Re-live today's live blog coverage of earnings season.

This is the time of year when publicly traded companies report their financial results, giving investors and analysts a glimpse into their performance and future outlook. We'll bring you real-time updates, analysis, and commentary on the latest earnings reports from major companies across various sectors. Stay tuned as we break down the numbers, highlight surprises, and provide insights into what these results mean for the market.

______________________________________________________________________________________

Summary

- Uber grows 14% but misses revenue expectations

- New York Times digital-only subscriber base grows

- Disney reports a 15% rise in revenue

- ANZ cash profit remains flat

- Arm, AppLovin, MercadoLibre, Cencora beat revenue estimates

_______________________________________________________________________________________

8:50 am (AEST):

Good morning and welcome to today’s live earnings blog! It’s Chloe Jaenicke here to take you through it.

Starting off, Uber (NYSE: UBER) has had a strong start to 2025, reporting 14% growth over the year in gross bookings to US$42.8 billion.

Despite this, the company missed the mark of Zacks Consensus Estimate of $11.6 billion, reporting revenue of $11.5 billion.

Uber CEO Dara Khrosrowshahi said the company experienced growth in trip volumes thanks to its focus on operational efficiency and consumer engagement.

“We kicked off the year with yet another quarter of profitable growth at scale, with trips up 18% and even stronger user retention,” Khosrowshah said.

“Supported by the consistent strength of our core business, we continue to build towards the future, including five new autonomous vehicle announcements in just the last week.”

Andrew Banks has the full story.

9:06 am (AEST):

Staying on the NYSE, The New York Times Company (NYT) reported strong first-quarter earnings for 2025, with its digital-only subscription base growing to 11.06 million.

The company also experienced strong revenue growth, driven by strength in digital subscription and advertising with a total rise of 7.1% year-on-year to US$635.9 million. Digital-only subscription saw a larger increase of 14.4% to $335 million.

While digital advertising grew 12.4% to $70.9 million, print advertising continues to decline, falling 8.5% to $37.2.

The New York Times Company CEO Meredith Kopit Levien said the company had a strong start to the year and is confident it will continue to grow and become more profitable.

“Our strategy is working and our business is growing and demonstrating resilience amidst the current economic and geopolitical uncertainty,” Levien said.

“We have a diverse portfolio of world-class news coverage and leading lifestyle products; multiple, complementary revenue lines across subscriptions, advertising, affiliate and licensing; and a model that generates significant free cash flow and a strong balance sheet.”

Andrew Banks has the full story.

9:10 am (AEST):

Global entertainment giant Walt Disney Company (NYSE: DIS) has reported a 15% increase in operating income for the second quarter of the 2025 financial year (Q2 FY25).

The 102-year American company said segment operating income increased to US$4.436 billion (A$6.93 billion) in the three months to 31 March 2025 from $3.845 billion in the previous corresponding period on revenue which rose 7% to $23.6 billion.

Diluted earnings per share (EPS) improved to $1.81 from a loss of $0.01 in Q2 FY24 while adjusted EPS, which excludes some items, rose 20% to $1.45, beating analysts' consensus expectations of $1.20.

For the first half of FY25, operating income jumped 23% to $9.496 billion and EPS surged to $3.21 from $1.03 as revenue grew 6% to $48.311 billion.

Chief Executive Officer Robert Iger said the outstanding performance in the second quarter, including adjusted EPS growth of 20% driven by its Entertainment and Experiences businesses, underscored the company’s continued success.

He said Disney had a lot more to look forward to including its upcoming “theatrical slate”, the launch of ESPN’s new direct-to-consumer offering, and an unprecedented number of expansion projects in Experiences.

“Overall, we remain optimistic about the direction of the company and our outlook for the remainder of the fiscal year,” Iger said in a press release.

The company, which opened its Disneyland theme park in California in 1955, also announced it would open a theme park in Abu Dhabi, adding it to a portfolio which also includes film studios, television networks, and resorts and streaming services.

