Amazon increased profits and revenue in the second quarter of the 2025 financial year (Q2 FY25) but its shares fell as the performance of its cloud-based business fell short of expectations.

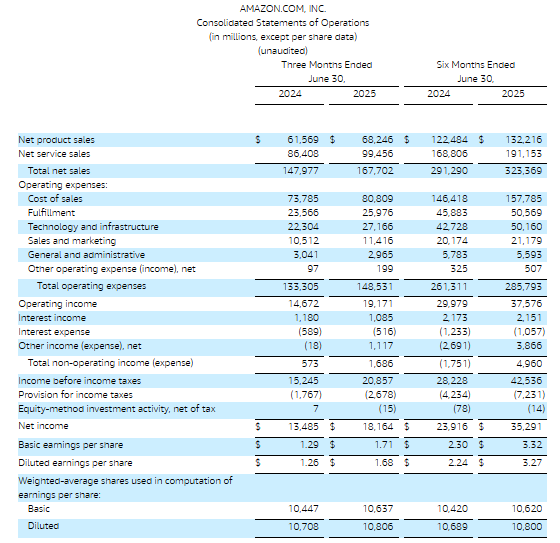

The United States-based technology company said net income surged 35% to $18.2 billion and diluted earnings per share (EPS) jumped 33% to $1.68 per share on net sales which rose 13% to $167.7 billion in the three months ended 30 June 2025.

President and CEO Andy Jassy said Amazon’s conviction that artificial intelligence (AI) would change every customer experience was starting to play out.

“Our AI progress across the board continues to improve our customer experiences, speed of innovation, operational efficiency, and business growth, and I’m excited for what lies ahead,” he said in a press release.

Amazon said net sales were expected to be between $174 billion and $179.5 billion in Q3, or to grow between 10% and 13% from Q3 FY24, and operating income was expected to be between $15.5 billion and $20.5 billion, compared with $17.4 billion.

America segment operating income surged 47% to $7.5 billion on sales which increased 11% to $100.1 billion in North America, international operating income soared 400% to $1.2 billion on sales up 16% to $36.8 billion, and Amazon Web Services (AWS) operating income rose 10% to $10.2 billion on sales which were up 17.5% to $30.9 billion.

Jassy also said Amazon had not seen demand falling as a result of United States tariffs in the first half of the year and the two million-plus sellers in its marketplace had different strategies about passing on higher costs to consumers.

“There continues to be a lot of noise about the impact that tariffs will have on retail prices and consumption. Much of it thus far has been really misreported, as we said before, it's impossible to know what will happen,” he said on an earnings call.

Although the Q3 forecast was higher than expected, the Q2 results for the AWS cloud computing unit disappointed with margins falling to 32.9% in Q2 from 39.5% in Q1 and 35.5% in Q3 FY24.

Amazon shares (NASDAQ: AMZN) closed up US$3.92 (1.70%) at $234.11, capitalising the company at $2.49 trillion, but plunged to $2.92 in after-hours trading.