Apple has reported a 9.2% increase in net income for the third quarter of the 2025 financial year (Q3 FY25) as revenue reached a record.

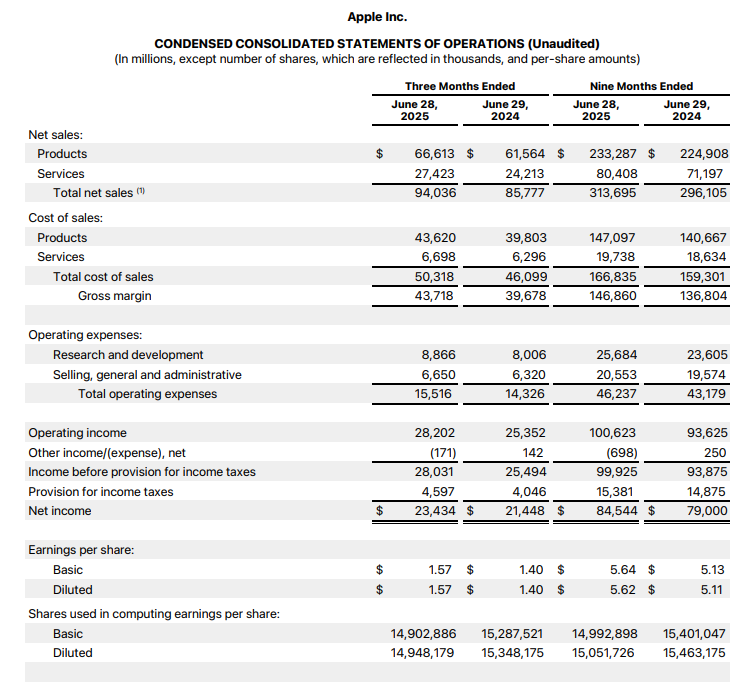

The technology giant said net income was US$23.4 billion (A$36.0 billion) in the three months ended 28 June 2025, compared with $21.5 billion in the previous corresponding period.

The company, whose products include the iPhone, Mac, iPad, Apple Watch and AirPods, said diluted earnings per share (EPS) grew 12% to a quarterly record of $1.57 as revenue rose 10% to $94.0 billion in Q3.

The Board declared a cash dividend of 26 cents per share payable on 14 August to shareholders of record at the close of business on 11 August.

“Today Apple is proud to report a June quarter revenue record with double-digit growth in iPhone, Mac and Services and growth around the world, in every geographic segment,” CEO Tim Cook said in a press release.

CFO Kevan Parekh said Apple’s installed base of active devices reached a new high across all product categories and geographic segments.

Cooke said United States tariffs added $800 million to costs in Q3 and the impact was expected to rise to $1.1 billion in the final quarter of FY25 but this should not be used to make forecasts.

For the nine months to 28 June, net income grew 7% to $84.5 million and diluted EPS rose 10% to $5.62 on revenue which increased 6% to $313.7 billion.

Parekh said Apple expected its September quarter revenue to grow by a mid-to-high single-digit percentage if current global tariff rates did not change, global macroeconomic conditions did not worsen and the revenue share agreement with Google continued.

The Services business, which includes the App Store, iCloud, Apple Music, Apple TV+, Apple Arcade, Apple News+, Apple Fitness+ and Apple Pay, lifted net sales by 12% to $26.6 billion.

Cook said growth accelerated in most tracked markets including Greater China and many emerging markets and it set June quarter revenue records in more than two dozen countries and regions including the United States, Canada, Latin America, Western Europe, the Middle East, India and South Asia.

“These results were driven by double-digit growth across iPhone, Mac and services,” he said on the call.

The Apple share price (NASDAQ: AAPL) rose in after-market trading as Q3 revenue and EPS were higher than the $89.34 billion and $1.43 per share forecast.

The shares closed $1.48 (0.71%) lower before the results were released at US$207.57 (A$319.16), capitalising the company at $3.12 trillion, but bounced back after the close to $209.85.