The first six months of 2025 have been marked by exceptional volatility across global equity markets, driven primarily by a wave of protectionist trade measures from United States President Donald Trump.

Despite a sharp sell-off early in the year, investors witnessed a significant rebound, as market participants and companies remained resilient amid significant uncertainty.

Global Tariff Shock and Market Selloff

In early 2025, the announcement of sweeping global tariffs by the United States triggered a sharp correction across international markets.

Major U.S. benchmarks declined between 20% and 30% during the first quarter, erasing gains from the prior two years. Investors sought refuge in traditional safe havens, with gold and cryptocurrencies reaching new highs and bond yields climbing as the “Sell America” trade gained momentum, pushing the U.S. dollar index to fresh multi-year lows as capital fled American assets.

Volatility surged, and hedge funds were forced to deleverage and reposition amid extreme market dislocations.

Rebound on Renewed Trade Optimism

By May, however, sentiment began to shift as the Trump administration announced preliminary trade agreements with the United Kingdom and with China in early June. These developments helped restore investor confidence and triggered a broad-based rally in equities.

The S&P 500 rebounded sharply from April lows, surpassing the 6,000 level by June. Defensive sectors, including Industrials, Utilities, and Financials, outperformed during the initial recovery, while the Technology sector led gains in Q2, fuelled by ongoing innovation in artificial intelligence.

Valuations and Sector Rotation

Morningstar data shows the U.S. equity market was trading at a modest 3% discount to fair value as of 30 May. While this reflects a relatively neutral valuation stance, analysts cautioned against complacency, citing a limited margin of safety given the macroeconomic headwinds.

Industrials posted the strongest returns over the first six months of 2025, rising 10.5% year-to-date (YTD), while Communication Services added 9.7%, while Financials and Utilities were up 7% and 6.7%, respectively.

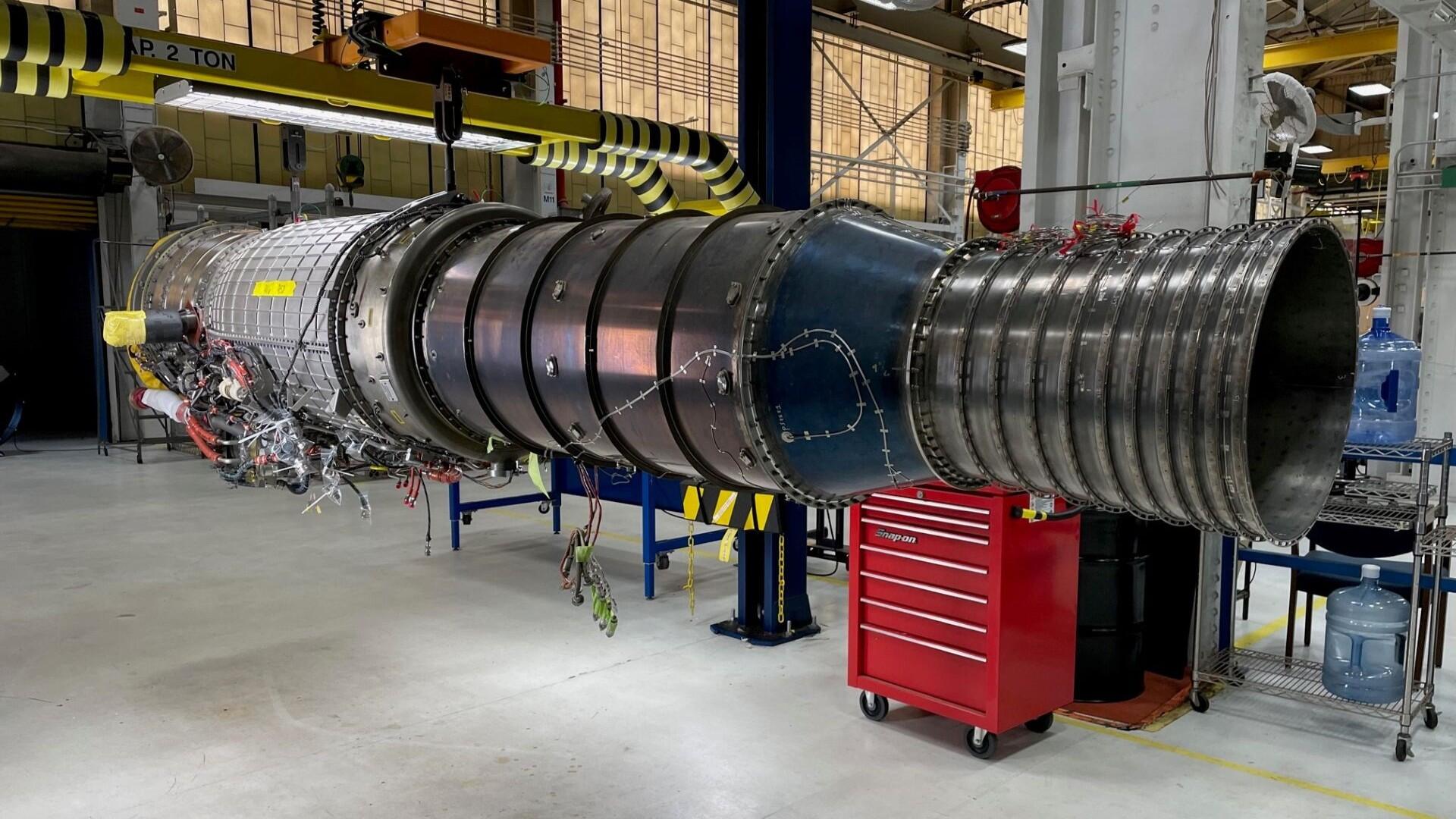

Outperformers in the Industrial sector included Howmet Aerospace (+58.9% YTD), energy equipment manufacturing and services company GE Vernova (+59% YTD), and aircraft engine supplier GE Aerospace (+53.3% YTD).

