue was A$390 million, down 8% year-over-year and below estimates of $474.58 million. Earnings per share were $0.056, missing estimates of $0.069.

Waste mined and hauled reached 10,963,600 wet metric tonnes, up 63% year-over-year. Ore mined and hauled was 10,070,700 wet metric tonnes, falling by 7%.

Total quarterly production was 3.5 million wet metric tonnes, 5% below Macquarie-compiled estimates. Macquarie lowered its rating on Champion Iron from ‘outperform’ to ‘neutral’ following the results.

2:09 pm (AEST):

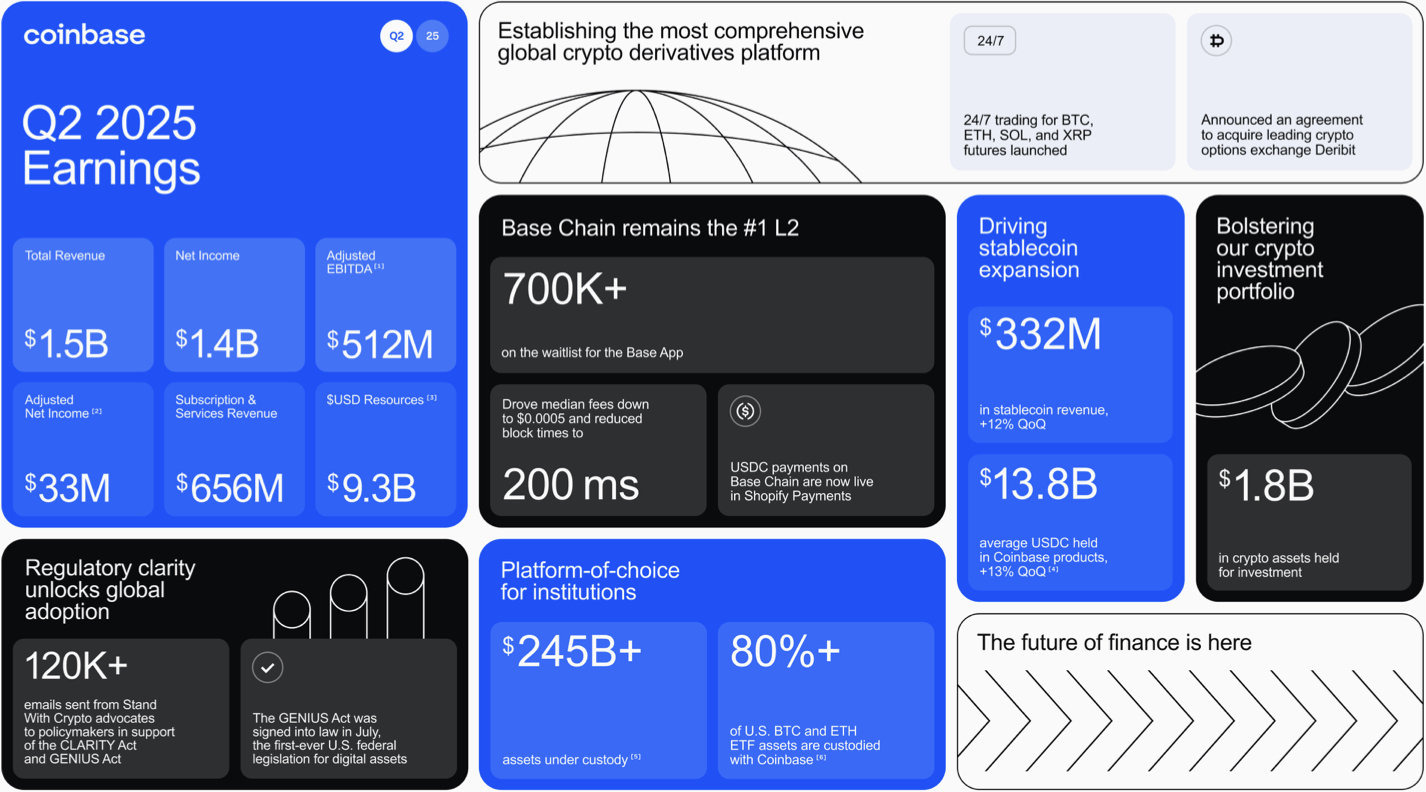

Over at the NASDAQ, Coinbase (COIN) saw transaction revenues drop, contributing to a revenue miss.