Thank you Garry West for the write up, the full story is here.

9:27 am (AEST):

Moving over the NASDAQ, chipmaker Arm (ARM) has posted major increases in revenue and earnings per share but issued lower-than-expected guidance.

Revenue rose 34% year-over-year to US$1.24 billion, surpassing the LSEG estimate of $1.23 billion. Non-GAAP diluted earnings per share were $0.55, up from $0.36 the same time last year.

Arm CEO Rene Haas and CFO Jason Child said this is the first time the company has passed the $1 billion mark in revenue.

“We achieved record licensing revenue and, in a clear signal that we are increasing royalty per chip, delivered record royalty revenue exceeding $600 million,” they wrote in a letter to shareholders.

“In addition, full year revenue for FYE25 exceeded $4 billion and royalty revenue exceeded $2 billion for the first time.”

Harlan Ockey has the full story.

9:47 am (AEST):

Danish pharmaceutical company, Novo Nordisk (CPH: NOVO-B) reported strong revenue growth that closely aligned with market expectations.

The company's revenue grew 19% to DKK 78.1 billion from last year’s DKK 65.3 billion.

Its operating profit also surged 22% in Danish kroner and 20% at constant exchange rates to DKK 38.8 billion.

Despite the overall growth, Novo Nordisk CEO and president Lars Fruergaard Jørgensen said the company has reduced its full-year outlook.

“We have reduced our full-year outlook due to lower-than-planned branded GLP-1 penetration, which is impacted by the rapid expansion of compounding in the US,” Jørgensen said.

“We are actively focused on preventing unlawful and unsafe compounding and on efforts to expand patient access to our GLP-1 treatments.”

10:00 am (AEST):

The Australia and New Zealand Banking Group (ASX: ANZ) has reported a flat cash profit for the first half of the 2025 financial year (H1 FY25).

ANZ said cash profit in the six months ended 31 March, which strips out non-core items, was unchanged on the previous corresponding period at $3.568 billion (US$2.28 billion).

The bank said statutory profit after tax rose 7% to $3.642 billion on operating income which gained 10% to $11.179 billion but the net interest margin was also unchanged at 1.56%.

Directors proposed a 70% franked interim dividend of 83 cents per share to be paid on 1 July to shareholders registered on 14 May, unchanged from the payment a year earlier.

“Our strong performance has again been driven by our continued momentum across each of our divisions, demonstrating the benefits of a stable, consistent strategy combined with sensible, targeted investment,” retiring Chief Executive Officer Shayne Elliott said in a news release.

Thank you Garry West for the write up, the full story is here.

10:57 am (AEST):

On the ASX, Orica (ORI) reported earnings increases across all regions thanks to strong customer demand, increased contributions from advanced technology offers and continued commercial discipline.

Net profit was up 40% from the same time last year to A$250.8 million.

Earnings per share were also up by 12.7 cents, growing 33% to 51.5 cents.

Orica managing director and CEO Sanjeev Gandhi said the company has delivered strong results and is well-positioned to navigate current geopolitical uncertainties.

“Despite trade uncertainties and geopolitical risks, our strong performance highlights our resilience and ability to adapt and optimise, with our global manufacturing and supply chain network being a significant competitive advantage,” Gandhi said in the ASX announcement.

“We are confident in sustaining this positive momentum supported by the strength of our business, demand for Orica’s premium products and innovative technology solutions and unique competitive advantages, while remaining vigilant given ongoing geopolitical uncertainty.”

