Global entertainment giant Walt Disney Company has reported a 15% increase in operating income for the second quarter of the 2025 financial year (Q2 FY25).

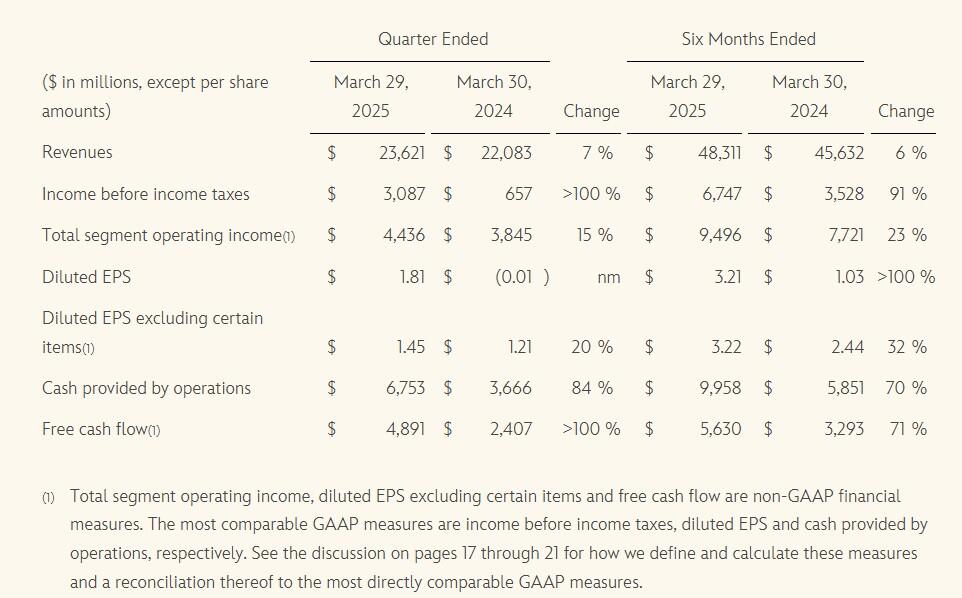

The 102-year-old American company said segment operating income increased to US$4.436 billion (A$6.93 billion) in the three months to 31 March 2025 from $3.845 billion in the previous corresponding period on revenue which rose 7% to $23.6 billion.

Diluted earnings per share (EPS) improved to $1.81 from a loss of $0.01 in Q2 FY24 while adjusted EPS, which excludes some items, rose 20% to $1.45, beating analysts' consensus expectations of $1.20.

For the first half of FY25, operating income jumped 23% to $9.496 billion and EPS surged to $3.21 from $1.03 as revenue grew 6% to $48.311 billion.

Chief Executive Officer Robert Iger said the outstanding performance in the second quarter, including adjusted EPS growth of 20% driven by its Entertainment and Experiences businesses, underscored the company’s continued success.

He said Disney had a lot more to look forward to including its upcoming “theatrical slate”, the launch of ESPN’s new direct-to-consumer offering, and an unprecedented number of expansion projects in Experiences.

“Overall, we remain optimistic about the direction of the company and our outlook for the remainder of the fiscal year,” Iger said in a press release.

The results included surprising strength in the Disney+ streaming business, which added 1.4 million subscribers, and strong results from Domestic Parks & Experiences, which lifted operating income 13%, despite challenging economic conditions.

Disney forecast adjusted EPS of $5.75 for F25, an increase of 16% over FY24, including double-digit percentage operating income growth from Entertainment, 18% from Sports and 6% to 8% from Experiences.

“We continue to monitor macroeconomic developments for potential impacts to our businesses and recognize that uncertainty remains regarding the operating environment for the balance of the fiscal year,” Walt Disney said.

The company, which opened its Disneyland theme park in California in 1955, also announced it would open a theme park in Abu Dhabi, adding it to a portfolio that also includes film studios, television networks, resorts and streaming services.

Walt Disney (NYSE: DIS) shares closed up $9.92 (10.76%) at $102.09 on Wednesday (Thursday AEST), capitalising the company at $184.56 billion.