Total revenue was US$1.50 billion, up from $1.45 billion year-over-year but missing estimates of $1.6 billion. Transaction revenue was $764.3 million, dropping below the $780.9 million seen one year ago.

Subscription & Services revenue was US$655.8 million, rising from $599.0 million.

Net income was US$1.43 billion, growing from $36.13 million in 2024's Q2. This was largely driven by gains of $1.5 billion on strategic investments. Adjusted net income was US$33 million.

Total operating expenses were US$1.52 billion, compared to $1.11 billion one year ago.

The company projects transaction revenue will be around US$360 million in July, with Subscription & Services revenue at $665-745 million in Q3. "We are working to bring the financial system onchain and made progress in Q2 across each phase of crypto adoption: first—as an investment, second—as financial services, and third—as an app platform," it wrote in a letter to shareholders.

2:26 pm (AEST):

At the NYSE, Cloudflare (NET) recorded a major surge in revenue last quarter, though its net losses continued to mount.

Revenue was US$512.3 million, rising 28% year-over-year. Its GAAP net loss was US$50.45 million, down from a loss of $15.08 million.

GAAP gross profit was US$383.6 million, up from $312.0 million. The company's GAAP operating loss was $67.3 million, compared with a loss of $34.7 million one year ago.

Cloudflare projects revenue of US$534.5-544.5 million next quarter.

“We had an excellent second quarter, exceeding $2 billion in annualized revenue while also reaccelerating revenue growth to 28% year-over-year. We’re innovating faster than ever, and demand remains strong, as our largest customers grow their investments with Cloudflare at the highest levels we’ve seen since 2022,” said Cloudflare CEO Matthew Prince.

“Sitting in front of more than 20% of all websites—with more than half of our dynamic traffic flowing through APIs—Cloudflare is uniquely positioned to enable the agentic web of the future.”

2:45 pm (AEST):

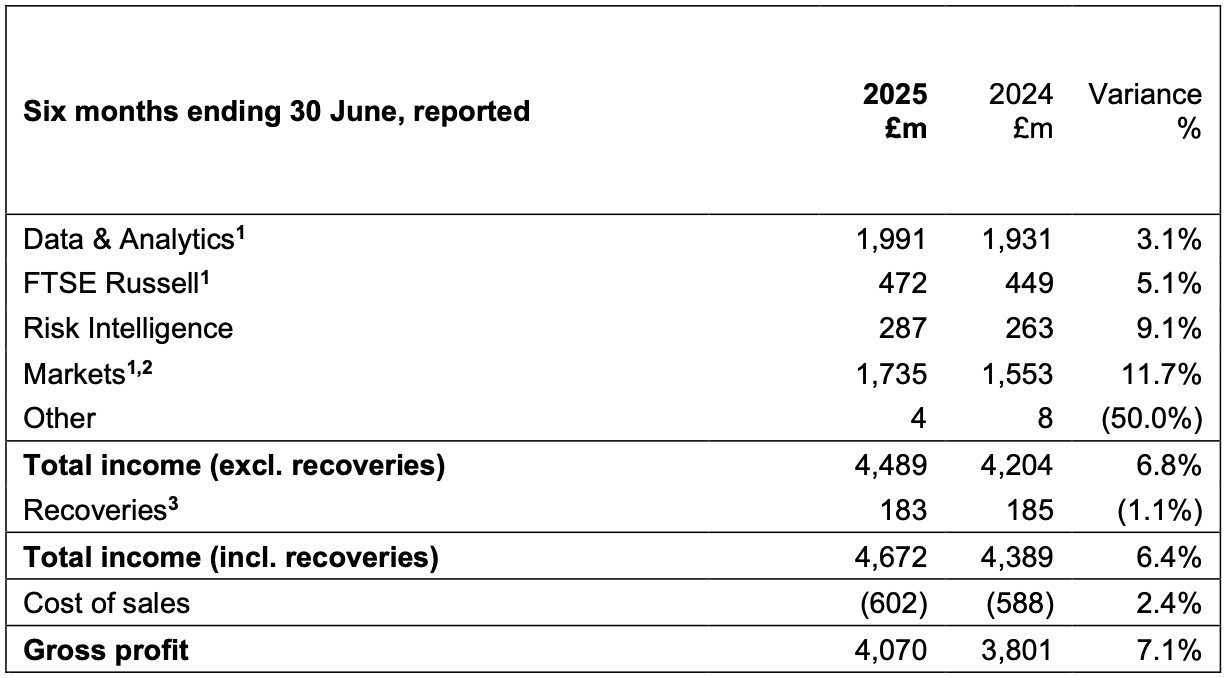

Back to the LON, London Stock Exchange Group (LSEG) saw income rise last half, with growth across divisions.

