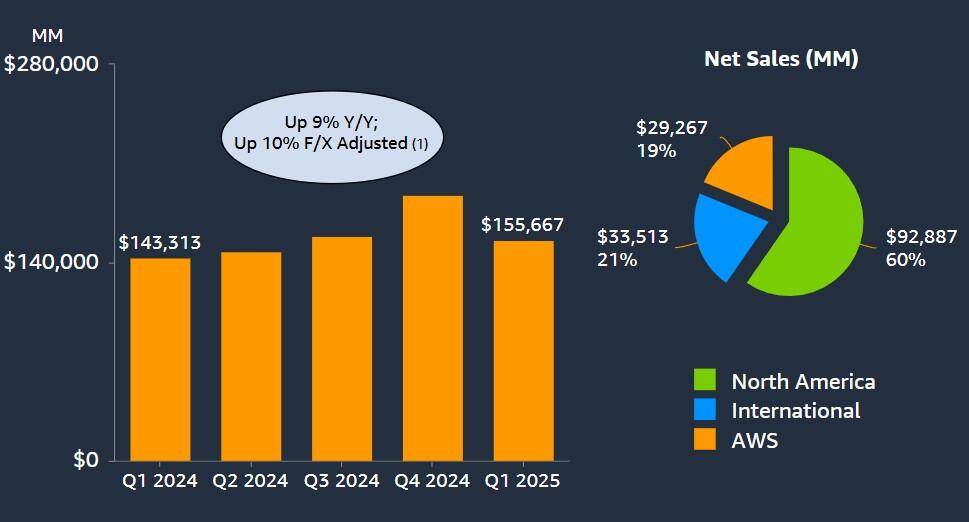

While Amazon posted better-than-expected results in its Q1 earnings report, driven by a 9% bump in net sales to US$155.7 billion for the quarter year-on-year, it warned that tariffs and trade disruptions would likely see a ripple effect to oncoming results.

That was made up by a North America segment sales increase of 8% year-over-year to $92.9 billion, while International segment sales increased 5% to $33.5 billion.

Amazon Web Services (AWS) had the biggest uptick, with a 17% year-over-year rise to $29.3 billion.

Other metrics:

- Net income increased to $17.1 billion in the first quarter, or $1.59 per diluted share, compared with $10.4 billion, or $0.98 per diluted share, in first quarter 2024.

- Operating cash flow increased 15% to $113.9 billion for the trailing 12 months, compared with $99.1 billion for the previous comparative reporting period.

“We’re pleased with the start to 2025, especially our pace of innovation and progress in continuing to improve customer experiences,” Amazon president and CEO Andy Jassy said.

“From Alexa+, to another delivery speed record for our Prime members, to our new Trainium2 chips and Bedrock model expansion that make it easier for AWS customers to train models and run inference more flexibly and cost-effectively, to our first Project Kuiper satellites successfully launching into low earth orbit in our quest to provide broadband access to hundreds of millions of households in rural areas without it today - we’re continuing to find meaningful ways to make customers’ lives easier and better every day.”

Navigating uncertainty

Amazon, like other large suppliers and retail businesses, have been bringing in any and all foreign goods before import levies take effect.

Jassy says that many of its third-party sellers did the same and that because of this, a fair amount of those sellers haven't changed their pricing yet - and vowed that Amazon would do everything possible to keep prices low, pointing to the company's vast product range to be able to nagivate the current market climate.

“When there are uncertain environments, customers tend to choose the provider they trust most,” Jassy said.

“Given our really broad selection, low pricing, and speedy delivery, we have emerged from these uncertain eras with more relative market segment share than we started, and better set up for the future.”

Investors responded negatively to Amazon's uncertainty, with shares dropping 4% in intra-day trade.