Welcome to our live blog coverage of earnings season!

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Walmart shares dive after disappointing results

- Guzman y Gomez shares trading lower than expected

- Airbus going strong, outperforming Boeing

_______________________________________________________________________________________

8:35 am (AEDT):

Hello everyone, Sienna Martyn here to take you through some earnings reports today. We have a lot of big companies coming through, such as QBE, Alibaba, Walmart, Booking.com, Guzman y Gomez and many more!

To kick us off, let's take a look at Walmart Inc (NYSE: WMT).

Shares in the company dived after the American retailer disappointed the market with profit and sales forecasts that were below expectations despite lifting fourth-quarter and full-year earnings.

Walmart earlier announced an 8.3% increase in operating income to $7.9 billion (A$12.5 billion) on revenue which grew 4.1% to $180.6 billion in the three months to 31 December 2024.

Earnings per share (EPS) dipped 4.4% to 65 cents on a reported basis but rose 10% to 66 cents on an adjusted basis in the final quarter of 2024. Over 2024 Walmart announced top-to-bottom increases with EPS up 26.2% to $2.41 and operating income 8.6% higher at $29.3 billion as revenue rose 5.1% to $681 billion.

“Looking ahead, the Company issues guidance for FY26 with net sales expected to grow 3% to 4% and adjusted operating income in constant currency to grow 3.5% to 5.5%, including a headwind of 150 basis points from the acquisition of VIZIO Holding Corp. and (a) lapping leap year,” Walmart said.

Analysts said these forecasts, which were below market estimates, suggested the toll that inflation was taking on shoppers was showing in Walmart’s performance.

Walmart Inc shares, which reached a new high of $105 last week after a strong rise in 2024, closed down $6.78 (6.52%) at US$97.21, giving it a market capitalisation of $780.93 billion.

Check out the full story here from Azzet's Garry West.

8:47 am (AEDT):