11:15 am (AEST):

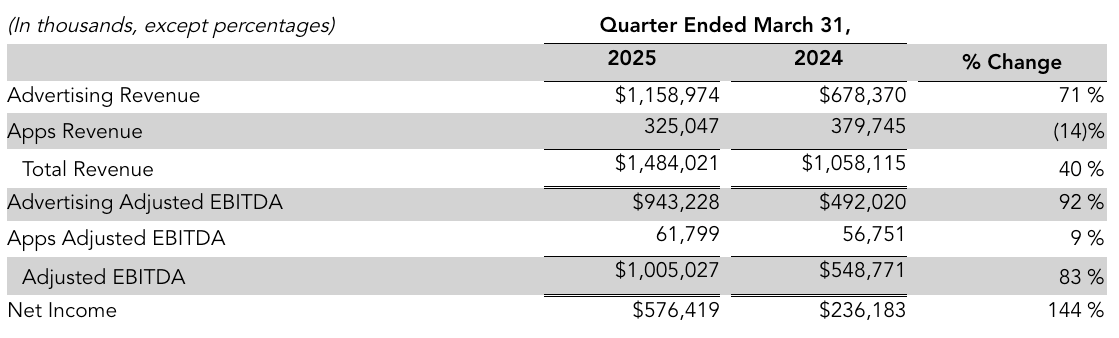

Mobile technology company, AppLovin (NASDAQ: APP) reported strong earnings in Q1 2025.

The company’s revenue grew by 40% from US$1.05 billion to $1.48 billion while also beating the LSEG consensus estimate of $1.38 billion.

AppLovin also beat expectations for earnings per share, reporting $1.67 instead of the expected $1.45.

11:30 am (AEST):

E-commerce and fintech company MercadoLibre (NASDAQ: MELI) said it started the year with strong momentum in a letter to shareholders.

Its revenue rose 37% year-on-year to US$5.9 billion, surpassing the Zacks Consensus Estimate of $5.53 billion.

The company also beat the consensus estimate of $7.67 earnings per share, reporting net income of $9.74 per share.

MercadoLibre experienced strong growth in Brazil, Mexico and Argentina.

11:52 am (AEST)

Thanks, Chloe! Harlan Ockey here for the next hour.

Moving to the NYSE, Flutter Entertainment (NYSE: FLUT, LSE: FLTR) slipped below estimates on revenue and earnings per share, and has revised its guidance.

Flutter, parent company to FanDuel and Sportsbet, saw revenue of US$3.67 billion last quarter. While this is a year-over-year increase of 8%, it missed LSEG estimates of $3.84 billion.

Revenue was negatively impacted in the U.S. by the results of the March Madness NCAA men's basketball tournament last quarter, the company said.

Adjusted earnings per share were US$1.59, compared with $1.05 one year ago. Estimates were $1.89.

The company's average monthly players across its subsidiaries were 14.9 million, up 8% year-over-year.

"I am pleased with the performance of the business during the first quarter, with the scaling of our US business driving a step change in the earnings profile of the Group," said CEO Peter Jackson.

“FanDuel continues to win in the US, retaining leadership positions in both online sports betting and iGaming, while we saw a positive performance within International, where our scale and the competitive advantages of our Flutter Edge have been enhanced by the acquisition of Snai in Italy.” The company's EU€2.3 billion purchase of betting platform Snai closed at the end of April.

Flutter lowered its full-year guidance in the U.S. to project US$7.4 billion in revenue, down $280 million. Full-year international revenue expectations were revised up by $1.43 billion to $9.68 billion, however.

12:02 pm (AEST):

Back to the NASDAQ, Zillow (Z) saw revenue beat its guidance last quarter.

Revenue was US$598 million, up 13% year-over-year and $15 million above the midpoint of its outlook.

For Sale revenue rose by 8% year-over-year to $458 million, with its Residential and Mortgages sub-segments seeing growth of 6% and 32% respectively. Rentals revenue was up by 33% to $129 million, largely due to 47% growth in multifamily revenue.

Its net income was US$8 million, compared with a loss of $23 million in Q1 2024.

“As we expand our services and scale the housing super app across more markets, we are bringing more customers and real estate professionals together and making buying, selling, and renting easier for them, which is helping us grow both our revenue and profits," said CEO Jeremy Wacksman.

Zillow projects revenue of US$635-650 million next quarter, below Benzinga estimates of $650.96 million.

