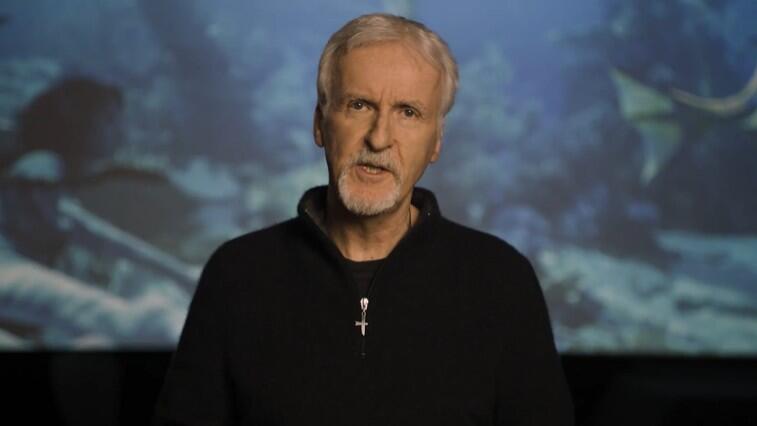

James Cameron slams Netflix takeover of WBD

Acclaimed filmmaker James Cameron has penned a letter to lawmakers, cautioning against Netflix's bid to takeover Warner Bros. Cameron, a veteran director, has been open about his concerns over the deal since it was first announced in December. Under the US$72 billion proposal, Netflix would acquire both the Warner Bros. film studio and its streaming platform, HBO Max, which was met with pushback from the film industry at large. Cameron's letter to Senator Mike Lee, who chairs the Senate subcommittee on antitrust, echoed these concerns, writing that he believes the deal would cause massive job losses and completely change theatrical releases and experiences. “I believe strongly that the proposed sale of Warner Brothers Discovery to Netflix will be disastrous for the theatrical motion picture business that I have dedicated my life’s work to,” Cameron wrote. “Of course, my films all play in the downstream video markets as well, but my first love is the cinema.”