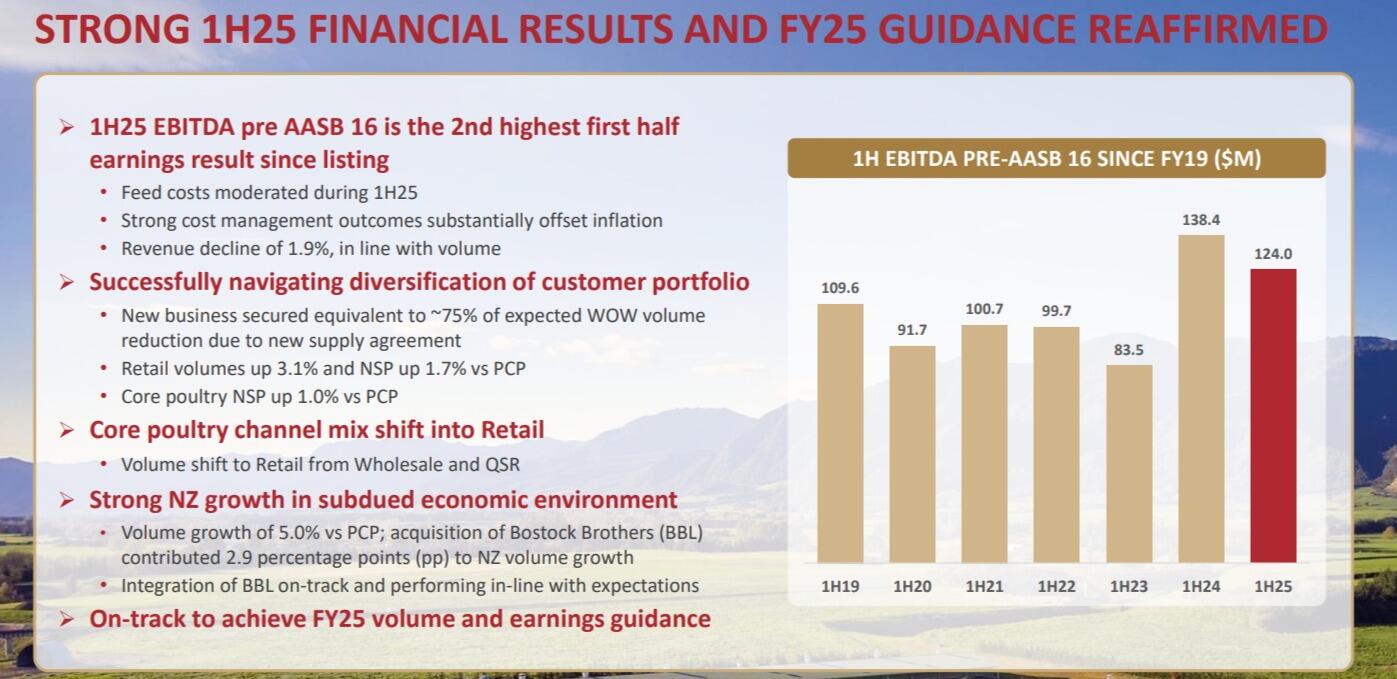

Poultry producer Inghams Group Limited (ASX: ING) reported a 19% decline in the first half of fiscal 2025 profit to A$51.1 million just missing market estimates as core poultry volumes declined in Australia, partly reflecting the company's transition to its new supply agreement with Woolworths.

According to analysts Inghams was expected to post a 16% fall in net profit to $53.15 million during the half, down from $63.40 million in the same period last year.

Core poultry volume in Australia declined 4.1% on PCP due to a temporary bird reduction.

Total costs within EBITDA declined 0.9% amounting to $12.4 million.

“We have made significant progress in covering the reduction in volume under the new Woolworths supply agreement, with new business in retail and QSR equivalent to approximately 75% of the volume reduction now secured and I remain confident of further progress in the coming months,” said Inghams’ CEO and Managing Director Andrew Reeves.

9:29 am (AEDT):

The Australian Securities Exchange is set to end the trading week on a positive note as index futures flag a higher opening, defying the trend of major United States stock indices which fell on Thursday (Friday AEDT).

At 9.05 am AEDT (10.05 pm GMT ) the S&P/ASX200 March share price index (SPI) contract was trading 16 points (0.19%) higher than the previous settlement at 8,304. A stronger start on the ASX would reverse the pattern of the first four days when the Australian benchmark index went backwards.

The profit reporting season continues today with results from Block, Guzman y Gomez, Inghams, Latitude, Michael Hill, Newmont and QBE Insurance, while Reserve Bank of Australia Governor Michele Bullock is to appear before a parliamentary committee, days after the central bank’s official interest rate cut.

Burrell Stockbroking wealth adviser Adam Dight said corporate results so far had been in line with better than forecast. “Almost all of the good companies and those the market would call blue chips have been fine to excellent,” he said.

“It’s those quiet companies that don’t say much during the year that have (fallen sharply)."

To gain more of a pre-market update, read Garry West's full story here!

9:37 am (AEDT):

Luxury car manufacturers Mercedes-Benz Group AG (ETR: MBG) posted group revenues of €38.5 billion for the fourth quarter, in line with consensus estimates.

While adjusted EBIT came in 10% above projections at €3.5 billion.

The company’s stronger performance was attributed to higher margins in the Cars division, which stood at 8.1% compared to the consensus of 7.8%.

Mercedes-Benz also benefited from a greater mix of high-end vehicle sales and consolidation effects.

The 2025 outlook however presents a mixed picture, while the guidance was largely in line with expectations, it also raised concerns about slowing momentum.

The car makers announced further cost-cutting and more petrol and diesel cars than EVs in its new product range, in a bid to revive margins as the company braces for a sharp drop in earnings in 2025.

At the time of writing, shares in Mercedes were trading at €59.63 (US$62.60) down 2.53% from the previous close. The company’s market capitalization is €88 million.

9:55 am (AEDT):

Global insurer QBE Insurance has announced a 31% increase in net profit after tax (NPAT) to US$1.779 billion (A$2.28 billion) for the 2024 financial year (FY24).