Total income including recoveries was UK£4.67 billion, up 6.4%. Basic earnings per share were £1.23, compared with £0.647 one year ago.

EBITDA was UK£2.15 billion, rising 10.9%, while operating profit increased by 30.7% to £1.06 billion.

“We have continued our strong and consistent growth track record, with a good performance from our subscription businesses enhanced by our leading markets platforms, which drove upside from increased volatility in the period. At the same time, we have improved our margins strongly as we realise the benefits of our ongoing transformation and deliver attractive operating leverage," said CEO David Schwimmer.

All divisions posted income growth last half. Income for its Markets segment was up 11.7% to UK£1.74 billion, while Data & Analytics income rose by 3.1% to £1.99 billion.

FTSE Russell and Risk Intelligence income grew by 5.1% and 9.1%, respectively.

Its guidance projects constant currency growth in total income excluding recoveries of 6.5-7.5% across 2025.

3:10 pm (AEST):

Over to the EPA, Euronext (ENX) reached a new record high in revenue and income last quarter, due to double digit percentage growth.

Its revenue and income were EU€465.8 million, up 12.8% year-on-year. Adjusted net income was €204.4 million, rising by 23.8%.

Adjusted EBITDA was EU€297.3 million, a 15.8% increase. Adjusted earnings per share were up 27.0% to €2.02.

"In the second quarter of 2025, Euronext achieved all-time record revenues and income of €465.8 million, driven by organic growth and acquisitions. This is the fifth consecutive quarter of double-digit top-line growth. The strong performance reflects the strength of Euronext’s diversified business model, capable of capturing favourable market conditions and of generating non-volume-related revenue growth," said CEO Stéphane Boujnah.

The company saw revenue and income grow across all segments except for Other Income. Capital Markets & Data Solutions, its largest, posted growth of 6.5% to EU€165.4 million.

3:26 pm (AEST):

Back to the NYSE again, Cigna (CI) posted a major revenue increase, driven by growth in its Evernorth pharmacy benefit management segment.

Revenue was up 11% year-over-year to US$67.2 billion last quarter. Adjusted income from operations was $1.93 billion, compared with $1.91 billion in 2024's Q2, or $7.20 per share.

Net earnings per share were US$5.71, up from $5.45 one year ago.

The company reported 121,892,000 total pharmacy customers, down from 122,470,000. Overall, its customer relationships declined from 186,232,000 to 182,236,000.

Its Evernorth Health Services segment led adjusted revenues at US$57.83 billion, up from $49.55 billion one year ago.

"Listening, adapting, and innovating to meet the evolving needs of our patients, customers, and clients enables us to deliver meaningful value," said Cigna CEO David M. Cordani. "Our performance in the second quarter reflects our disciplined execution and the strength of our business mix."

Cigna reaffirmed its 2025 outlook, which includes adjusted income from operations per share of at least US$29.60.

3:54 pm (AEST):

Sticking with the NYSE, Kellanova (K) reported mixed results, beating estimates on revenue but missing estimates on earnings per share ahead of its purchase by Mars.

Net sales increased by 0.3% year-on-year to US$3.20 billion last quarter, above Zacks estimates of $3.18 billion. Adjusted diluted earnings per share were $0.94, falling from $1.01 one year ago and below estimates of $0.99.

The company's net income was US$303 million, down from $347 million in 2024's Q2.

"It is a testament to the strength of our people, portfolio, and plans that we continue to manage effectively through challenging business conditions," said CEO Steve Cahillane. “While demand softness in most of our categories did not improve as much as we had hoped, we delivered earnings above our expectations in Q2, thanks to our innovation, commercial and operational execution, and emerging markets growth, notably noodles in Africa.”

In North America, net sales dropped by 4.1% in its Snacks segment and 2.6% in its Frozen segment. Snacks and Cereal both saw positive growth in Europe, though Cereal sales plummeted by 14.0% in Latin America. In Africa, Noodles & Other sales surged by 52.0%.

Mars agreed to acquire Kellanova in 2024 for around US#36 billion, with the transaction set to close later this year. The European Union's antitrust regulators began an investigation into the purchase in June, though this was paused on 29 July while awaiting data from Mars and Kellanova. U.S. regulators approved the acquisition in June.

Thank you for joining us today. We'll see you next time!