In a turbulent market rocked by United States President Donald Trump’s sweeping tariff measures, hedge funds are grappling with unprecedented volatility and uncertainty.

Prominent hedge fund managers are not only warning of an impending recession, but also cautioning that the current policy could trigger financial conditions “worse than a recession”.

As major market players reposition and scramble to hedge risks, the disruptive effects of the trade war are rippling across sectors - from quant models to tech valuations - raising fundamental questions about the future of the global financial system.

Warnings from the Top

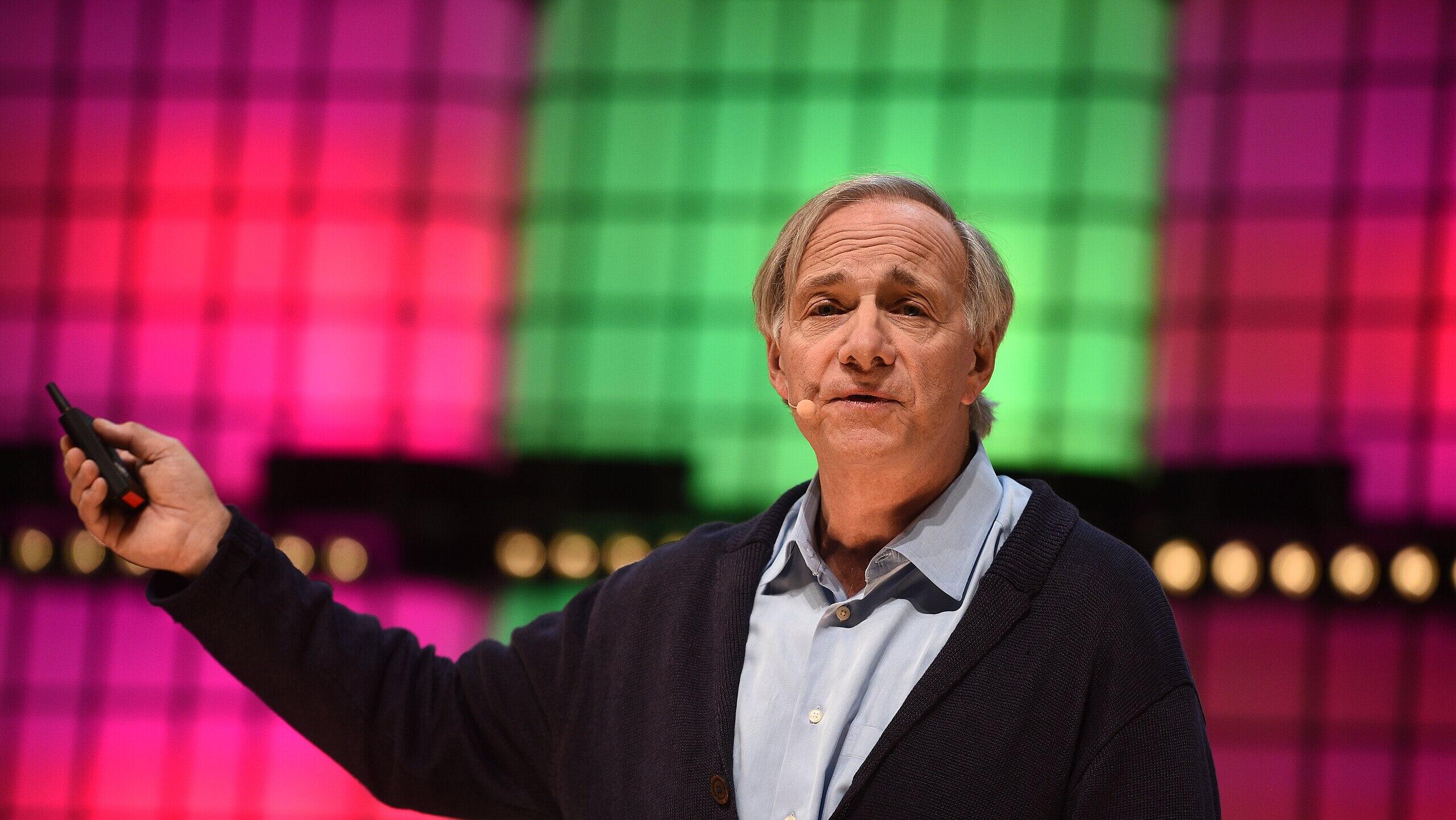

Billionaire hedge fund manager Ray Dalio has issued a stark warning about the escalating U.S. trade war, cautioning that the financial system could face disruptions "worse than a recession" if Trump's tariff policies are not carefully managed.

Speaking on NBC's Meet the Press on 13 April, the Bridgewater Associates co-CIO described the tariffs as "very disruptive", likening them to "throwing rocks into the production system".

Dalio’s concerns follow a market rout triggered by Trump’s so-called “Liberation Day” tariffs - sweeping levies on nearly all imported goods, which blindsided investors and led to sharp deleveraging across the hedge fund industry.

He elaborated that while recessions are an almost regular part of economic cycles, what is unfolding now appears far more profound.

Dalio warned that unless the situation is managed carefully, there’s a genuine risk of igniting a breakdown in the broader financial system — a scenario that could leave the world facing conditions even more severe than a typical recession.

According to Commodity Futures Trading Commission data, hedge funds rapidly offloaded U.S. dollars and trimmed commodity positions, cutting their net long holdings across 27 contracts by 37%, the steepest reduction in seven months.