The company said revenue increased by 5% to $21.778 billion in the 12 months to 31 December 2024. QBE said adjusted net profit after tax surged 27% to $1.729 million, resulting in an adjusted return on equity of 18.2%.

The Board declared a final dividend of 63 Australian cents per share, 4.8 cents of which was franked, to be on 11 April to shareholders registered on 6 March.

This brings the full-year payment to 87 Australian cents per share. As for the outlook, QBE forecasts constant currency gross written premium percentage growth in 2025 in the mid-single digits, a combined operating ratio of about 92.5% and an “exit core fixed income yield” of 4.3%. C

EO Andrew Horton said he was pleased with QBE’s performance, which reflected its commitment to driving greater consistency and unlocking value by operating as a global enterprise.

“We beat our plan for the year, continue to demonstrate greater resilience and are excited about our prospects for the year ahead,” Horton said in an ASX announcement.

QBE (ASX: QBE) shares had closed on Thursday at $20.07, down 27 cents (1.13%) which implies a market capitalisation of $30.21 billion.

Thanks to Garry West for the full story here!

10:07 am (AEDT):

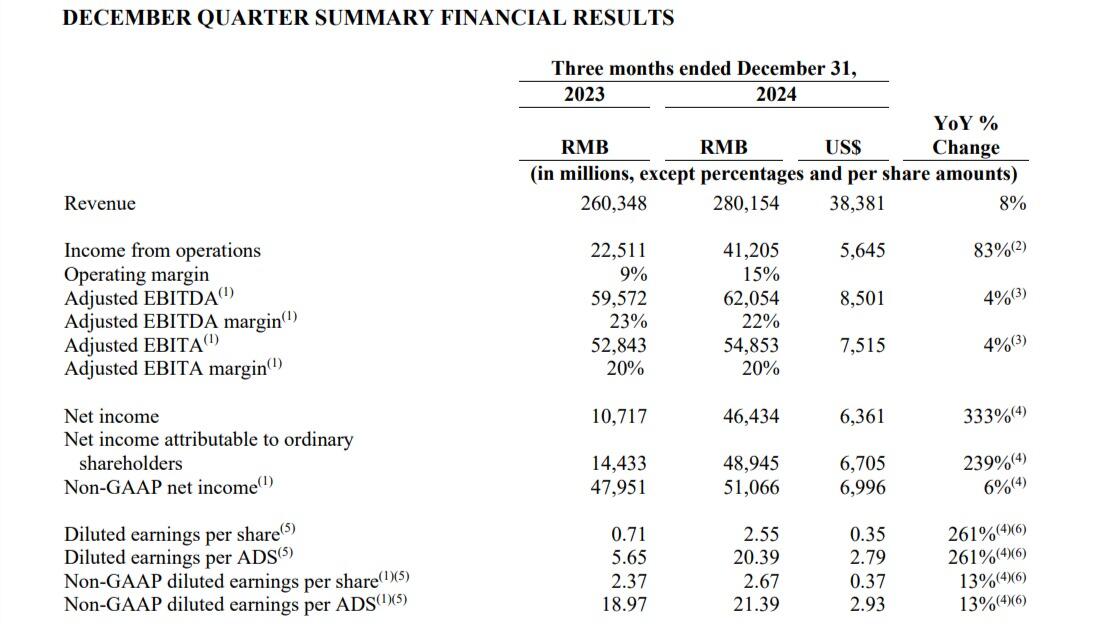

Alibaba Group Holding Ltd - ADR (NYSE: BABA) saw strong growth in revenue and income last quarter, particularly in its e-commerce and cloud divisions.

Its revenue was CN¥280.2 billion, rising 8% year-over-year and besting LSEG forecasts of ¥279.3 billion.

The company’s net income was CN¥48.9 billion, up 333% year-over-year and above analyst estimates of ¥40.6 billion. Non-GAAP diluted earnings per share were CN¥2.67, rising 13% from the prior year.

