Shares in Walmart dived after the American retailer disappointed the market with profit and sales forecasts that were below expectations despite lifting fourth quarter (Q4) and full year sales and earnings.

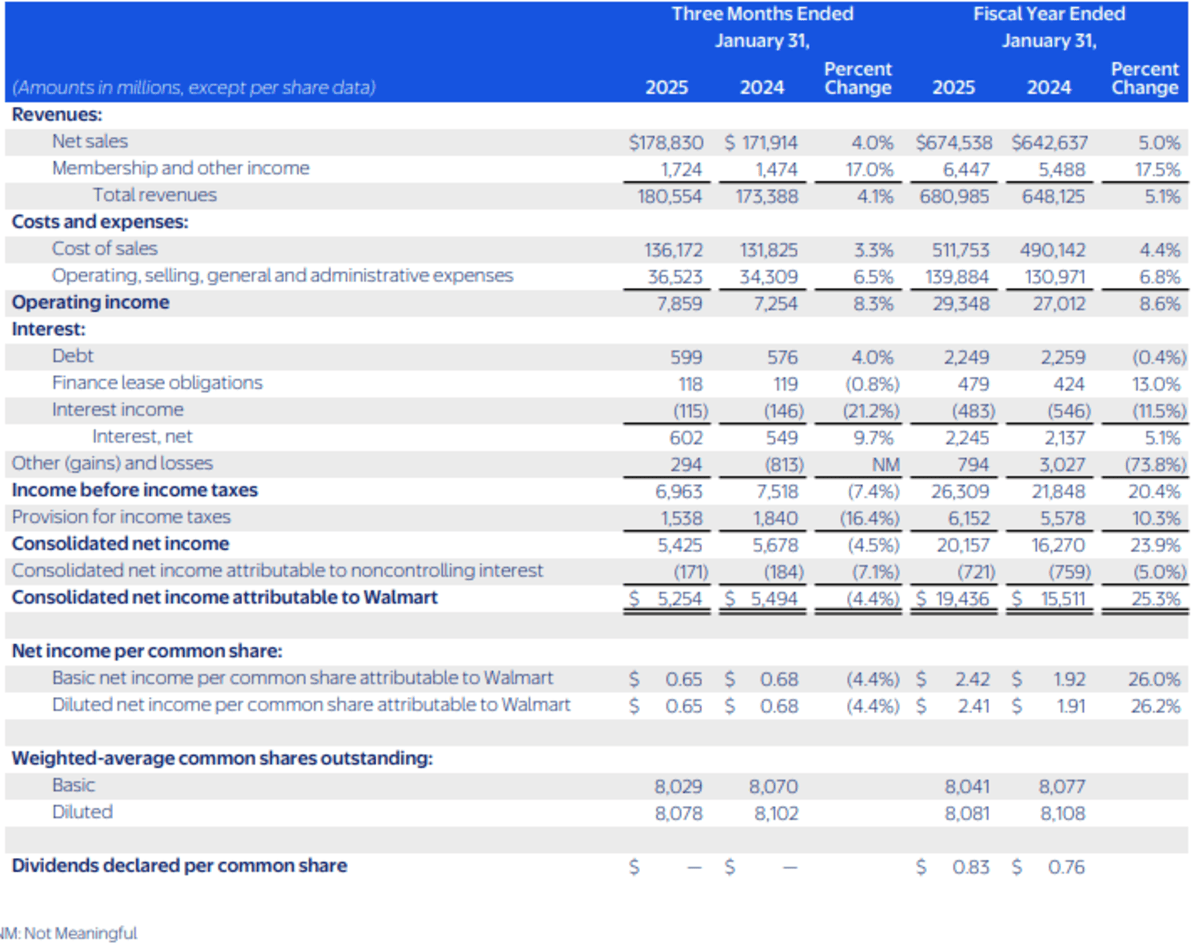

Walmart earlier announced an 8.3% increase in operating income to $7.9 billion (A$12.5 billion) on revenue which grew 4.1% to $180.6 billion in the three months to 31 December 2024.

Earnings per share (EPS) dipped 4.4% to 65 cents on a reported basis but rose 10% to 66 cents on an adjusted basis in the final quarter of 2024.

Over 2024 Walmart announced top-to-bottom increases with EPS up 26.2% to $2.41 and operating income 8.6% higher at $29.3 billion as revenue rose 5.1% to $681 billion.

The full-year dividend rose 13% to 94 cents per share, the largest increase in more than a decade.

President and CEO Doug McMillon said Walmart finished the year with another quarter of strong results with momentum driven by low prices, a growing product range and an eCommerce business driven by faster delivery times.

“We’re gaining market share, our top line is healthy, and we’re in great shape with inventory,” McMillon said in a statement.

He said Walmart would remain focused on growth, improving operating margins and strengthening the return on investments to serve customers and members better.

“Looking ahead, the Company issues guidance for FY26 with net sales expected to grow 3% to 4% and adjusted operating income in constant currency to grow 3.5% to 5.5%, including a headwind of 150 basis points from the acquisition of VIZIO Holding Corp. and (a) lapping leap year,” Walmart said.

Analysts said these forecasts, which were below market estimates, suggested inflation was taking a toll on shoppers, showing in Walmart’s performance.

Walmart Inc shares (NYSE: WMT) shares, which reached a new high of $105 last week after a strong rise in 2024, closed down $6.78 (6.52%) at US$97.21, giving it a market capitalisation of $780.93 billion.