Technology giant Apple estimated that new United States tariffs will add US$900 million (A$1.4 billion) to third quarter costs as it reported a 4.8% increase in net income for the second quarter (Q2) of the 2025 financial year.

CEO Tim Cook said Apple saw "limited impact" from tariffs in Q2 as the company shifted supply chains and inventory but for Q3 "assuming the current global tariff rates, policies and applications do not change for the balance of the quarter and no new tariffs are added, we estimate the impact to add $900 million to our cost.”

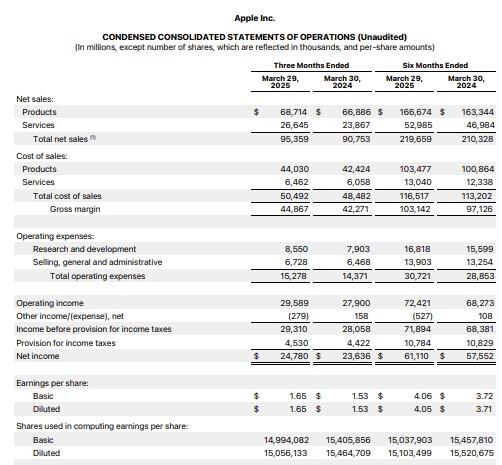

Cooke was speaking on an earnings call after Apple (NASDAQ: AAPL) reported net income of US$24.780 billion (A$38.71 billion) for the quarter ended 29 March 2025, compared with $23.636 billion in the previous corresponding period (pcp).

The world’s largest company, whose products include the iPhone, Mac, iPad, Apple Watch and AirPods, said diluted earnings per share (EPS) rose 8% to $1.65 on revenue which grew 5% to $95.4 billion.

The board of directors declared a cash dividend of 26 cents per share, up 4% on the pcp.

“Today Apple is reporting strong quarterly results, including double-digit growth in Services,” CEO Tim Cook said in a press release.

The Services business, which includes the App Store, iCloud, Apple Music, Apple TV+, Apple Arcade, Apple News+, Apple Fitness+ and Apple Pay, lifted net sales by 11.6% to $26.645 billion.

Cook said Apple added iPhone 16e to its product line and introduced powerful new Macs and iPads that took advantage of the capabilities of Apple silicon in the March quarter and cut carbon emissions by 60% percent over the last decade.

Chief Financial Officer Kevan Parekh said Apple’s installed base of active devices has reached a new all-time high across all product categories and geographical segments.

The results were released after the close of Apple shares trading, which ended 82 cents (0.39%) higher at $231.32 on Thursday (Friday AEST), capitalising the company at $3.20 trillion.

Although the results were better than expected, the share price dipped $8.57 (4.02%) to $204.75 in after-hours trading as investors focused on the tariff impact.