Its Taobao and Tmall division reported the highest revenue, growing 9% year-over-year to reach CN¥100.8 billion. Alibaba’s International Digital Commerce division posted the sharpest year-over-year revenue growth, increasing 32% to CN¥37.76 billion.

Alibaba’s Cloud Intelligence Group saw CN¥31.74 billion in revenue last quarter, a 13% increase. Revenue from its artificial intelligence products grew by triple digits year-over-year for the sixth consecutive quarter.

“Looking ahead, revenue growth at Cloud Intelligence Group driven by AI will continue to accelerate. We will continue to execute against our strategic priorities in e-commerce and cloud computing, including further investment to drive long-term growth,” said CEO Eddie Wu.

Alibaba’s NYSE-listed shares closed more than 8% higher at US$135.97 after the results were released.

Harlan Ockey has the full story.

11:10 am (AEDT):

Anglo-American slashed its dividend almost in half as writedowns of its ailing DeBeers diamond business hit the bottom line.

Yet non-core asset sales across its coal, platinum group metals and nickel operations will rake in US$5.2 billion for the further development of its "high priority" copper and iron ore streams.

Underlying EBITDA decreased by US$1.5 billion to US$8.5 billion, predominantly impacted by lower iron ore, PGM and steelmaking coal prices and challenging diamond market conditions.

It also chalked up a US$3.8 billion impairment - $US3.1 billion of which is the net loss of its ailing DeBeers diamond business which is now worth US$4 billion - and declared a dividend of 64c per share for ~US$800 million, down from 96c per share previously.

Looking ahead, 2025 guidance is set lower than 2024, reflecting expectations that its 50.1%-owned Los Bronces copper operation in Chile will not return to normal production levels until 2027.

That may change though, as on the same day the financials were released earlier this week, it announced a US$5 billion agreement with Chile’s state-run miner Codelco to implement a mine plan for both Los Blancos and the Andina mine.

Thanks, Cameron Drummond for the write-up! Check out the full story here!

11:20 am (AEDT):

Gold miner Ramelius Resources Ltd (ASX: RMS) reported that it has more than tripled (313%) its first-half profit after tax.

The company declared its maiden interim dividend of 3 cents per share, reflecting its strong financial performance, boosted by higher production at its flagship Mount Magnet mine in Western Australia.

Ramelius reported record high gold production of 147,775 ounces at an all-in sustaining cost (AISC) of A$1,699/oz along with record basic earnings per share (EPS) of 14.82 cents, up 287%.

As of 10:57 AEDT shares in Ramelius Resources were trading at $2.68, up 1.71% from yesterday’s close following the positive results.

11:45 am (AEDT):

Latitude Group Holdings Ltd (ASX: LFS) reported that revenue increased by 11.4% with a profit rise of 129.8%, boosting shareholder confidence.

FY24 statutory profit after tax was $30.6 million, up from a loss of $102.7m in FY23 while net profit came in at $21.6 million also recovering from a loss.

The financial services company reported profit from ordinary activities after tax attributable to members rose by 129.8% to $30.6 million.

The improvement was attributed to a 139% rise in Cash Net Profit After Tax (Cash NPAT) from continuing operations.

A final dividend of 3 cents per share and the reactivation of its Dividend Reinvestment Plan, reflect a positive outlook for fiscal 2025.

12:29 pm (AEDT):

