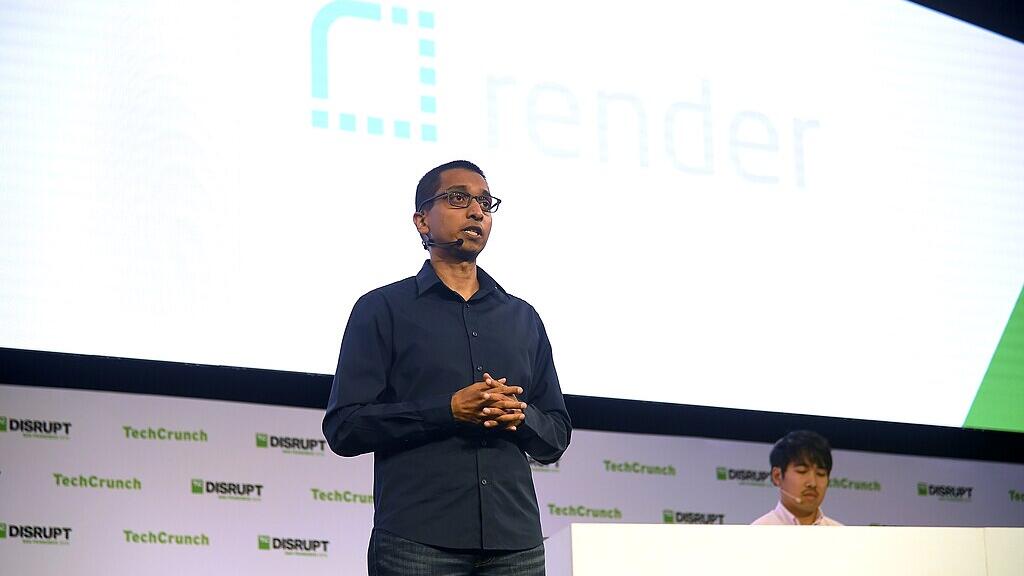

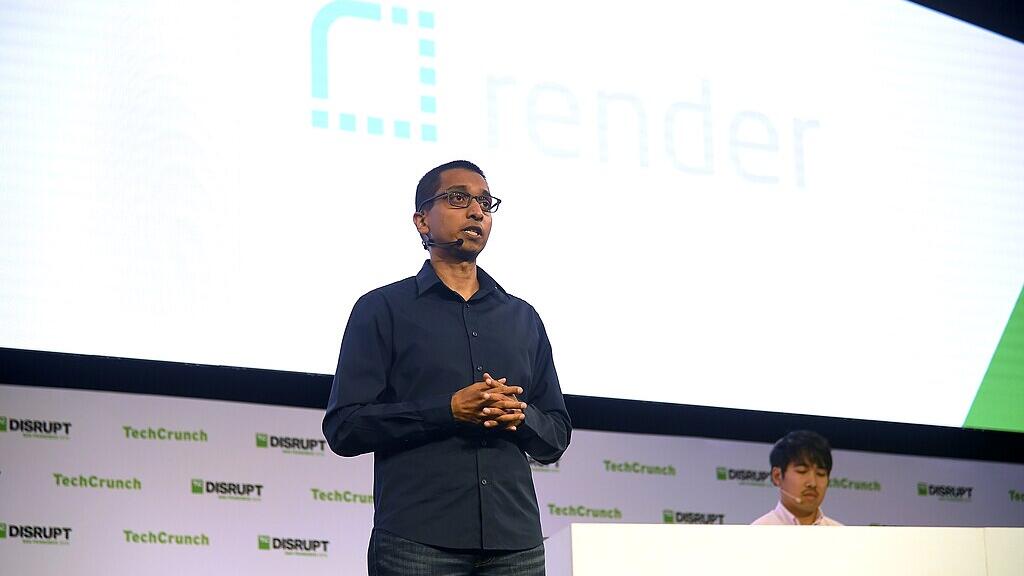

Render raises funding at US$1.5bn valuation

Cloud startup Render has raised US$100 million at a $1.5 billion valuation. The company is benefitting from the people asking AI models to write software for them, and seeking advice on where to run new programs in a cloud computing world dominated by Amazon, OpenAI, Microsoft, Alphabet and Nvidia. Render’s co-founder and CEO, Anurag Goel, told CNBC that the company’s revenue growth is well over 100%, and more than 4.5 million developers use its tools. Goel also said that the company has benefited from a generational shift in how developers choose cloud developers. “Hyperscalers are no longer the default for teams that want to move fast. AI-assisted coding means developers can build faster than ever, and they need a cloud that can keep up. That's what Render delivers,” Goel said in a media release. Render was founded in 2018 and is San Francisco-based with around 100 employees. Investors include 01A, Addition, Bessemer Venture Partners, General Catalyst and Georgian Partners. With the new capital, Render will hire additional technical staff members to build features. The cloud startup runs its software on Amazon Web Services and Google Cloud Platform but is testing the use of its own servers. Expanding the