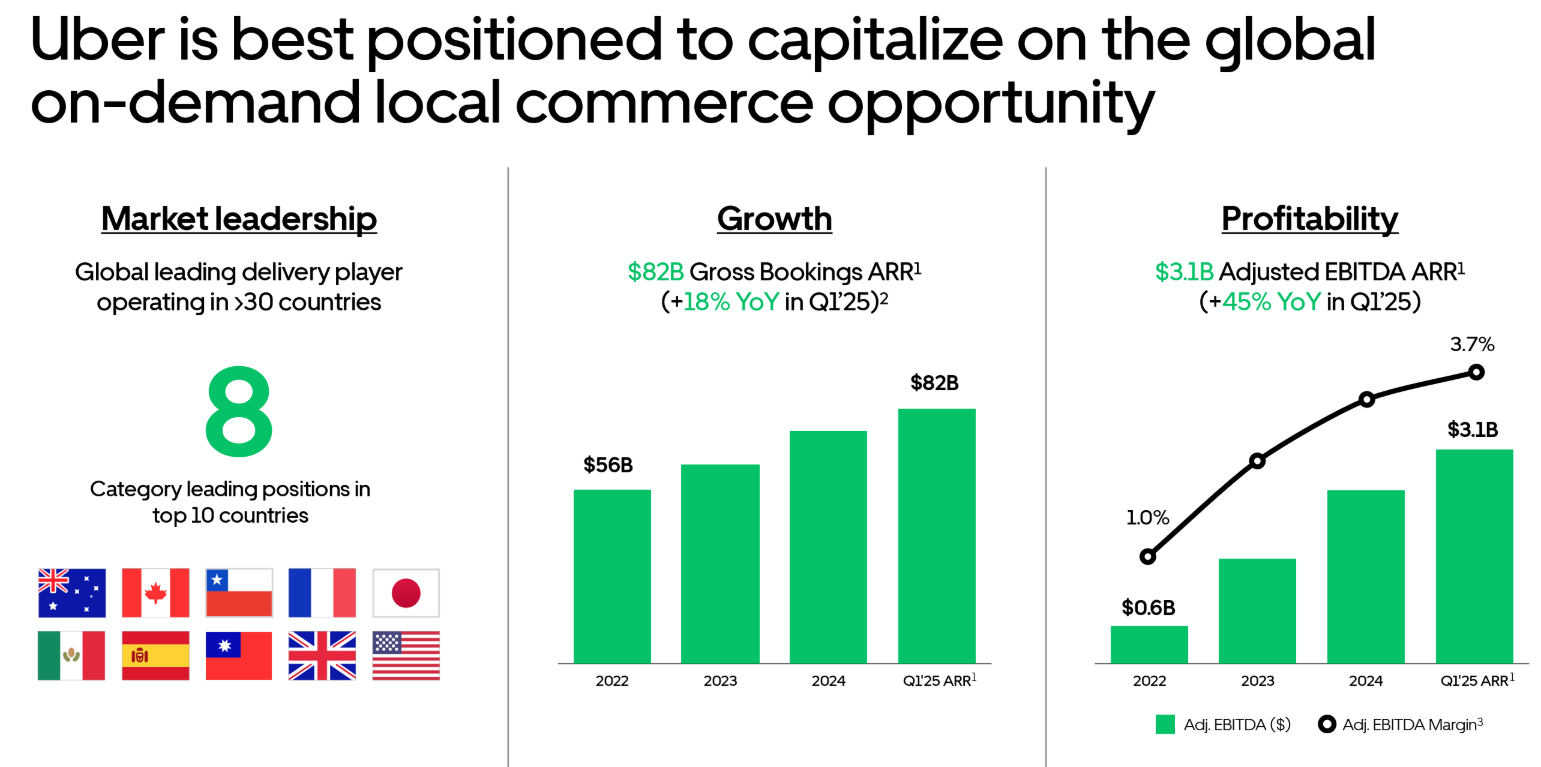

Uber has started 2025 with a strong financial performance, reporting 14% growth over the year in gross bookings to US$42.8 billion (A$65.22 billion).

The company’s focus on operational efficiency and consumer engagement drove trip volumes up 18%, underscoring its ability to scale profitably.

“We kicked off the year with yet another quarter of profitable growth at scale, with trips up 18% and even stronger user retention,” said Dara Khosrowshahi, CEO. “Supported by the consistent strength of our core business, we continue to build towards the future, including five new autonomous vehicle announcements in just the last week.”

With revenues reaching $11.5 billion, Uber is maintaining momentum in its core business while eyeing future innovation, including a string of new autonomous vehicle announcements.

Goldman Sachs has updated its financial outlook for Uber Technologies Inc., yet total revenues missed the Zacks Consensus Estimate of $11.6 billion.

Profitability surged as operations income hit $1.2 billion, marking a $1.1 billion YoY increase. Adjusted EBITDA climbed 35% YoY to $1.9 billion.

Net cash flow was a standout performer, with Uber generating $2.3 billion in free cash flow, reinforcing its financial strength.

“We delivered over $2 billion of quarterly free cash flow, with multiple levers in our control to generate industry-leading cash flow growth,” said Prashanth Mahendra-Rajah, CFO. “We remain focused on disciplined capital allocation to drive greater financial durability and are on track to deliver against our multiyear plan.”

Uber’s user base expanded, with Monthly Active Platform Consumers (MAPCs) growing 14% YoY, driving trip frequency up 3%.

This engagement, combined with operational efficiencies, helped lift the Adjusted EBITDA margin to 4.4%, up from 3.7% in Q1 2024. The company ended the quarter with $6.0 billion in unrestricted cash, providing ample liquidity to fuel strategic investments.

Looking ahead, Uber projects Q2 gross bookings between $45.75 billion and $47.25 billion, targeting 16% to 20% YoY growth on a constant currency basis. Adjusted EBITDA is expected to land between $2.02-$2.12 billion, reflecting 29% to 35% YoY growth. Currency fluctuations are anticipated to pose a minor headwind, particularly in the mobility segment.

Uber’s confident outlook underscores its ability to balance expansion with financial discipline. With autonomous technology advancements and a laser focus on profitability, the company continues to strengthen its industry leadership while positioning itself for sustainable long-term growth.

At the time of writing, Uber Technologies Inc's (NYSE: UBER) stock price was US$83.65, down $2.18 (2.54%) today, with a market cap of approximately $174.93 billion.

Related content