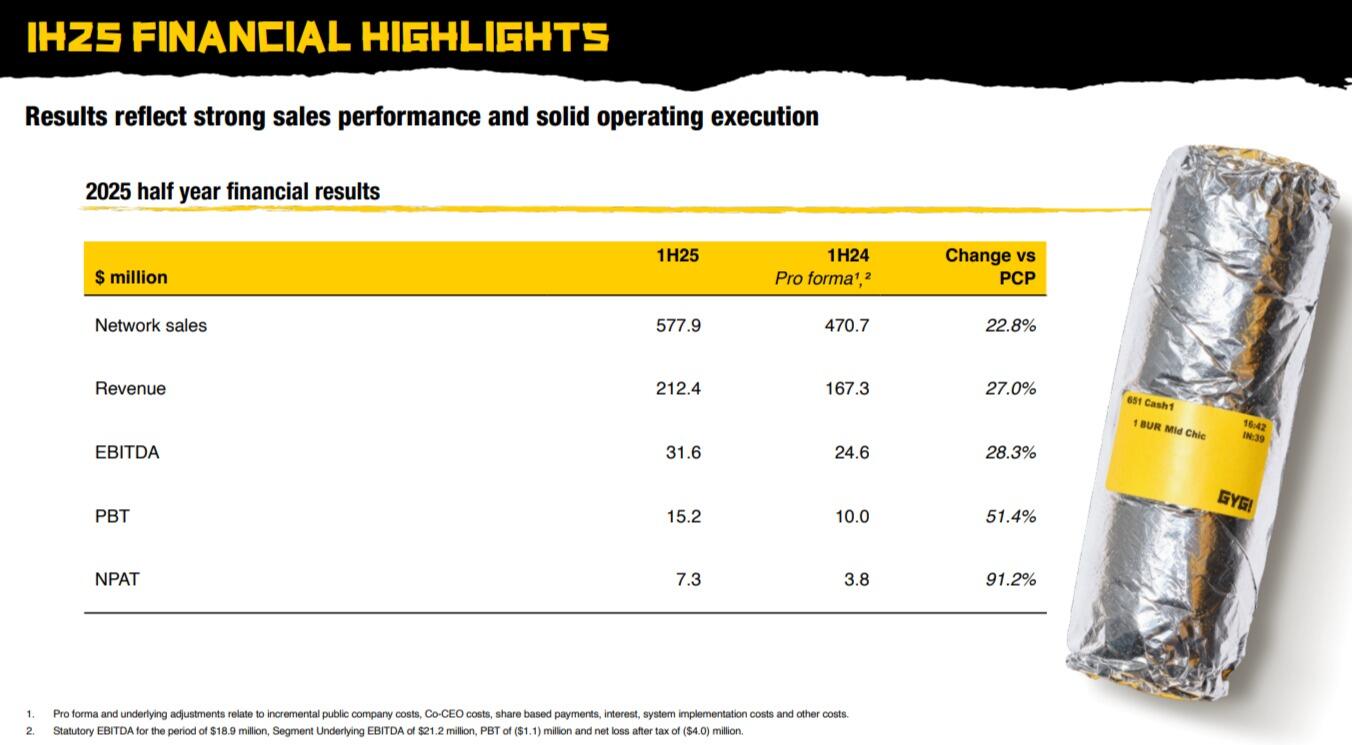

Shares in recently listed Guzman y Gomez (ASX: GYG) were trading around 10% lower at midday (AEDT), despite telling the market it was on track to beat its prospectus profit forecast for the year.

Strong sales and earnings growth in 1H FY25 saw the Mexican food chain post revenue of $212.5 million, which delivered an inaugural profit of $8.1 million compared with the $4.3 million loss posted in the previous period.

What the market clearly didn’t like was a slushy looking United States result that came in 25% down on market expectations.

The U.S. segment experienced a 12.7% decline in network sales to $4.9 million and corporate restaurant margins also decreased, due to additional investment in restaurant labour ahead of anticipated sales growth.

Mark has the full story here!

12:32 pm (AEDT):

Booking Holdings Inc. (NASDAQ: BKNG) reported Q4 earrings that surpassed market expectations with strong financial performance.

The accommodation booking company responsible for Booking.com posted an earnings per share (EPS) of $41.55, significantly beating the forecast of $36.13.

Revenue also was well above expectation reaching $5.47 billion against a projected $5.19 billion.

The company maintains impressive gross profit margins of 84.67% as room nights and gross bookings showed significant year-over-year growth.

The company also highlighted their strategic investments in AI and operational efficiencies.

"We are pleased to be reporting a strong finish to 2024, with full-year revenue increasing by 11% year-over-year while delivering faster profitability growth, as we continue to take a disciplined approach to managing our expenses," said Glenn Fogel, CEO of Booking Holdings.

