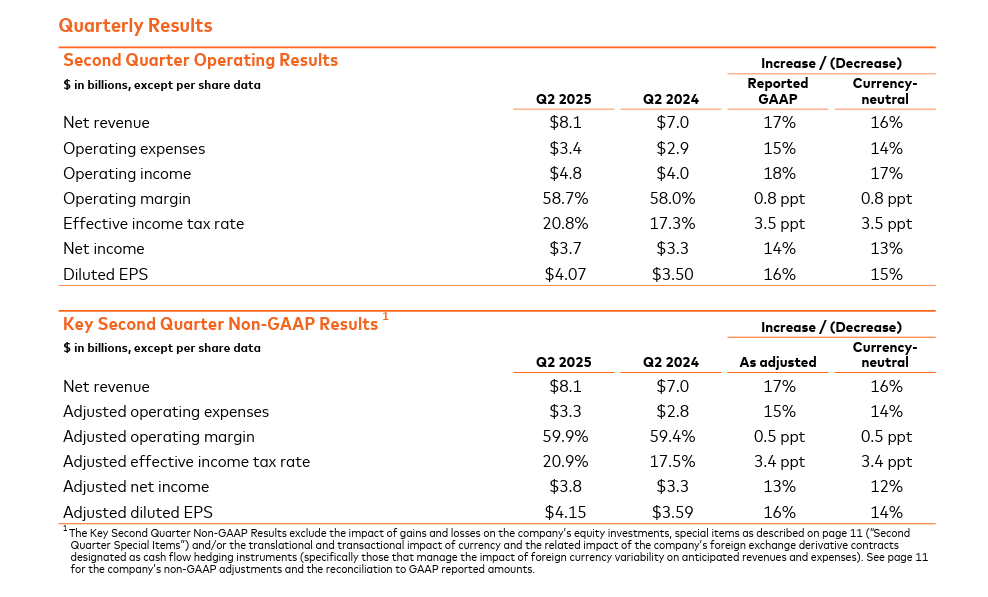

Mastercard reported a solid second quarter for 2025, with net income rising to $3.7 billion and diluted earnings per share reaching $4.07.

“Our momentum of deal wins continued this quarter, including the extension of our exclusive partnership with American Airlines,” said Michael Miebach, Mastercard CEO.

“Overall, the second quarter was another strong one for Mastercard, with net revenue growth of 17% year-over-year, or 16% on a currency-neutral basis. These results reinforce how our teams are executing every day and delivering value in every transaction and beyond. We're well positioned for the opportunities ahead and continue to drive new innovation like the Mastercard Collection and Mastercard Agent Pay.”

On an adjusted basis, net income was $3.8 billion and EPS was $4.15.

Net revenue grew 17% year-over-year to $8.1 billion, or 16% on a currency-neutral basis.

Visible Alpha had expected an adjusted EPS of $4.03 and net revenue of $7.97 billion.

Key volume metrics also improved, with gross dollar volume up 9% and purchase volume rising 10% in local currency terms.

These gains were supported by strong performance across the company’s payment network and value-added services.

The quarter saw cross-border volume grow 15% and switched transactions increase 10%.

Value-added services and solutions revenue jumped 23%, or 22% on a currency-neutral basis, driven by demand for digital authentication, security tools, and consumer engagement services.

Year-to-date, Mastercard has generated $15.4 billion in revenue, up 16% from the same period in 2024. Operating income reached $8.9 billion with a margin of 58.0%, and net income totalled $7.0 billion, with diluted EPS of $7.66.

Capital returns remain a priority. In Q2, Mastercard repurchased 4.2 million shares for $2.3 billion and paid $691 million in dividends. As of 28 July, $9.3 billion remained under the approved repurchase programs.

Mastercard’s adjusted operating expenses for the quarter were $3.3 billion, with an adjusted operating margin of 59.9%.

In the APMEA region, Q2 2024 data showed modest growth, with gross dollar volume at $573 million, purchase volume up 7% to $425 million, and cash volume rising 1.2% to $147 million. Purchase transactions increased by 10.3%.

Globally, Mastercard’s programs show consistent growth. Worldwide gross dollar volume reached $4.7 trillion, up 7.4%, and purchase volume rose 10% to $3.8 trillion. Cash volume increased 6.1%. Regional highlights included 9.2% GDV growth in Europe, 11.8% in Latin America, and 6.6% in the U.S. Credit and charge programs saw a 6.1% global GDV increase, while debit programs grew 8.6%, with strong uptake outside the U.S.

At the time of writing, Mastercard Inc (NYSE: MA) stock closed at $566.47, up $7.36 (1.32%) today. It has a market cap of around $514.38 billion.

All financials are in US dollars.