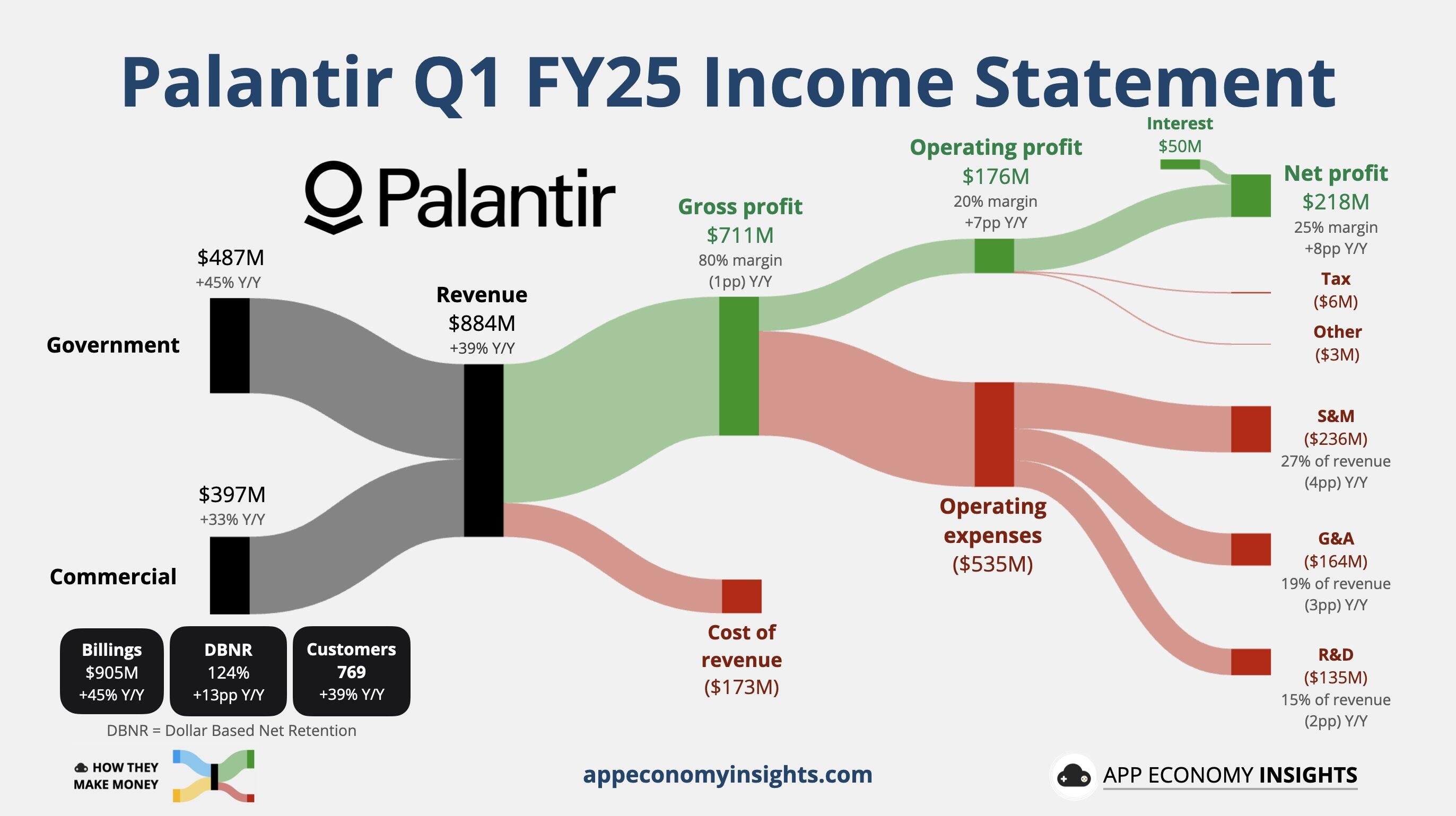

Palantir Technologies (PLTR : NASDAQ) has beaten Q1 earnings expectations across all major metrics today, including a 39% year-on-year (YoY) quarterly revenue increase to US$884 million - $22 million higher than forecast.

The software company's game-changing large language model (LLM) powered AI platforms (AIP) are being rolled out across key sectors at pace as earnings showed a substantial 39% increase in customers YoY to 769 during the quarter.

It has contracts everywhere - big new ones in Q1 alone in fact - including billion dollar deals and with recognisable entities such as the U.S. Department of Defense, NATO, Heineken and others.

“We are in the middle of a tectonic shift in the adoption of our software, particularly in the U.S., where our revenue soared 55% year-over-year, while our U.S. commercial revenue expanded 71% year-over-year in the first quarter to surpass a one-billion-dollar annual run rate,” Palantir CEO Alexander Karp said.

Wall Street had forecast Q1 revenue at $862.13 million YoY, with adjusted earnings per share (EPS) pegged at $0.13 and analyst EBITDA expected to come in at $374.49 million, according to Capital IQ data.

The earnings report had better ideas:

Yet despite impressive defense contracts and a near 90% rally since early April, its stock price crashed about 10% in intra-day trade on the news today.

Best performer?

It’s been a rollercoaster Q1 for Palantir Technologies (PLTR : NASDAQ), having risen from the ‘Liberation Day’ tariff market crash up >80% as one of the most traded stocks on Wall Street.

However, intra-day trade at time of writing has seen Palantir’s stock price fall about 6% after investors seemed less than impressed with Q1 earnings results - even though it beat analyst forecasts across all metrics.

“We are seeing rapid expansion and very significant demand both in America and outside America [as people have] Increased recognition that LLM’s are commodities,” Palantir CEO Alexander Karp said.

Looking ahead

The company says it’s raising its earnings guidance to between $3.89-$3.9 billion for 2025, and expects revenue of up to $938 million next quarter, while it reckons adjusted income from operations will come in at between $401-$405 million.

The $292 billion market-capped Palantir is trading down outside trading hours at US$113.30 per share.