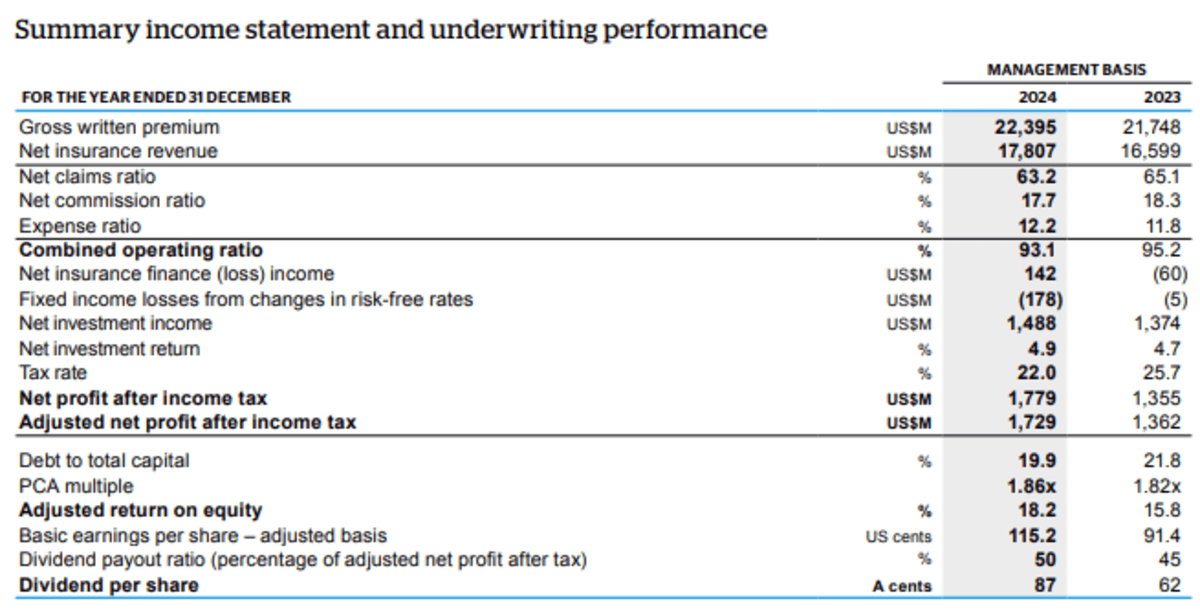

Global insurer QBE Insurance has announced a 31% increase in net profit after tax (NPAT) to US$1.78 billion (A$2.28 billion) for the 2024 financial year (FY24).

The Australian company, which offers coverage for businesses, individuals and institutions including property, casualty, health, and life insurance, said revenue increased by 5% to $21.78 billion in the 12 months to 31 December 2024.

QBE said adjusted net profit after tax surged 27% to $1.73 million, resulting in an adjusted return on equity of 18.2%.

Gross written premium growth of 3% tracked in line with expectations and was supported by group-wide renewal rate increases of 5.5% and new business growth.

The combined operating ratio improved to 93.1% ahead of the plan for the year, and was supported by a favourable catastrophe experience and more stable central estimate reserve development.

The strong investment performance continued, with total investment income rising 4.5% to $1.49 billion, equating to a return of 4.9%.

The board declared a final dividend of 63 Australian cents per share, 4.8 cents of which were franked, to be paid on 11 April to shareholders registered on 6 March. This brings the full-year payment to 87 Australian cents per share.

As for the outlook, QBE forecast constant currency gross written premium percentage growth in 2025 in the mid‑single digits, a combined operating ratio of about 92.5% and an “exit core fixed income yield” of 4.3%.

CEO Andrew Horton said he was pleased with QBE’s performance, which reflected its commitment to driving greater consistency and unlocking value by operating as a global enterprise.

“We beat our plan for the year, continue to demonstrate greater resilience and are excited about our prospects for the year ahead,” Horton said in an ASX announcement.

QBE (ASX: QBE) shares closed on Thursday at $20.07, down 27 cents (1.13%), implying a market capitalisation of $30.21 billion.