12:15 pm (AEST):

Still with the NASDAQ, Fortinet (FTNT) posted double digit percentage growth in revenue and net income.

Revenue last quarter was US$1.54 billion, up 13.8% year-over-year and in line with estimates. Product revenue was $459.1 million, rising 12.3%, while Service revenue grew by 14.4% to $1.08 billion.

Non-GAAP net income was $452.3 million, compared with $333.9 million one year ago.

Non-GAAP diluted earnings per share were US$0.58, above consensus forecasts of $0.53. Fortinet also beat earnings per share estimates throughout 2024.

“We continue to accelerate our growth strategy by investing in the rapidly expanding Unified SASE and Security Operations markets, while strengthening our leadership in Secure Networking," said CEO Ken Xie. "Leveraging our deep expertise in networking and security convergence, a strong track record of AI-driven innovation, and seamless product development and integration through our FortiOS operating system, we have established ourselves as the leader in organic innovation and will continue setting the industry standard in cybersecurity.”

Fortinet expects revenue of US$1.59-1.65 billion next quarter, and its full FY2025 guidance projects revenue of $6.65-6.85 billion.

12:29 pm (AEST):

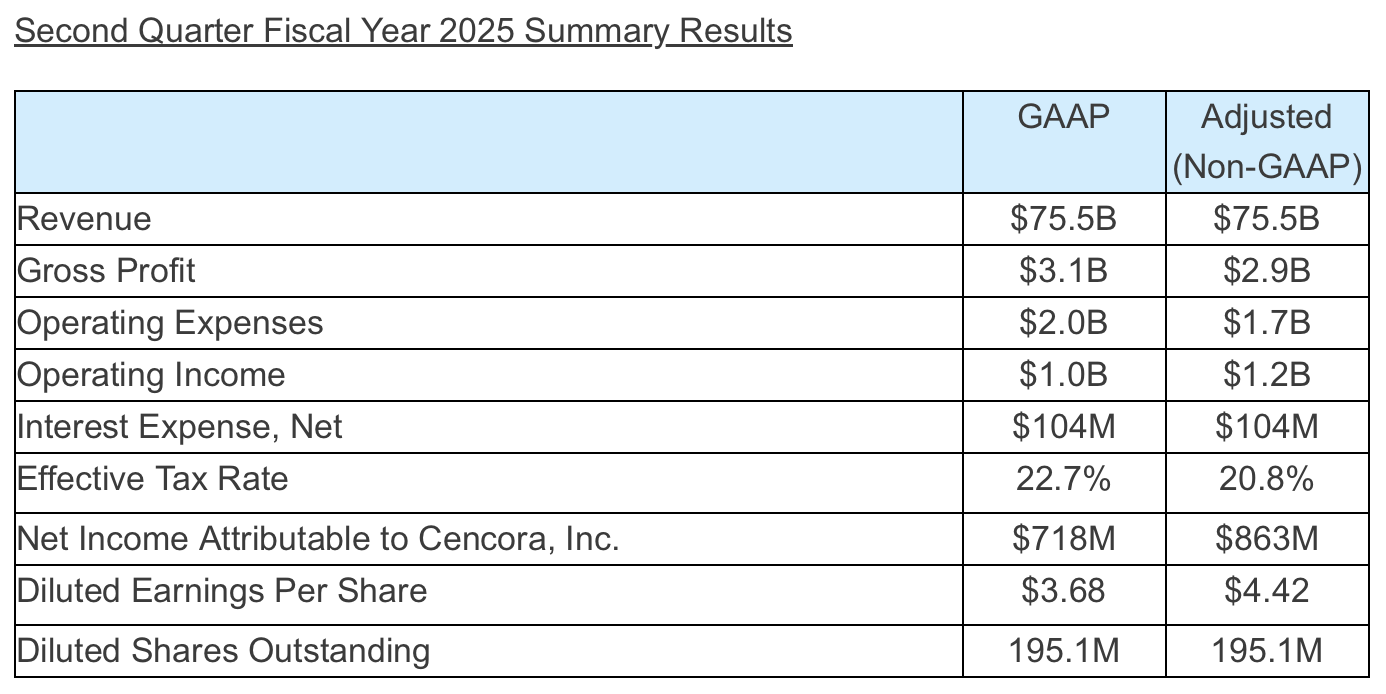

Back to the NYSE, Cencora (COR) reported major growth in revenue and earnings per share, surpassing estimates.