Quantitative Funds Under Fire

The ripple effects of the trade war have not spared quant hedge funds, which rely on historical data and statistical models to navigate markets. Leda Braga’s Systematica, for example, has come under significant strain, with its flagship Schroder Gaia BlueTrend fund declining approximately 19% year-to-date.

This marks the fund's most substantial drawdown since its inception, now nearly 36% below its 2022 peak.

With sudden policy shifts rendering many predictive models less reliable, quant funds find themselves scrambling to reconfigure portfolios amid unpredictable swings.

Systematica's challenges underscore a broader issue within the quant community: when market fundamentals are in flux, even the most sophisticated algorithms can struggle to keep pace.

The Tesla Factor

The current environment of instability has also led to dramatic warnings about asset valuations, particularly in the tech sector. Swedish billionaire hedge fund manager, Christer Gardell, recently issued a dire prediction regarding Tesla’s staggering market valuation.

In an interview shared by Teslarati through finance news channel EFN, Gardell argued that Tesla was “probably the most expensive stock on the global stock exchanges” and could witness a collapse of up to 95%. He remarked that such a decline might be justified given the overly exuberant pricing and the chaotic “Musk circus” that has gripped the market.

This pessimism about Tesla’s valuation is emblematic of broader concerns beyond the tech sector. As asset bubbles become increasingly visible, investors worry that unsustainable pricing across key sectors could exacerbate market corrections already underway.

Short Covering

Amid the market tumult, hedge funds reportedly bought U.S. equities at the largest notional value in more than a decade on a single day.

This surge, reported by Reuters, was driven largely by short covering in macro products - an indication that funds are attempting to contain losses from earlier bearish bets.

Hedge funds, which had built significant short positions betting on a market downturn, are now forced to cover those shorts as the broader market experiences rapid movements.

The short covering exercise, while offering temporary relief, is also a sign of mounting nervousness among funds. The shock to the system has left many managers reeling, questioning whether their traditional risk metrics can hold up under the new dynamics of a trade war-fueled market.

Global Losses

Across global markets, hedge funds have not been immune to the adverse effects of Trump’s tariffs. Reports from Morgan Stanley reveal that hedge funds have suffered growing losses, with net leverage dropping as markets tumbled following the tariff announcements.

As losses mounted, funds were forced into a desperate scramble to reduce margin calls - a situation that cascaded into broader market sell-offs.

The rush for liquidity, magnified by margin calls, has forced even defensive stocks to be sold off. Financial institutions warn that, as margin calls propagate through the market, forced selling may trigger a self-reinforcing cycle of decline.

Some experts even liken the current phenomenon to a “falling knife” scenario, where investors who try to catch the plunge could end up with even greater losses.

Hedge Funds' Critiques

Not everyone in the hedge fund community is silent about Trump's tariff policies' destructive impacts. Hedge fund titan Ken Griffin has been openly critical of the administration’s approach, stating that the tariffs not only disrupt market stability but also threaten to damage the U.S. economy over the long term.

Griffin’s comments reflect a growing consensus among industry leaders that the current policy mix is unsustainable.

JPMorgan Chase CEO Jamie Dimon also told Fox Business he thinks a recession is a “likely outcome” of Trump’s tariffs - though he said he’s currently taking a “calm view” of the financial situation, after Dimon expressed concerns in his annual letter to shareholders, saying they “will likely increase inflation and are causing many to consider a greater probability of a recession”.

Positioning for ‘Liberation Day’

Amidst the chaos, hedge funds are not standing still. Funds reportedly adjusted their portfolios extensively in anticipation of what President Trump dubbed “Liberation Day” - the day when reciprocal tariffs are set to take effect.

Hedge funds dumped global stocks at a historic pace after Trump's tariff shock, according to Goldman data.

As part of the repositioning, many funds turned bearish on tech stocks, with some managers fleeing the sector altogether to avoid further losses.

With massive shifts away from riskier exposures, funds are scaling back positions in emerging markets, cyclical stocks, and even some European auto stocks in favour of safer bets like stocks sensitive to metal prices.

Bond Market Dislocations

The trade war’s impact isn’t limited to equities alone. U.S. Treasury markets have experienced significant dislocations as tariffs have shaken investor confidence.

The disruption in the U.S. Treasury market is raising long-term concerns, as the traditional safe-haven dynamics of bonds have been upended by policy-induced turbulence.

For many hedge funds, the breakdown in the bond market represents a further indicator of systemic risk - one that could compound losses if not addressed by policymakers.

Contrarian Bets

In a display of bold contrarian positioning, hedge fund Qube Research & Technologies disclosed a roughly US$105 million short position in Trump Media & Technology Group.

With Trump Media serving as the parent company for Truth Social, this move is a direct bet on the financial viability of an enterprise closely tied to the current administration’s media ventures.

Qube’s aggressive short stance reflects broader market scepticism about the soundness of assets linked to Trump’s brand amid escalating trade and political conflicts.

Looking Ahead

While the immediate outlook remains highly uncertain, not all investors are entirely pessimistic. Some believe that amid the carnage lies opportunity - if policymakers can steer the financial system back to a more stable footing, the current volatility could eventually give way to a more measured recovery.

Hedge funds are now faced with the dual challenge of mitigating short-term risks while identifying pockets of resilience that may provide long-term value.

The current period of market stress serves as a critical reminder of the fragility of financial interconnections. Whether these events ultimately catalyse a deep economic crisis remains to be seen.