Reddit's performance as a community-driven platform with expanding monetisation capabilities continued to be strong in the second quarter of 2025.

Daily Active Uniques (DAUq) rose 21% year-over-year to 110.4 million, with international users contributing significantly to the growth.

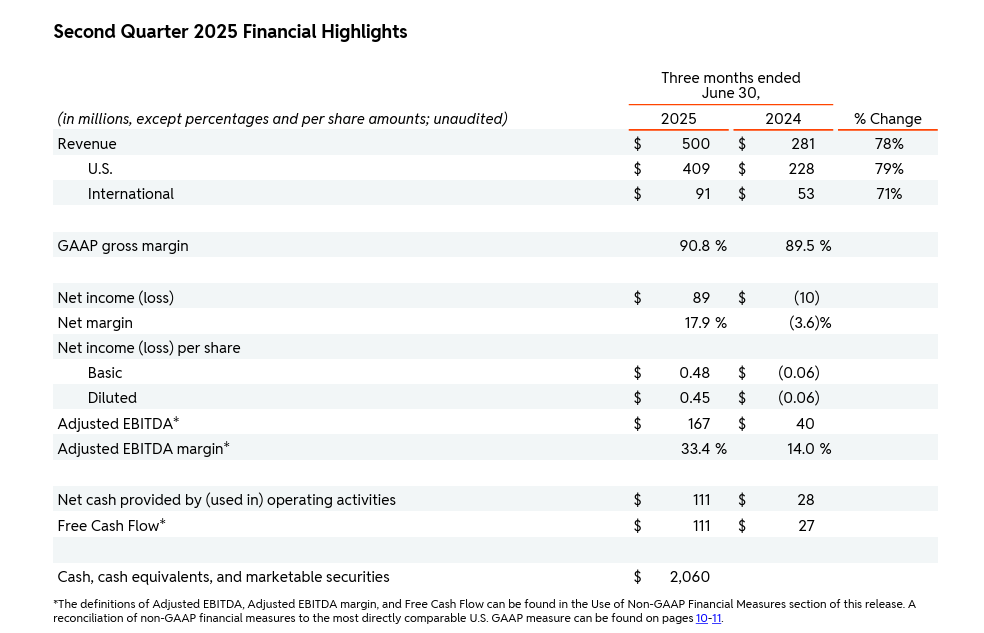

Total revenue surged 78% to $500 million, driven largely by advertising, which accounted for $465 million — an 84% increase from the prior year. Gross margin expanded to 90.8%, up 130 basis points, reflecting improved operational efficiency.

Net income reached $89 million, reversing a $10 million loss in the same period last year.

Adjusted EBITDA climbed to $167 million, representing 33% of revenue, while operating cash flow improved to $111 million, up $83 million year-on-year.

U.S. revenue totaled $409 million, a 79% increase, and international revenue rose 71% to $91 million.

Basic and diluted earnings per share were $0.48 and $0.45, respectively.

Free cash flow matched operating cash flow at $111 million, up $84 million from Q2 2024.

Looking ahead, Reddit issued optimistic guidance for the third quarter of 2025.

The company expects revenue between $535 million and $545 million, with adjusted EBITDA projected to range from $185 million to $195 million. The Bloomberg consensus estimate was $472.7 million for revenue and $159.5 million for adjusted EBITDA.

These targets reflect continued confidence in Reddit’s advertising ecosystem and its ability to scale across its global user base.

Founded on user-generated content and authentic dialogue, Reddit now supports over 100,000 active communities. With more than 110 million daily active visitors, the platform continues to position itself as a trusted space for real-time information, discussion, and discovery.

At the time of writing, Reddit Inc (NYSE: RDDT) stock closed at $160.59, up $11.26 (7.54%) today. In after-hours trading it was $188, up $27.41 (17.07%). It has a market cap of around $29.63 billion.

All financials are in U.S. dollars.