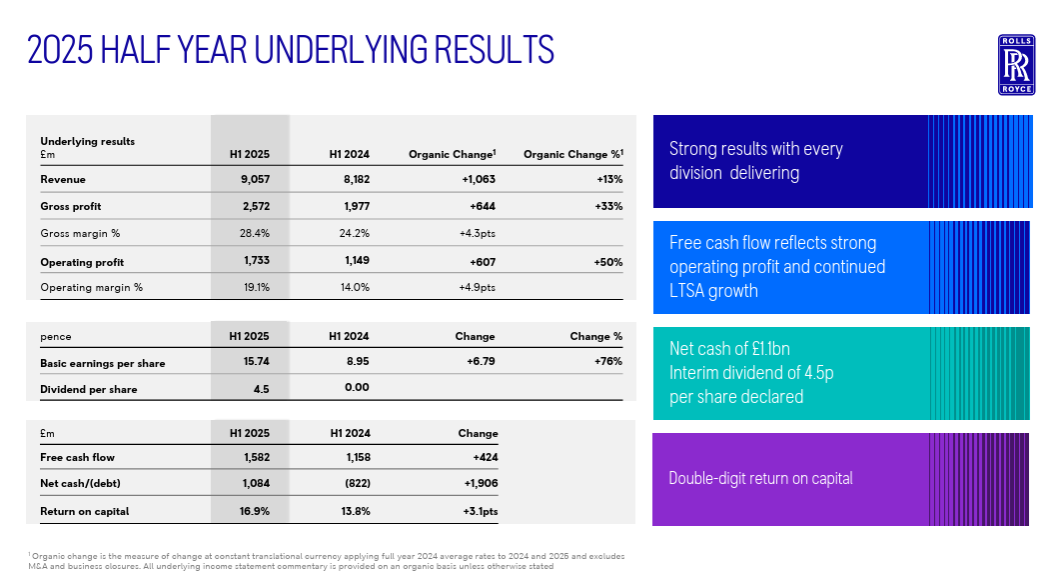

Rolls-Royce Holdings PLC turned in a solid first half of 2025, with profit growth and strong cash generation prompting an upward revision of its full-year outlook.

Underlying operating profit rose 50% from the prior year to £1.7 billion, reflecting a 19.1% margin. Free cash flow came in at £1.6 billion, backed by stronger earnings and an uptick in long-term service agreement balances.

The company now expects to deliver between £3.1 billion and £3.2 billion in operating profit and £3.0 billion to £3.1 billion in free cash flow at year-end. Net cash rose to £1.1 billion.

To reward investors, Rolls-Royce announced a 4.5p interim dividend and a £1 billion share buyback program, “far exceeding” its 3p forecast, according to analysts.

Group revenue increased to £9.49 billion, up from £8.86 billion in the same period last year.

Statutory operating profit reached £2.07 billion, with pre-tax earnings jumping to £4.84 billion, boosted in part by gains tied to the deconsolidation of its Rolls-Royce SMR unit.

Basic earnings per share more than tripled to 52.38p, compared to 13.71p a year earlier.

Return on capital improved to 16.9%, while the effective tax rate declined to 8.9%, down from 19.8%.

The Civil Aerospace division led the charge, generating £4.79 billion in revenue and £1.2 billion in operating profit — equating to a margin of 24.9%.

Power Systems saw its revenue climb 20% to £2.04 billion, with operating profit nearly doubled to £313 million.

Defence held steady with £2.22 billion in revenue and £342 million in profit.

Meanwhile, Rolls-Royce SMR was chosen as the sole supplier for the UK’s first small modular reactor program, which is projected to become profitable by 2030.

Management credited its ongoing transformation efforts for the gains.

Initiatives such as commercial optimisation, next-generation engine development, and cost efficiencies — amounting to £450 million since 2022 — continue to deliver impact.

Improvements to engine durability under the Time on the Wing program also contributed. Operational efficiency was further improved, as reflected in a TCC/GM ratio of 0.35x.

Looking ahead, Rolls-Royce remains confident about its trajectory.

Midterm targets for 2028 are unchanged: operating profit of £3.6–£3.9 billion and free cash flow of £4.2–£4.5 billion.

CEO Tufan Erginbilgic noted that these figures represent “milestones, not endpoints,” suggesting additional room for growth.

Erginbilgic said: "Our multi-year transformation continues to deliver. Our actions led to strong first-half-year results, despite the challenges of the supply chain and tariffs. We are continuing to expand the earnings and cash potential of Rolls-Royce.

"We expect Rolls-Royce SMR to be profitable and free cash flow positive by 2030. A strong start to the year gives us confidence to raise our guidance for 2025. We now expect to deliver underlying operating profit of £3.1 billion-£3.2 billion and free cash flow of £3.0 billion-£3.1 billion. This builds further conviction in our mid-term targets, which include underlying operating profit of £3.6 billion-£3.9 billion and free cash flow of £4.2 billion-£4.5 billion. We see these targets as a milestone, not a destination, with substantial growth prospects beyond the mid-term.”

Liquidity remains strong at £8.5 billion, with £6 billion in cash reserves set aside for reinvestment and shareholder returns.

At the time of writing, Rolls-Royce Holdings PLC (LON: RR) stock was trading at £1,060.00, up £72.00 (7.29%) today. It has a market cap of around £89.5 billion.

All financials are in British pounds.