Jefferies reaffirmed its "buy" rating on GE Aerospace in early June, raising its target price from US$260 to $300, citing strong growth prospects for the company’s commercial aircraft equipment business.

The brokerage forecasts average annual growth of 10% through to 2030, with earnings expected to track revenue expansion. Based on this outlook, Jefferies projects annual operating income of $12.5 billion by 2028 - well above GE Aerospace’s official target of $10 billion.

The firm also expects operating income to reach $15 billion by 2030.

In contrast, Consumer Discretionary, Healthcare, and Energy remained 4.2%, 2.6%, and 1.8% lower respectively, with losses led by tariff-exposed retailers Deckers Outdoor (-49.8% YTD), lululemon athletica (-37.7% YTD), as well as pharmaceutical giants UnitedHealth Group (-38.6% YTD), and Moderna (-34.6% YTD).

According to Morningstar, telecommunication services and small-cap stocks remain among the most undervalued areas, while consumer defensive, utilities, and select large-cap growth names trade at elevated valuations.

Strategic Positioning: Focus on Value and Resilience

Analysts from Wells Fargo also identified several sectors likely to outperform through year-end: Financials, Aerospace and Defence, Energy and Utilities, and Technology.

The firm argues these sectors offer protection against tariff volatility and geopolitical instability.

In the firm's 2025 Midyear Outlook, Darell Cronk, chief investment officer at Wells Fargo noted: “Our preference remains to allocate based on quality, and we favour U.S. Large Cap Equities and U.S. Mid Cap Equities over U.S. Small Cap Equities.

"We ultimately see upside potential in U.S. equities through 2026 but are focusing on valuations while near-term market action is volatile. If risk appetite weakens and prices fall, we favour reallocating from our unfavorably rated defensive sector (Consumer Staples) and from some neutral-rated sectors (Health Care and Real Estate) to our favorable cyclical sectors (Energy, Financials, Communication Services, and Information Technology).

“By contrast, during risk-on rallies we prefer to reallocate from sectors we see as overvalued, such as the cyclically-oriented Consumer Discretionary sector, to a more defensive sector, Utilities, which we see as more favourably valued.”

Aerospace and defence companies have shown resilience amid heightened global tensions. Palantir, for instance, has surged 78.9% year-to-date, supported by strong government contract flows.

Energy and utilities have also attracted investor attention due to their inflation-hedging properties and growing exposure to AI-related energy demands.

Risks Persist: Volatility Likely to Return

While markets have stabilised, analysts warn the calm may be temporary. Morningstar described current conditions as "the eye of the hurricane" in May, noting unresolved trade disputes, slowing economic growth, and interest rate uncertainty as critical risks.

Final U.S. gross domestic product (GDP) contracted by 0.5% in Q1, largely due to front-loaded imports ahead of tariff deadlines.

The Atlanta Fed’s GDPNow model projects Q2 growth at 2.9% on June 27, down sharply from 3.4% on June 18.

Treasury yields remain elevated, with the 10-year near 4.6%. A break above 5% could place renewed pressure on equity valuations.

The Fed is not expected to begin easing policy until at least September, according to CME FedWatch data.

Outside the U.S., Japan’s 40-year bond yield spiked to 3.7% before retracing, raising broader concerns about sovereign debt sustainability and financial sector exposure.

Outlook for H2 2025

Analyst forecasts vary widely. Morgan Stanley remains constructive, citing the potential for an AI-led productivity surge.

Conversely, Trading Economics expects a 2.5% decline in the S&P 500 by year-end.

Fidelity projects a range-bound environment with modest earnings growth of 7%, revised down from 12%.

Charles Schwab maintains a more optimistic stance, suggesting the index could test all-time highs near 6,144.

Morningstar recommends a tactical overweight in equities, particularly in value and small-cap names, while maintaining caution around overvalued defensive sectors.

Their outlook includes a 40–50% chance of a U.S. recession in 2025, with GDP growth slowing to 1.2% this year and 0.8% in 2026.

ASX 200 Mirrors Global Trends

The Australian share market closely followed international patterns. The ASX 200 sold off sharply in Q1 but rebounded through Q2 as tariff fears eased and domestic monetary policy remained steady.

Financials, healthcare, and select consumer names led gains, while resources stocks recovered as commodity prices stabilised.

Technology stocks lagged the U.S. but showed increasing interest in AI-related initiatives.

Conclusion: Cautious Optimism, and Elevated Risks

The first half of 2025 has been marked by extreme shifts in market sentiment, driven by geopolitical developments, economic data, and policy signals.

While equities have rebounded strongly, supported by easing trade tensions and resilient sectors, substantial risks remain.

According to market analysts, investors will do well to maintain diversified portfolios, emphasise undervalued sectors, and remain vigilant for signs of renewed volatility.

As the second half of 2025 unfolds, market participants will need to navigate an environment where opportunities and elevated risks remain tightly interwoven.