Uber Technologies shares fell after it reported profits for the third quarter of the 2025 financial year (Q3 FY25) and forecasts that were below expectations.

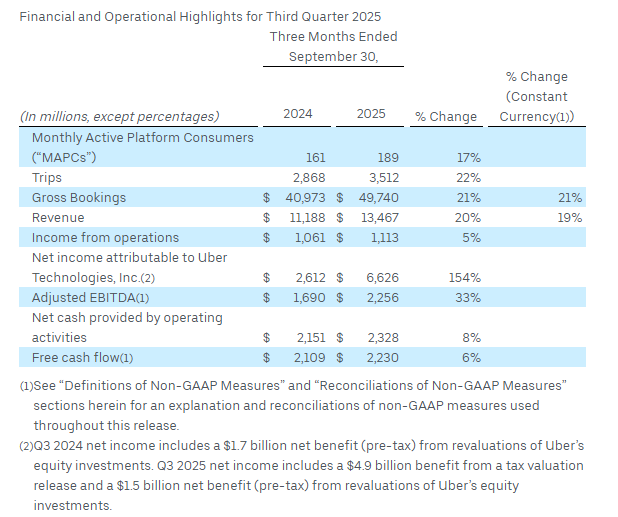

The ride share and transport company said net income soared 154% to US$6.626 billion (A$10.19 billion) in the three months ended 30 September on revenue which grew 20% to $13.467 billion and gross bookings which increased 21% to $49.7 billion compared with the previous corresponding period (pcp).

However, net income included a $4.9 billion benefit from a tax valuation release.

Adjusted earnings before interest, tax, depreciation and amortisation (EBITDA) jumped 33% to $2.3 billion, and income from operations grew 5% to $1.1 billion.

Uber forecast adjusted EBITDA of $2.41 billion to $2.51 billion, representing growth of 31% to 36% compared with the pcp.

Chief Executive Officer Dara Khosrowshahi said the company reported one of the largest trip-volume increases in its history.

“We delivered another impressive quarter on both the top and bottom lines, with accelerating growth and record profitability,” Chief Financial Officer Prashanth Mahendra-Rajah said in a press release.

“This consistent execution positions us very well to invest in the many accretive growth opportunities ahead, while maintaining our commitment to returning capital to shareholders.”

However, the shares fell as income from operations and the Q4 forecast were below estimates based on Visible Alpha data.

Uber shares (NYSE: UBER) closed $5.04 (5.05%) lower at $94.68 on Tuesday (Wednesday AEDT), capitalising the company at $197.26 billion.