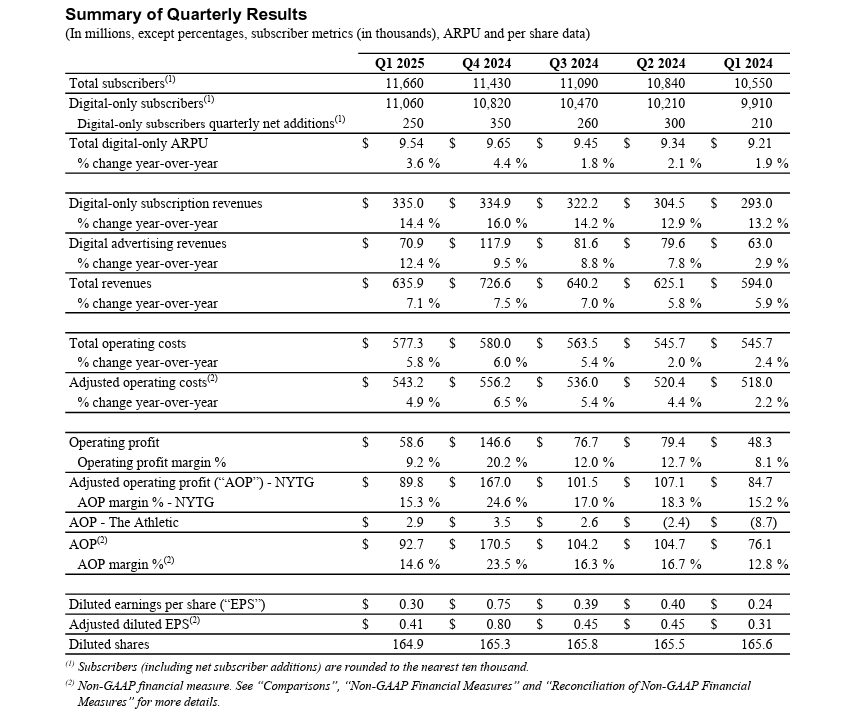

The New York Times Company delivered a strong performance in Q1 2025, continuing its digital growth trajectory with 11.06 million digital-only subscribers, a 1.15 million YoY increase.

This expansion underscores the success of its bundle offerings, which now account for 5.76 million digital subscribers.

The company's strategy is to deepen engagement and boost retention.

Meredith Kopit Levien, president and chief executive officer, The New York Times Company, said, “As our first quarter results show, we've had a strong start to the year. Our strategy is working and our business is growing and demonstrating resilience amidst the current economic and geopolitical uncertainty. We have a diverse portfolio of world-class news coverage and leading lifestyle products; multiple, complementary revenue lines across subscriptions, advertising, affiliate and licensing; and a model that generates significant free cash flow and a strong balance sheet. All of which makes us confident we are continuing to build a larger, more profitable New York Times company.”

Revenue growth remains robust, driven by strength in digital subscriptions and advertising. Total revenue rose 7.1% YoY to US$635.9 million (A$988 million), with digital-only subscription revenue surging 14.4% to $335 million.

Digital advertising saw a double-digit increase, up 12.4% YoY to $70.9 million, while print advertising continued its decline, falling 8.5% to $37.2 million. The shift toward digital monetisation remains a key driver of the company’s overall growth strategy.

Despite rising operating costs, profitability has improved significantly. Operating profit soared 21.3% YoY to $58.6 million, while adjusted operating profit climbed 21.9% to $92.7 million, reflecting disciplined cost management and increased revenue flow.

EPS rose to $0.30, up from $0.24 YoY, while adjusted diluted EPS jumped to $0.41, supported by a lower tax rate of 22.5%. These indicators highlight strong financial health and resilience. Among analysts polled by FactSet, 34 cents a share was expected on $635 million in revenue.

The Times strengthened its liquidity position, ending the quarter with $902.3 million in cash and marketable securities.

Free cash flow nearly doubled, hitting $89.9 million compared to $46.7 million YoY, a testament to effective financial discipline.

Net cash from operating activities surged to $99.1 million, reinforcing its ability to fund continued investments in content, technology, and expansion.

Looking ahead, the company projects 13-16% growth in digital subscription revenue in Q2, with total subscription revenue expected to rise 8-10%.

Adjusted operating costs are anticipated to increase modestly, by 5-6%, as it continues its push toward higher-margin digital products.

With accelerated digital engagement and strong cash flow, The Times is positioned for sustained profitability and long-term shareholder value.

At the time of writing, New York Times Co's (NYSE: NYT) stock price was US$52.64, down 0.020 (0.038%) today, with a market cap of approximately $8.61 billion.