“We remain highly focused on appropriately investing in our business for the long term, including by leveraging and deploying Generative AI technology to drive further value to our travellers and partners.”

12:45 pm (AEDT):

PWR Holdings Limited (ASX: PWH) has reported Net Profit After Tax (NPAT) of A$4.1 million for the last quarter, which came in above the November guidance range of $3.2 - $3.7 million.

PWR is a major supplier of cooling products for cars and in the quarter PWR saw strong growth in Aerospace and Defence, and continued momentum in Motorsports programs.

A&D revenue grew by 79% driven by an increasing number and scale of programs, while Motorsport revenue grew by 5% due to increasing demand for emerging technologies including micro matrix and cold plates.

“FY2025 is a pivotal transition year for PWR, marked by a significant investment to position the company for future growth,” said Founding shareholder and Managing Director, Kees Weel.

While this is our largest investment to date, the scale of the opportunity makes it both necessary and timely.”

Earnings per share for the quarter came in at 4.06 cents down 58.2% from the first half of 2024 at 9.74 cents.

1:09 pm (AEDT):

Airbus SE (EPA: AIR) announced a strong order intake across all divisions, further outperforming troubled competitor Boeing.

The company delivered 766 commercial aircraft in 2024 after a concerted end-of-year effort, compared to 735 in 2023.

Gross commercial aircraft orders for 2024 totalled 878, with net orders of 826 after cancellations.

Revenues totalled €69.23 billion in 2024, up from €65.45 billion in the previous year.

EBIT came in at €5.35 billion, an 8% drop from 2023's total of €5.84 billion.

"FY2024 results are a testament to Airbus' leadership maintaining an acute focus on the fundamentals," said Anita Mendiratta, aviation and tourism expert.

"The strong order intake across all divisions signifies sustained market confidence – critical in 2024 when, for the first full year since the end of the global pandemic, trade was able to not only recover but grow to a rate of surge," she said.

At the time of writing Airbus stocks were trading at €165.08 down 2.27% from yesterday’s close.

And that's all from me today folks, have a great afternoon with Frankie Reid!

1:30 pm (AEDT):

Good afternoon, Frankie Reid here taking over from the excellent coverage Sienna has provided so far!

Steering us back to local waters, Spark New Zealand (SPK: ASX) today reported a massive 78% fall to its net profit, and cut back guidance.

The telecommunications company cited “a recessionary environment” for the profit plummet.

Spark's guidance for earnings before interest, taxes, depreciation, and amortisation (EBITDAI) were reduced from a range of $1.12 - $1.18 billion to $1.04 - $1.10b, falling below analysts’ expectations

2:10 pm (AEDT):

Genesis Energy (NYSE: GEL) saw a strong result, with half-yearly profits almost doubling.

This was lead by the rise in both consumer and wholesale prices for its coal and gas electricity last winter, and the increased value of its hedging contracts.

It also maintained its guidance forecast of full year operating earnings of $460 million.

2:30 pm (AEDT):

Block Inc (ASX: XYC), known for Afterpay, CashApp, saw a Q4 performance that fell below analysists expectations, but tapped out an operating profit of US$13 million (A$20.6 million) versus a loss of $131 million in the last quarter of 2023.

Block, which provides payment services such as point-of-sale systems, posted $2.31 billion in gross profit, a 14% increase from $2.03 billion a year ago.

The company, said adjusted operating profit increased 17% to $402 million and gross profit grew 14% to $2.31 billion in the three months to 31 December 2024.

It also set gross profit growth expectations for 2025 at 15% and adjusted operating income of $2.1 billion for a margin of 21%.

Garry West with the full story.

3:05 pm (AEDT):

Mining company Anglo American (LON: AAL) announced plans to sell its Brazilian nickel operations to MMG Singapore, alongside its full year results for 2024.

An upfront payment of US$350 million, a potential price-linked earnout up to $100 million and a further $50 million, dependent on a final investment decision for the development projects, all make up the total purchase price.

