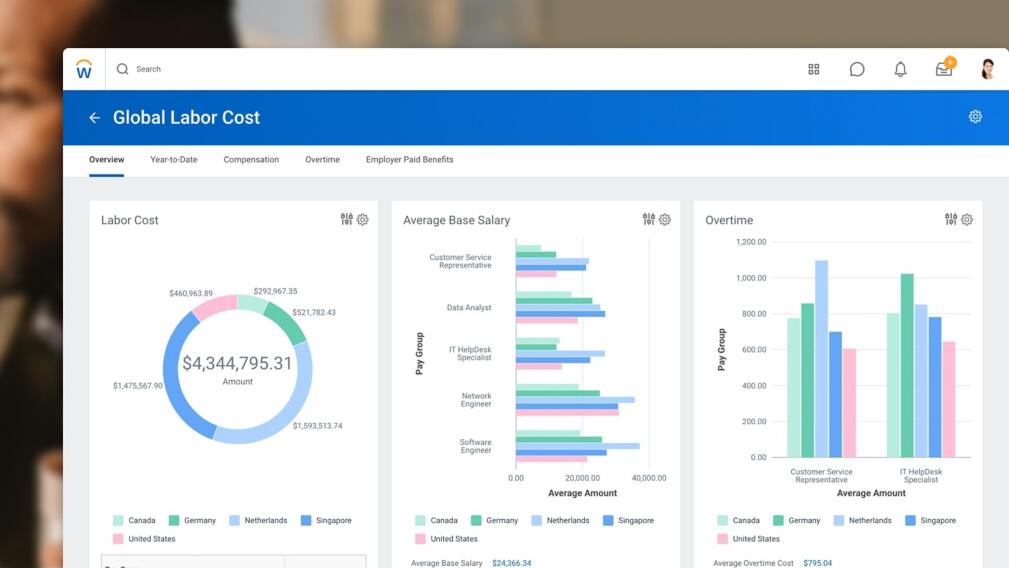

Software company Workday beat earnings estimates last quarter, but shares fell by 7.9% after it issued weaker-than-expected full-year guidance.

Earnings per share were US$2.32, rising from $1.89 year-over-year and passing LSEG estimates of $2.18. Revenue was $2.43 billion, up 13% year-over-year and just above estimates of $2.42 billion.

“Workday delivered another solid quarter, fueled by the strength and diversity of our business and the momentum we're seeing across our AI portfolio," said Workday CEO Carl Eschenbach. "By unifying people, money, and AI agents on one trusted platform, we're giving customers a real edge — helping them empower their people, simplify how work gets done, and drive results that truly matter.”

“Our Q3 results were driven by continued progress across several key growth initiatives, as we accelerate innovation across the platform and bring exciting AI solutions to market,” said Workday CFO Zane Rowe.

Its guidance projects subscription revenue of $8.828 billion across the fiscal year ending on 31 January. While its latest full-year outlook includes the impact of new contracts with the United States Defense Intelligence Agency, it was raised by just $13 million from August.

Next quarter, it expects $2.355 billion in subscription revenue, in line with StreetAccount estimates of $2.35 billion.

Subscription revenue last quarter was $2.24 billion, also matching estimates and up 14.6% year-over-year. Its 12-month subscription revenue backlog grew by 17.6% to $8.21 billion.

Operating income was $259 million, increasing from $165 million the previous year.

Workday’s (NASDAQ: WDAY) share price closed at $215.34, dropping 7.9% from its previous close at $233.69. Its market capitalisation is $55.76 billion.

Related content