Revenue was US$75.5 billion last quarter, up 10.3% year-over-year and beating Zacks projections by 0.8%. This increase was driven by 11.4% revenue growth in its U.S. Healthcare Solutions division, which reached $68.3 billion. International Healthcare Solutions revenue was up 0.7% to $7.2 billion.

Adjusted diluted earnings per share were US$4.42, rising by 8.3% and passing estimates of $4.08.

“Cencora’s second quarter results reflect the strength of our value proposition as a healthcare services provider and the important role we play in the supply chain, driven by our pharmaceutical distribution footprint and complementary end-to-end services and solutions,” said CEO Robert Mauch.

Cencora has revised its full-year guidance upwards, and now projects adjusted diluted earnings per share of US$15.70-15.95. Previous expectations were $15.30-15.60.

Fellow medication company Novo Nordisk also posted strong results, with sales increasing by 19% last quarter.

Handing back over to Chloe for the rest of the afternoon. Thanks for having me!

12:57 pm (AEST):

Thanks Harlan for taking care of the blog! Chloe back here to take you through the rest of the day.

Carvana (NYSE: CVNA) reported record profitability in Q1 2025.

The company’s total revenue grew 38% year on year to US$4.232 billion and at the same time retail unit sales grew 46% from last year.

According to CEO and founder Ernie Garcia, these are record sales.

“We are incredibly well positioned for the path ahead and have very clear visibility to even stronger financial performance, much larger scales, and even better customer experiences,” Garcia said.

“As Carvana grows larger and more efficient, we look forward to making our offering even faster and more convenient, and sharing the value we create with our customers as we continue our mission of changing the way people buy and sell cars.”

The record sale also beat the LSEG revenue estimate of $3.98 billion.

1:55 pm (AEST)

Nutrien (TSX and NYSE: NTR) have announced its Q1 2025 results, with net earnings of US$19 million and earnings per share of $0.02.

The company’s president and CEO, Ken Seitz said they intend to maintain their 2025 full-year guidance.

“Our world-class asset base and resilient business is built to generate free cash flow in a range of market conditions,” Seitz said.

“We continue to focus on actions within our control and are taking a disciplined and intentional approach to capital allocation, prioritising high-value investment opportunities, divesting non-core assets and returning cash to shareholders.”

2:18 pm (AEST):

