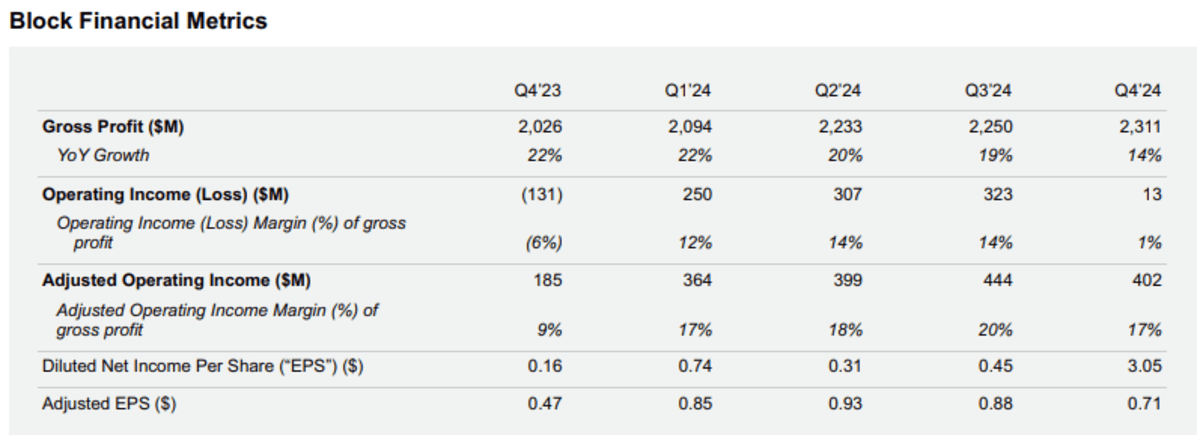

Financial services company Block Inc turned around its performance in the fourth quarter of the 2024 financial year (Q4 FY24), tapping out an operating profit of US$13 million (A$20.6 million) versus a loss of $131 million in the last quarter of 2023.

Block, which provides payment services including point-of-sale systems, said adjusted operating profit increased 17% to $402 million and gross profit grew 14% to $2.31 billion in the three months to 31 December 2024.

The company, formerly known as Square, said diluted earnings (net income) per share (EPS) was $3.05 compared with 16 cents, while adjusted EPS rose 51% to 71 cents, in Q4.

For the 2024 year, net profit after tax was $2.897 billion, compared with a loss of $9.772 million in 2023. Gross profit increased 18.4% to $8.889 billion while net revenue rose 10% to $24.121 billion.

Block is best known in Australia for buying Australian "buy now, pay later" company Afterpay in 2021 for A$29 billion in an all-stock transaction, making billionaires of founders Nick Molnar and Anthony Eisen.

In February 2025, Block began integrating Afterpay with its Cash App Card, enabling eligible customers to retroactively pay over time for their purchases.

Block said profitability increased year-over-year across all key measures and outperformed guidance in the fourth quarter of 2024.

“For 2025, we expect strong gross profit growth of at least 15% year over year. Growth for Cash App and Square is expected to improve meaningfully in the back half of the year,” the company said in ASX announcement.

E&P analyst Paul Mason said Q4 results were in line with, or ahead of, consensus. FY25 guidance was consistent with prior comments and consensus for gross profit and slightly ahead of operating income, but Q1 FY25 guidance was a little lower.

By 1:35 pm AEDT (2:35 am GMT) Block Securities (ASX: XYC) had fallen $9.62 (7.30%) to A$122.21, capitalising the company at US$57.61 billion.