The transaction still has to face regulatory and competition approvals, with completion expected by Q3 2025.

More from Cameron Drummond here

3:25 pm (AEDT):

Back on home soil Telix Pharmaceutricals (ASX: TLX) had a very strong full year report, and confident 2025 updated guidance.

The biopharmaceutical company saw a 56% increase in revenue up by A$783.2 million, mostly driven by sales of radioactive diagnostic agent Illuccix.

This was Telix's second year of profitable growth and their 2025 guidance was adjusted accordingly, up to $1.23 billion.

“2024 has been an extraordinary year for Telix.” Group CEO, Dr. Christian Behrenbruch said.

"We see 2025 as a year of significant growth and evolution for Telix in terms of international business, multiple product launches and the integration of key infrastructure that will further deliver on our mission to ensure global patient access.”

3:40 pm (AEDT):

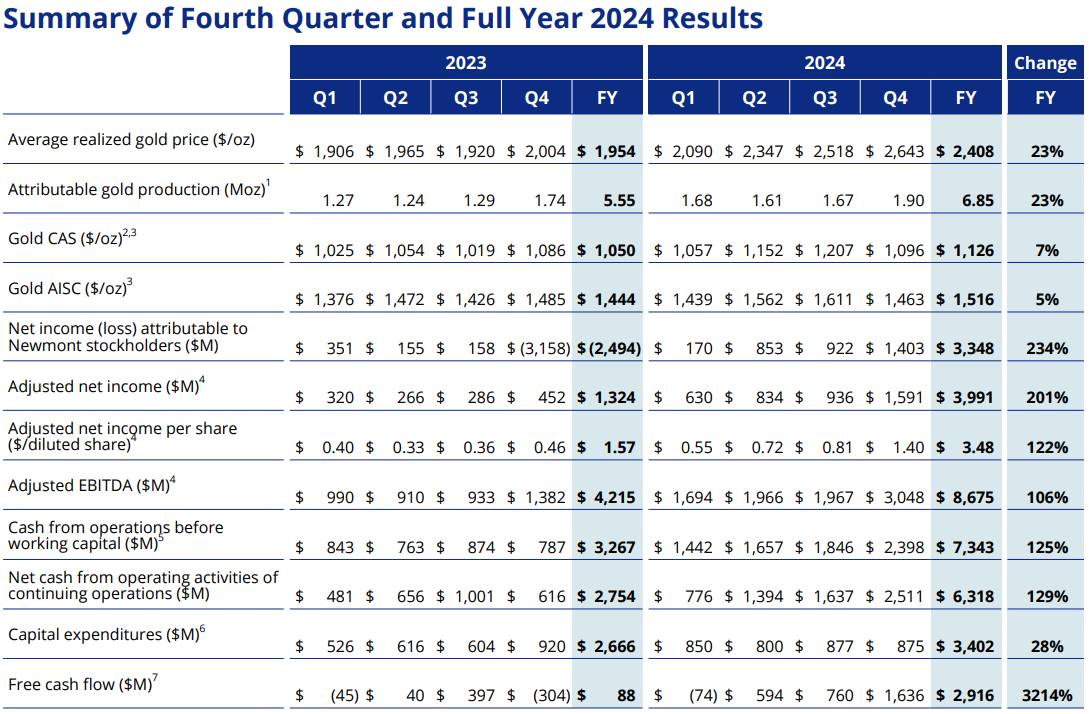

Sticking with the ASX, Newmont Corp (NEM) beat out analysists estimates for Q4, reporting quarterly earnings of $1.40 per share

Zacks Consensus estimated a lower result of $0.95 EPS, and this marks the third time over the last four quarters that the company has surpassed consensus EPS estimates.

Revenue also surpassed expectations, coming in at $5.65 billion for Q4, surpassing the Zacks Consensus Estimate by 15.80%.

That's all from me today, thank you to Sienna for carrying us along earlier, and we'll see you next week for more earnings updates!