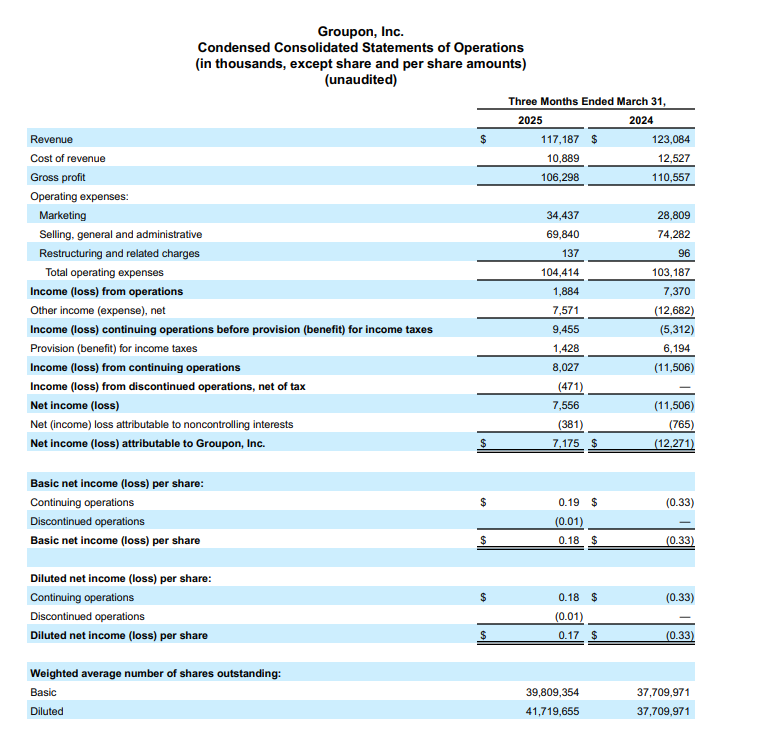

Back on the NASDAQ, Groupon (GRPN) has reported a decline in revenue by 5% to US$117.2 million from the same time last year.

Unit sales were also down 17% from last year to 8.5 million.

International sales fell more than the North American sales, declining 10% and 3% respectively.

Groupon CEO, Dusan Senkypl said it is time for the company to go on offence.

"With North America Local Billings accelerating to double-digit growth and our local marketplace strategy showing green shoots across geographies and verticals, we are building momentum and expect to continue to accelerate our growth,” Senkypl said.

“We're focused on delivering sustainable growth by creating exceptional value for both consumers and merchants."

2:55 pm (AEST):

Gaming and console giant Nintendo (TYO: 7974) is expected to announce a drop in earnings for Q1 2025.

The company’s net profit is set to go down by 53% to 38.5 billion yen according to a poll of analysts by Visible Alpha.

Revenue is also expected to fall by 19% to 224.3 billion yen.

Investors are also keeping a close eye on the upcoming Switch 2 and how U.S. President Donald Trump’s tariffs will impact the rollout.

At the time of writing, Nintendo shares closed at 12,080 yen, down 2.19% from the previous close, and their market cap is 15.63 trillion yen.

3:12 pm (AEST):

Toyota (TYO: 7203) reported a strong start to 2025.

In Q1 2025 the company saw a revenue increase of 6.5% when compared to the same period last year to 48,036.7 billion yen.

Operating income also increased by 10.4% to 4,795.5 billion yen.

Despite this, unit sales in Japan and overseas dropped by 80 thousand units, or 0.9% in the first quarter of 2025 compared to Q1 2024. Most of the decrease came from overseas, where sales decreased by 78 thousand units or 1%.

The company is optimistic for the rest of the year, forecasting a 1% increase from FY2025 in FY2026.

3:34 pm (AEST):

Earnings for Shopify (NASDAQ: SHOP) are projected to rise when they release tomorrow.

According to consensus expectation on FactSet, revenue is expected to rise to US$2.36 billion from $1.86 billion at the same time last year.

Adjusted earnings per share are expected to come in at 26 cents.

At the time of writing, Shopify shares come in at $94.50, up 0.71% from the previous close and its market cap is $122.57 billion.

4:01 pm (AEST)

After beating analysts' expectations by 3.1% last quarter, Newscorp (NASDAQ: NWSA) earnings are expected to decline in Q1 2025.

While beating estimates last quarter, the company’s revenue was still down 13.5% year on year, and the same pattern is likely to emerge this quarter with a 17.8% year-on-year fall to US$1.99 billion.

Adjusted earnings per share are expected to come in at $0.13.

At the time of writing, News Corp earnings come in at $28.18, up 1.62% from the previous close, and its market cap is $16.82 billion.

4:39 pm (AEST):

Wall Street analysts expect Monster Beverage Corp (NASDAQ: MNST) to improve upon last quarter in its upcoming release.

The business is estimated to report quarterly earnings of US$0.46 per share, a 9.5% increase from last year and revenue is tipped to increase by 4.3% to $1.98 billion.

At the time of writing, Monster shares come in at $60.56, up 0.90% from the previous close and its market cap is $59.06 billion.

That’s all for today, check back in tomorrow for more earnings season news.